Louisiana Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Louisiana’s foreclosure style is unique due to its judicial-only foreclosure system. Through this article, you’ll gain a detailed understanding of the foreclosure process in Louisiana.

Foreclosure Process Overview

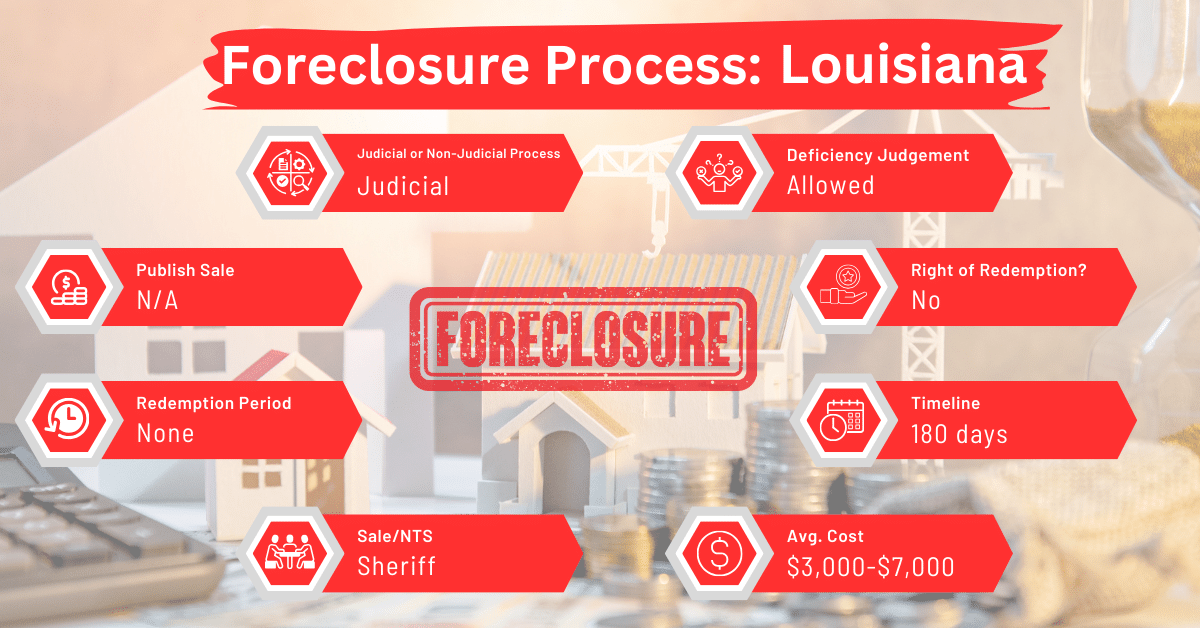

Louisiana permits only judicial foreclosures, but there are two types: executory and ordinary. The timeline for a foreclosure in Louisiana can range from 180 to 270 days, depending on the type of foreclosure and whether the homeowner contests it.

Executory foreclosures, which are more common, allow lenders to bypass some steps typical of a judicial foreclosure. On the other hand, ordinary judicial foreclosures follow a more extensive and costly process, similar to a lawsuit. They usually last about nine months.

Pre-foreclosure Period

In Louisiana, the pre-foreclosure period begins when a homeowner fails to make mortgage payment 12o days after it’s due. This is in line with the Dodd-Frank Act, which discourages initiating foreclosure proceedings until the borrower is 120 days past due.

During this period, the servicer must contact the homeowner to discuss foreclosure alternatives and provide information about loss mitigation options. Many Louisiana home loans require lenders to send a “breach letter” to the borrower, warning of potential foreclosure if the debt remains unpaid.

Types of Foreclosures

As mentioned above, Louisiana’s judicial foreclosure process includes two types: executory and ordinary. Executory foreclosures involve a mortgage with an “authentic act that imparts a confession of judgment,” allowing the lender to file a foreclosure petition without prior notification to the borrower. Ordinary foreclosures are more traditional, involving a lawsuit against the borrower.

Notice and Sale Process

In executory foreclosures, once the petition is filed, the borrower is served with a demand for the default amount. If not paid within three days, the court orders a writ of seizure and sale.

The sheriff then serves the writ of seizure and publishes the notice of sale, which includes details about avoiding foreclosure and the sheriff’s sale. The sale is a public auction conducted by the sheriff, and the winning bidder must pay the sale price in cash or within 30 days if a deposit is made.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Louisiana facing foreclosure have the option to sell their mortgage notes to a reputable note buyer. This can provide an alternative solution, potentially avoiding the foreclosure process and its negative consequences.

Borrower Rights and Protections

Borrowers in Louisiana have certain rights during the foreclosure process, including the right to be properly served with foreclosure documents and to respond to the foreclosure petition. They also have the opportunity to appeal the petition or bring suit against the lender.

Redemption and Deficiency Judgments

Louisiana does not offer a right of redemption after the foreclosure sale. However, lenders can file for a deficiency judgment if the sale does not cover the owed amount, provided the property was appraised before the sale.

Comparative Insights

Below, we examine how Louisiana’s foreclosure practices compare with other states is essential for homeowners, investors, and legal professionals.

Publish Sale Notice

Louisiana mandates that the notice of sale be published at least twice in a local newspaper. This requirement is consistent with judicial foreclosure states like Florida.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Louisiana, which include legal fees and court costs, generally fall between $3,000 and $7,000. Going through foreclosure in Connecticut, Illinois, Maryland, Nebraska, Ohio, or Vermont, which are all judicial foreclosure states, costs the same amount.

Impact on Credit Score

The impact of foreclosure on a borrower’s credit score in Louisiana is similar to that in other states. Foreclosure typically leads to a significant decrease in credit scores, often by 100 points or more. This impact is a consistent feature across the United States, regardless of the state-specific foreclosure processes. Nevertheless, the duration of the foreclosure process, which can be longer in judicial states like Louisiana, might influence the time it takes for a borrower’s credit score to start recovering.

Conclusion

The judicial nature of the process in Louisiana offers certain protections to borrowers but also necessitates a thorough understanding of the legal proceedings involved. In the event that foreclosure may hugely impact the borrower, they may be better off selling their mortgage note instead.