Maine Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

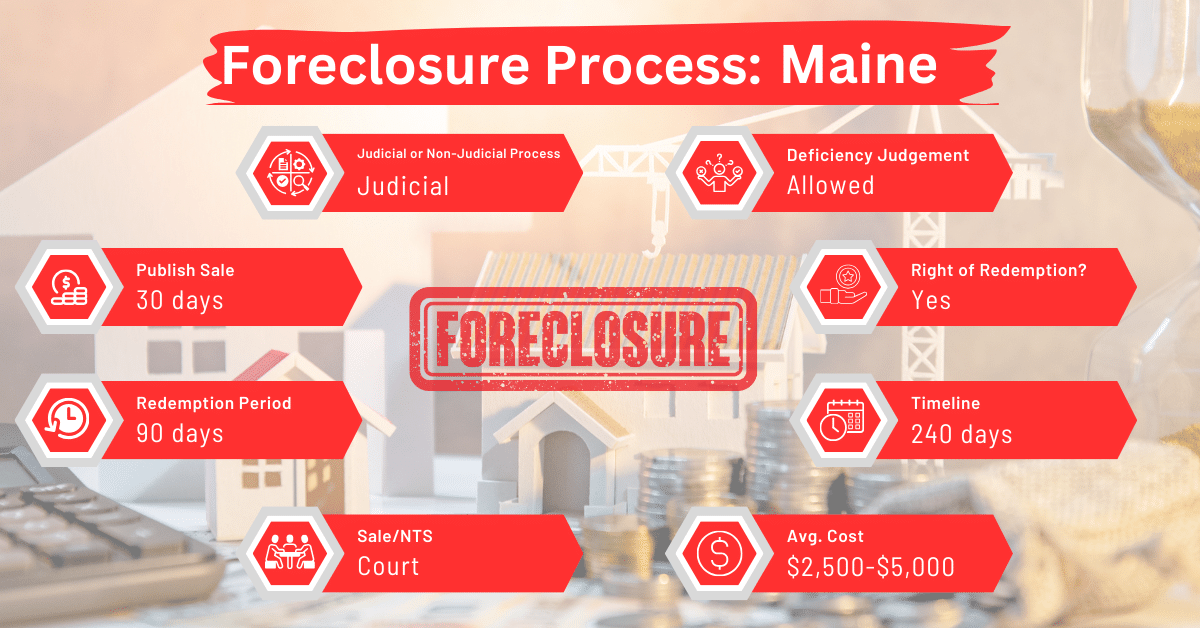

Maine employs a judicial-only foreclosure process, typically taking about 240 days (approximately eight months). This process involves the court system, starting when the lender files a lawsuit against the defaulting borrower. If the court rules in favor of the lender, the property is ordered to be sold at auction.

Pre-foreclosure Period

Before foreclosure proceedings can begin in Maine, a lender must deliver a default notice to the borrower. If the homeowner does not catch up by the deadline in the default letter (which is usually 30 days), the lender may start a foreclosure action by “serving” the homeowner with a foreclosure summons and complaint. The homeowner may be served in person by a sheriff, or by mail (if the homeowner signs and returns a receipt of the mailed complaint).

Once a foreclosure case has started, if the lender accepts any payment from the homeowner, even for less than the full amount owed, the foreclosure is canceled (unless the parties agree in writing that it is not). Because of this, it is common for homeowners who try to send in checks after they have been served to have those checks returned.

The foreclosure court papers contain important information, including:

- The location and address of the court where the case has been filed;

- The clerk’s office telephone number;

- The amount claimed to be owed; and

- A Response to Complaint and Request for Mediation form for the homeowner to return to the court within 20 days.

The pre-foreclosure period usually lasts about six to seven months, including 90 days for the borrower to stop the foreclosure by paying all amounts due.

To object to a foreclosure or to request mediation, a homeowner must respond to the complaint within 20 days by filing a response with the court. There are several ways to do this. The homeowner’s response may be:

- A court document called an “answer” prepared by an attorney or by the homeowner;

- The one-page Response to Complaint and Request for Mediation form. This form is also included with the foreclosure papers; or

- Another form of written request for mediation.

Even if the deadline has passed, a homeowner may still contact the court or send in a response to the foreclosure complaint.

Types of Foreclosures

Maine exclusively uses judicial foreclosures, which involve the court system. Like we stated above, the process starts with the lender filing a lawsuit against the borrower who has defaulted on their mortgage. The court oversees the entire process, including the sale of the property.

Resolving Foreclosure in Maine Through Mediation

You might be able to resolve your foreclosure case during mediation or at another stage in the process. If you reach a settlement, you can ask the court to temporarily pause (“stay”) the case while any final steps are completed. If no further actions are necessary, both parties can request the court to end the case, known as a “Stipulation to Dismissal.”

During mediation, you can explore different ways to settle your case, such as:

- Loan Modification: This changes your loan terms to make monthly payments more affordable.

- Repayment Plan: You agree to pay a portion of the overdue payments in addition to your regular monthly payment for a certain period until you catch up.

- Short Sale: You sell your home for less than the outstanding loan amount, with the sale’s proceeds going to the lender, which then dismisses the foreclosure.

- Deed in Lieu of Foreclosure: You hand over the property’s deed to the lender in exchange for them dismissing the foreclosure.

If the case isn’t settled during or before mediation, it goes back on the court’s list of active cases. The process then continues, allowing each side time to gather information (“discovery”) or ask the court for certain actions (“motions”). After this phase, the case may go to trial, where settlement is still possible at any time, even during the trial itself.

Notice and Sale Process

If the borrower does not stop the foreclosure during the pre-foreclosure period, the lender publishes a notice of sale for three weeks in a local newspaper. The sale is scheduled 30-45 days after the first publication date. The notice includes the property description and the date, time, and location of the sale. The sale is often conducted by the foreclosure attorney or at the courthouse and is open to public bidding.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Maine facing foreclosure have the option to sell their mortgage note to a reputable note buyer. This can provide an alternative solution, potentially avoiding the foreclosure process and its negative consequences.

Borrower Rights and Protections

Borrowers in Maine have the right to be properly served with foreclosure documents and to respond to the court action. They also have at least 90 days to keep the property and stop the foreclosure proceedings by paying all amounts due.

Redemption and Deficiency Judgments

Maine offers a 90-day redemption period for borrowers. Within this period, they may reclaim their property after the foreclosure sale by paying the full sale price plus certain additional costs.

Deficiency Judgments

If a lender in Maine wants to claim more money (a deficiency) after selling a foreclosed home, they must follow specific steps.

First, they need to send a written notice to the homeowner or their representative. This notice, which must state the lender’s intention to claim a deficiency, should be sent by registered or certified mail with a return receipt requested. It must be sent to the last known address of the homeowner or to an address agreed upon in the mortgage agreement. This notice needs to be sent at least 21 days before the foreclosure sale.

Second, the lender must complete an affidavit within 30 days after the foreclosure sale. This affidavit must confirm that the notice was mailed as required. Only after taking these steps can the lender legally pursue a deficiency claim against the homeowner.

Comparative Insights

Let’s discuss how certain areas of the foreclosure process in Maine compare to foreclosures in other states.

Publish Sale Notice

Maine mandates that the notice of sale be published for three weeks in a local newspaper. This requirement is consistent with many judicial foreclosure states, including Kentucky, Indiana, Illinois, and Kansas.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Maine, are between $2,500 and $5,000. This is comparable to other states that also use a judicial process, like North Dakota (where the range is $2,500 to $5,000) and Wisconsin (where the cost of foreclosure is between $2,5000 and $6,000).

Impact on Credit Score

The impact of foreclosure on a borrower’s credit score in Maine is similar to that in other states. Foreclosure typically leads to a significant decrease in credit scores, often by 100 points or more. This impact is a consistent feature across the United States, regardless of the state-specific foreclosure processes.

Conclusion

Maine handles foreclosures through the courts, which means there are clear protections in place for borrowers. However, it also requires a good understanding of the legal steps involved. Selling your mortgage note can be a smart way to avoid the negative impacts of foreclosure. Feel free to use this knowledge you’ve gathered to make informed decisions in Maine’s real estate market.