Exploring Indiana Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Curious about Indiana’s foreclosure laws and processes? They’re a unique set of rules and timelines that are crucial for homeowners, investors, and legal professionals to understand. In this post, you’ll take an in-depth look at the foreclosure process in Indiana and gain valuable insights into each stage of the procedure.

Foreclosure Process Overview

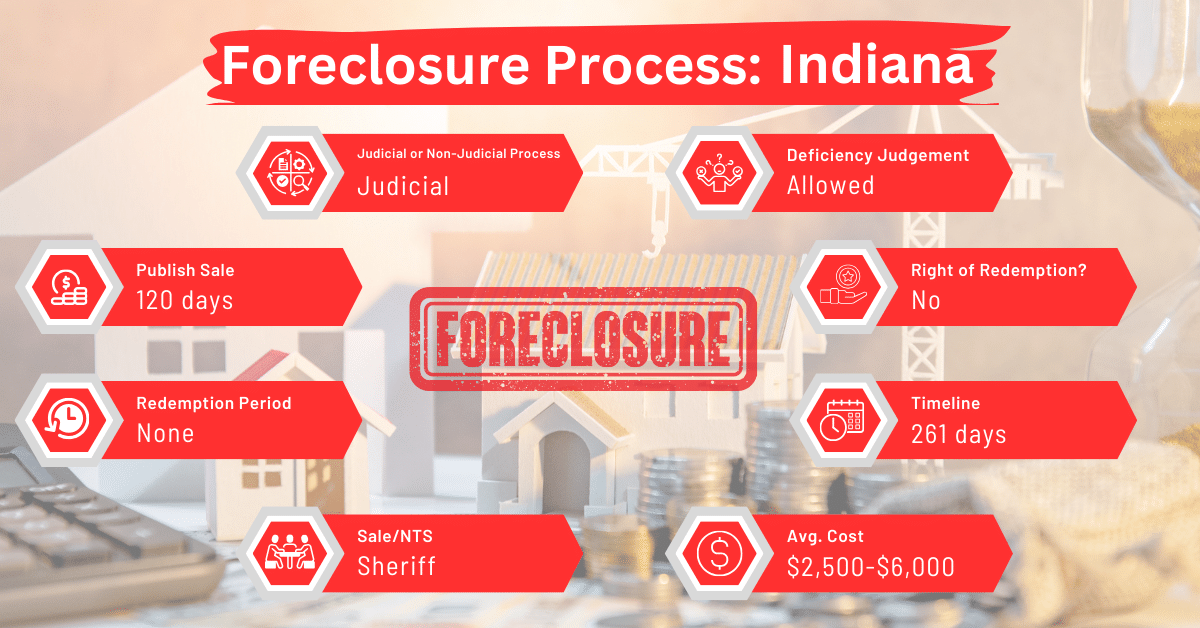

Indiana exclusively employs a judicial foreclosure process. This means that to foreclose on a property, the lender must bring an action for foreclosure against the borrower who has defaulted on their mortgage. The foreclosure process in Indiana typically takes about 261 days. This is relatively lengthy compared to some other states like Connecticut, Delaware, Florida, Kansas, Kentucky, Louisiana, Nebraska, New Mexico, North Dakota, South Carolina, South Dakota, and Vermont, where the judicial foreclosure process is shorter.

Pre-foreclosure Period

In Indiana, the pre-foreclosure period begins when the lender files a complaint in court against the borrower. While Indiana law does not mandate a default notice before filing the complaint, most lenders opt to send one.

The duration of this pre-foreclosure period varies based on the date the mortgage was executed, typically ranging from three to twelve months. For abandoned properties, there is no waiting period. During this phase, the borrower can satisfy the judgment by paying the debt, interest, and costs, leading to the dismissal of the complaint.

Types of Foreclosures

As mentioned, Indiana only allows for judicial foreclosures. This process involves the court system, where the lender must file a lawsuit to initiate foreclosure. Unlike non-judicial foreclosures, which are quicker and involve less legal intervention, Indiana’s judicial process provides a platform for borrowers to legally contest the foreclosure.

Notice and Sale Process

The notice of sale must be published in a local newspaper once a week for three consecutive weeks, with the first publication occurring at least 30 days before the sale.

Additionally, the sheriff must post the notice in three public places and at the county courthouse. The borrower is also served with the notice of sale.

If the debtor or any creditor involved in the foreclosure proceedings requests it, the court can decide to have the property sold by the sheriff through an auction. This will happen if:

- The court thinks selling the property at an auction is a financially sensible option.

- All the creditors involved agree to this method of sale and to the payment that the auctioneer will receive.

Once the court gives the order, the sheriff must hire an auctioneer within 14 days. The auctioneer will then set up the auction date and carry out the necessary activities to attract the highest possible bid for the property. This auction will be advertised, which is in addition to any other legal notices that must be given. After the foreclosure sale, the borrower loses any redemption rights.

Avoiding Foreclosure by Selling Your Mortgage Note

An alternative to undergoing the foreclosure process in Indiana is selling your mortgage note to a reputable note buyer. This option can provide immediate financial relief and is a viable solution for homeowners looking to avoid the negative consequences of foreclosure.

Borrower Rights and Protections

Indiana’s foreclosure laws offer several protections for borrowers, including the right to be properly served with foreclosure documents and the opportunity to respond to the complaint in court. These legal safeguards ensure that borrowers have a fair chance to address their mortgage default.

Redemption and Deficiency Judgments

Redemption Period

Before a property goes up for sale in Indiana, any owner or part-owner has the option to stop the sale by paying off the debt. This payment includes the judgment amount, any interest, and costs associated with the sale. Here’s how it works:

- If the payment is made before the court issues the final sale order to the sheriff, it should be made to the court clerk.

- If the payment is made after the sale order has been issued to the sheriff, it should be made directly to the sheriff.

When an owner or part-owner makes this payment (known as redeeming the property), the scheduled sale is canceled. The official who receives the payment must then clear the judgment and cancel the sale order.

If only a part-owner makes the payment to redeem the property, that part-owner can claim a lien on the portions of the property owned by others. This means the part-owner who paid has a right to get back their share of the money from the other owners, with an additional 8% interest per year, plus any costs they incurred in the redemption process. This lien is as enforceable as the original judgment lien and can be pursued through legal action if necessary.

However, once the foreclosure sale is complete, the borrower no longer has any redemption rights.

Deficiency Judgments

In Indiana, there’s usually no need for the lender to obtain a separate deficiency judgment. The sale order usually states that if the money raised by selling the mortgaged property doesn’t fully cover the mortgage balance and associated costs, the remaining amount should be collected by selling other properties owned by the debtor. Here’s a summary of what happens:

- The court’s order and judgment are officially prepared by the court clerk, who stamps it with the court’s seal and sends it to the sheriff.

- The sheriff then conducts a sale of the mortgaged property, or as much of it as needed, to pay off the judgment, including any interest and costs.

- If there’s still money owed after the property sale, the sheriff is authorized to continue selling any other properties owned by the debtor to make up the difference.

Special Protections and Programs

Indiana encourages settlement conferences as a part of its foreclosure process. These conferences provide a platform for borrowers and lenders to discuss potential solutions and avoid foreclosure.

Comparative Insights

Indiana’s approach to foreclosure has distinct characteristics when compared to other states in the US. Below, we’ll compare and contrast foreclosure in Indiana to how it works in some other states.

Publish Sale Notice

Indiana mandates a 30-day notice period before the foreclosure sale, with the notice of sale being published once a week for three consecutive weeks in a local newspaper. This requirement falls in the middle compared to the notice periods required before foreclosures in other states.

Costs in a Range and Comparison to Other States

The costs of going through foreclosure in Indiana, which mainly include legal fees and court costs, range from $2,500 to $6,000. This is similar to Wisconsin, where the costs are also high because both states require foreclosures to go through the courts (judicial foreclosure).

In contrast, states that allow foreclosures without court involvement (non-judicial foreclosures) usually have lower costs. For example, in Missouri, which is a non-judicial foreclosure state, the foreclosure costs range from just $1,000 to $3,000.

Impact on Credit Score

In Indiana, as in other states, foreclosure can lead to a significant decrease in credit scores, often by 100 points or more. This negative impact is a consistent feature of foreclosures, regardless of the state. The duration of the foreclosure process, which is longer in Indiana due to its judicial nature, might influence the time it takes for a borrower’s credit score to start recovering.

Conclusion

Going through a foreclosure in Indiana means you need to really understand how the judicial process works and what specific steps are involved. If you’re a homeowner facing foreclosure, it’s important to look into every option available to lessen the financial blow. Wondering where to begin? Selling your mortgage note might be a good first step.