New York Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

New York’s diverse real estate market means its foreclosure laws have special challenges and safeguards for homeowners. This article will clarify the foreclosure process in New York, explaining the laws and steps involved. At the end of it, you’ll be better equipped to navigate New York’s real estate scene.

Foreclosure Process Overview in New York

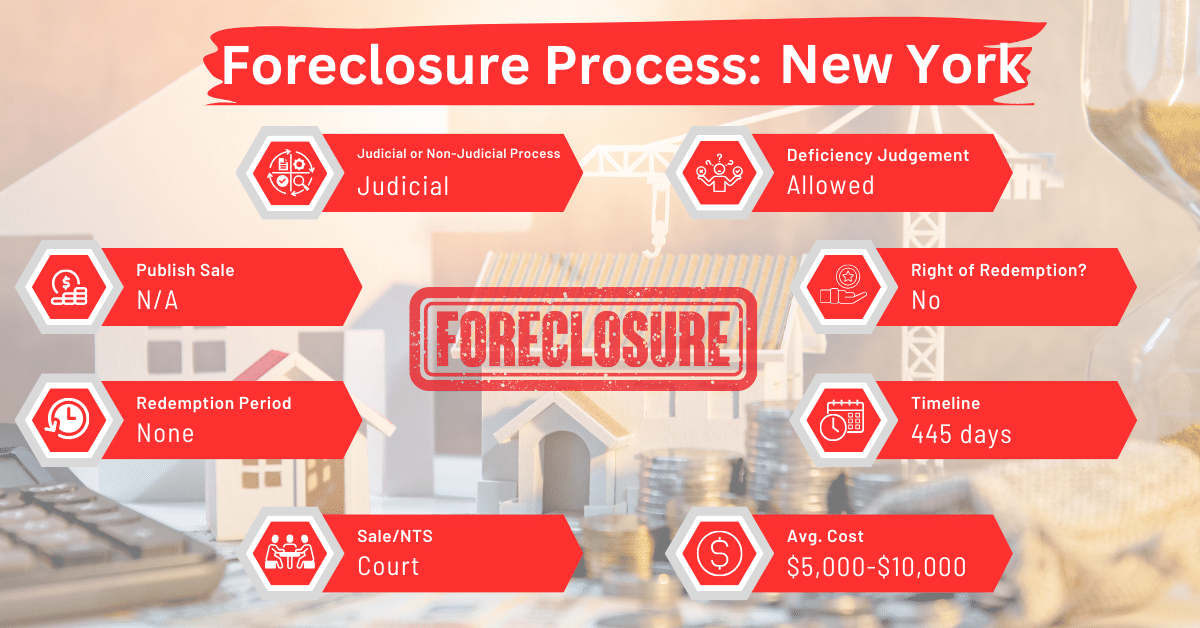

In New York, foreclosures are primarily judicial. They’re processed through the court system for about 445 days. This makes New York the state with the longest foreclosure timeline in the US.

Pre-foreclosure Period in New York

At least ninety days before initiating any legal action against the borrower, including mortgage foreclosure, the lender, assignee, or mortgage loan servicer must send a notice of default to the borrower. This notice must be provided in at least fourteen-point type and must be sent to both the property address and any other address on record for the borrower.

The lender, assignee (including purchasing investors), or mortgage loan servicer must send the required notices to the borrower via both registered or certified mail and first-class mail. They should address these notices to both the borrower’s last known address and the property’s address. Each notice must be enclosed in its own separate envelope, distinct from any other mailings or notices. The mailing date of the notice is considered its official issuance date.

Each notice must include an up-to-date list of at least five housing counseling agencies that serve the property’s county, according to the most recent listing available from the Department of Financial Services. This list must provide the latest known addresses and telephone numbers of the agencies.

Notwithstanding the requirements above, the lender, assignee, or servicer is not required to observe the 90-day pre-action period if the borrower has filed for bankruptcy protection under federal law. Also, if the borrower no longer resides at the property as their principal dwelling, the lender may commence legal action again the borrower before the 90-day period is over.

If a borrower is known to have limited English proficiency, they must provide the notices in the borrower’s native language or a language in which they are proficient. But that language must be one of the six most common non-English languages spoken by individuals with limited English proficiency in the state of New York, based on United States census data.

After the 90-day period elapses, the lender can file a lawsuit against the borrower, praying the court to declare a foreclosure of the property. If the borrower fails to appear, the court may rule against them, allowing the foreclosure sale to proceed. This pre-foreclosure phase typically lasts 7-9 months.

Types of Foreclosures in New York

As stated above, foreclosures in New York are usually judicial.

Notice and Sale Process in New York

The foreclosure sale is usually scheduled to hold about four months after the court enters judgment against the borrower. The judgment usually states that the sheriff or a referee must sell the mortgaged property within ninety days to cover the mortgage debt, sale costs, and legal fees. The notice of sale must be published in a newspaper once a week for at least four weeks before the sale.

Foreclosure sales are conducted through a public auction, often at the county courthouse, and the property is sold to the highest bidder.

Avoiding Foreclosure by Selling Your Mortgage Note

One option for homeowners facing foreclosure in New York is to sell their mortgage notes to a reputable note buyer. This can provide a way to avoid the foreclosure process and its impact on the homeowner’s credit and financial situation.

Borrower Rights and Protections in New York

Borrowers in New York have certain rights and protections during the foreclosure process. These include the right to be notified of the foreclosure proceedings and the opportunity to appear in court to contest the foreclosure.

Redemption and Deficiency Judgments in New York

Redemption

In New York, borrowers do not have the right of redemption after the foreclosure sale. This means they cannot reclaim their property once it has been sold.

Deficiency Judgments

The borrower may be served with summons to appear in an action for a deficiency judgment brought against them by the lender. In this situation, the court will order them to pay the balance of the mortgage debt that hasn’t been satisfied by the proceeds of the foreclosure sale.

For the lender to be eligible to seek a deficiency judgment, they must have made a motion for an order confirming the foreclosure sale within 90 days post-sale. If the lender doesn’t follow the prescribed procedures for making a motion for a deficiency judgment, then the court will presume that the sale proceeds have fully satisfied the

Special Protections and Programs in New York

New York offers various programs and protections for homeowners facing foreclosure. Some of these are mandatory settlement conferences and the possibility of loan modifications or other loss mitigation options.

Comparative Insights

As New York’s foreclosure processes are compared with those of other states, you’ll notice some differences and similarities, particularly in terms of notice periods, associated costs, and the impact on credit scores.

Publish Sale Notice

In New York, the foreclosure sale notice must be published at least four weeks prior to the sale. This duration is comparable to that of Maine and Maryland, where the notice period is 30 days.

Costs in a Range and Comparison to Other States

In New York, foreclosure costs range from $5,000 to $10,000. This price range is much higher than that in other states in the US besides New Jersey. There, foreclosure also costs between $5,000 and $10,000. New Jersey is a judicial foreclosure state too, so its similarity to New York in this respect is understandable.

Impact on Credit Score

The impact of foreclosure on a homeowner’s credit score in New York is similar to that in other states. A foreclosure can lead to a decrease of approximately 100 points or more in the credit score. The mark of foreclosure stays steady on the credit report for seven years. Over time, its impact gradually diminishes, especially if the individual takes steps to rebuild their credit.

Conclusion

Whether you’re a homeowner or an investor in New York, understanding New York’s foreclosure laws and processes will do you a great favor. For those facing foreclosure, options such as selling the mortgage note can provide an alternative to losing the property.