Fully Amortized Loans Explained

The Amortization Process Explained: What is a Fully Amortized Loan?

If you’re in the process of selling a real estate note, you’re going to want to have a firm understanding of the process of amortizing a loan. Put simply, your loan’s amortization schedule will determine how long it takes for you to receive a full payoff. With that in mind, we’ve created a guide on the amortization process below. Keep reading to learn more.

Key takeaways

By the end of this article, you will know that:

- Amortization refers to the schedule for paying off a loan.

- Loans can be categorized as fully-amortized, partially-amortized or non-amortized.

- An amortization schedule is determined by the number of scheduled payments, the interest rate and principal balance owing.

What is amortization?

Amortization is a financial term that refers to the process of spreading out a loan into a series of fixed payments over time. This method provides a clear timeline for when the loan will be paid off and helps borrowers see a gradual decrease in their debt level over the loan term.

Amortized loan meaning

While there’s no singularly accepted amortized loan definition, this term usually refers to a type of loan that requires a monthly payment and follows an amortization schedule. Typically, with this type of loan, the loan payments are divided between the remaining principal and interest until such time as the loan is paid off in full at the end of the loan term or the amortization period ends.

Many types of loans are amortizing loans. However, the example of amortized loan that most people are familiar with is a 30-year, fixed-rate mortgage. With this type of home loan, the homeowner’s monthly payment remains the same, but the portion of the payment that goes to the principal and interest varies according to the loan’s amortization schedule. In total, the homeowner is expected to make 360 monthly payments to pay off the loan.

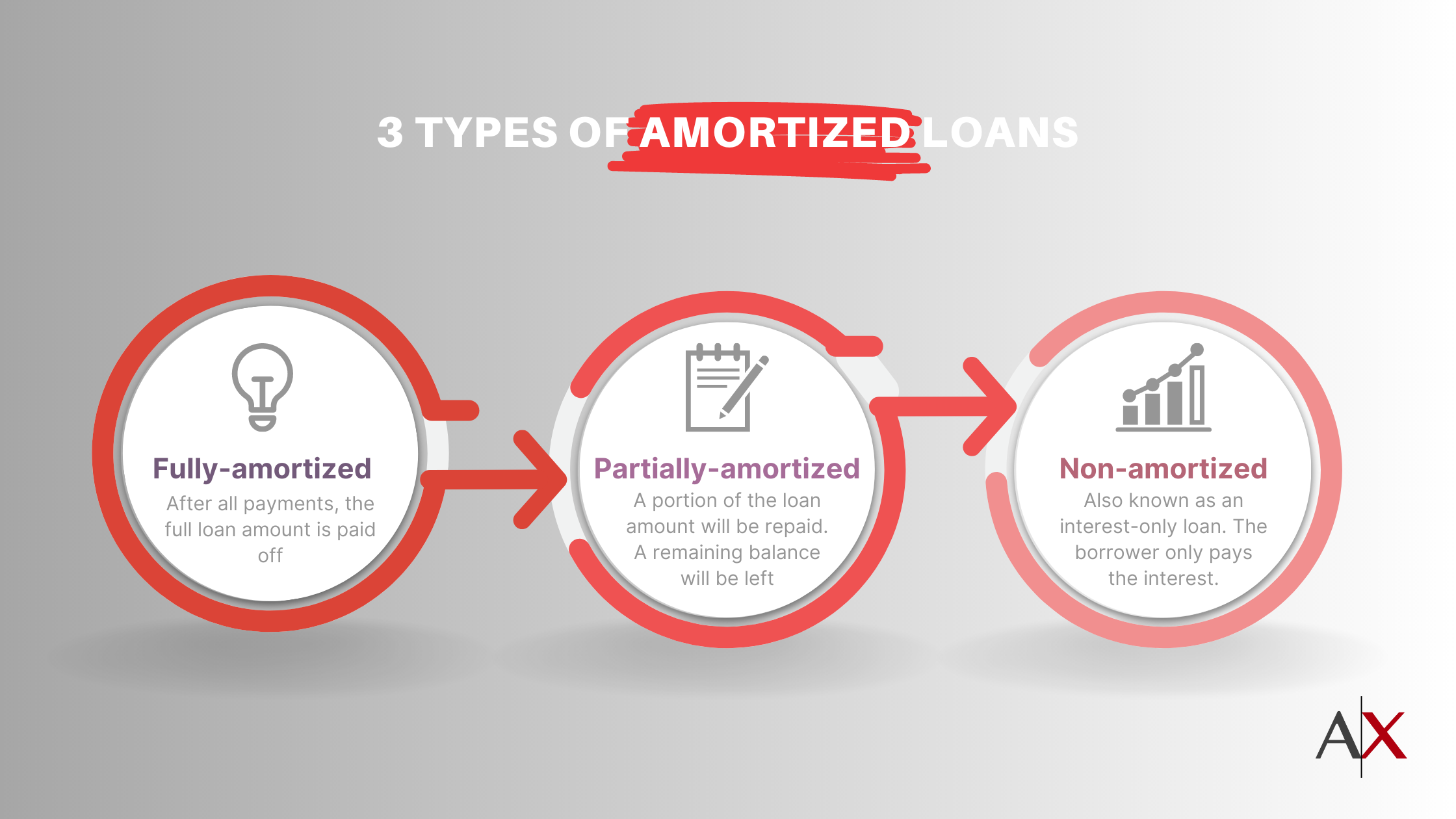

Different types of amortization

Now that you know how to define an amortized loan, it’s time to take a look at the different types of amortized loans that are available on the market today. In general, there are three types to keep in mind: the non-amortized loan, the partially-amortized loan and the fully-amortized loan. We’ve gone into more detail about each amortization type below for your benefit.

Fully-amortized loan definition

Put simply, if you make every payment on a fully amortizing loan, the loan will be paid off in full at the end of the loan term. The 30 year fully amortized loan we described above is a good example of a fully amortized payment arrangement. However, it’s worth noting that adjustable-rate mortgages can be fully amortized as well.

Partially amortized loan

Partially amortizing a loan means that only a portion of the loan amount is amortized. Then, after a certain period of time, the remainder of the loan becomes due as a balloon payment. Notably, these days, balloon payments are more commonly found in mortgage notes than in traditional home loans.

Non amortized loans

Finally, there are also non amortized loans. These loans are often more commonly referred to as an interest-only loan. With this type of loan, the borrower will only pay interest on the loan until such time that the loan reaches maturity. At that point, the entire principal balance will become due.

How are loans amortized?

Typically, loan amortization is based upon three individual components. They are as follows:

- Your scheduled payments: Your payments are typically listed individually, one for each month over the life of the loan.

- Your interest rate: a portion of each payment will go towards interest, which is calculated by multiplying your current principal balance by your monthly interest rate.

- Your principal balance: After the interest has been paid, the remainder of your monthly payment will go towards reducing your principal balance and paying back your debts.

In order to reach a firm understanding of how loan amortization works the best thing you can do is look at an amortization schedule. If you have a typical mortgage on your home, you will likely have received the schedule with the rest of your loan documents. However, if you have an alternative financing scenario, you may have to ask the person handling your financing to provide one to you.

Frequently Asked Questions

Where can I find the amortization schedule for my loan?

Typically, the amortization schedule is included along with the other documents you receive when you take out or issue a loan. Look for a table or list with dates of payment, and the payment amount broken down into principal repayment and interest charge.

Is it possible to change the amortization schedule on a loan I hold or owe?

That depends on your specific loan. If you are the borrower in a mortgage contract, you may be able to refinance your loan with the same lender or with another lender, depending on the terms of your mortgage. If you are the holder of a mortgage note, you can ask the borrower if they would agree to a new amortization schedule. However, they have no obligation to agree, unless that was written into your contract in the first place.

What is amortized interest?

Amortized interest refers to the way interest is calculated and paid off over the life of an amortizing loan, where the payments are structured to cover both the principal amount and the interest.

What is “negative amortization?”

Negative amortization happens when the interest owed in a given pay period is greater than the total payment for that period. This can happen with adjustable-rate or floating-rate loans, where the interest is adjusted during the course of the loan. When this happens, the payer of the loan sees the total amount owing grow every month, rather than shrink.

What is a negative amortization loan?

A negative amortization loan is a type of loan in which the monthly payments are not large enough to cover the interest due. This shortfall in payment leads to an increase in the loan’s principal balance rather than a decrease. Essentially, instead of gradually paying off the loan over time, the borrower ends up owing more than the original loan amount because the unpaid interest is added to the principal. This scenario typically occurs in adjustable-rate mortgages or other loan types that offer initially low payment options to the borrower.

What is bullet amortization?

Bullet amortization refers to a specific type of loan repayment structure where the borrower pays only interest on the principal balance over the term of the loan, with the entire principal amount due in a single lump sum payment at the end of the loan term. This final payment is often referred to as a “bullet payment” or “balloon payment.”

Unlike traditional amortizing loans, where each payment gradually reduces the principal amount along with covering the interest, bullet amortization loans defer the repayment of the principal to the end of the loan term. This structure can make the loan more manageable on a month-to-month basis since the periodic payments are lower during the term of the loan. Bullet amortization is synonymous with non amortization.