Nebraska Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

As a homeowner or investor in Nebraska, you need to understand Nebraska’s foreclosure laws and processes. In this post, you’ll learn a lot about the legal framework, timelines, and critical steps involved in Nebraska’s foreclosure proceedings.

Foreclosure Process Overview

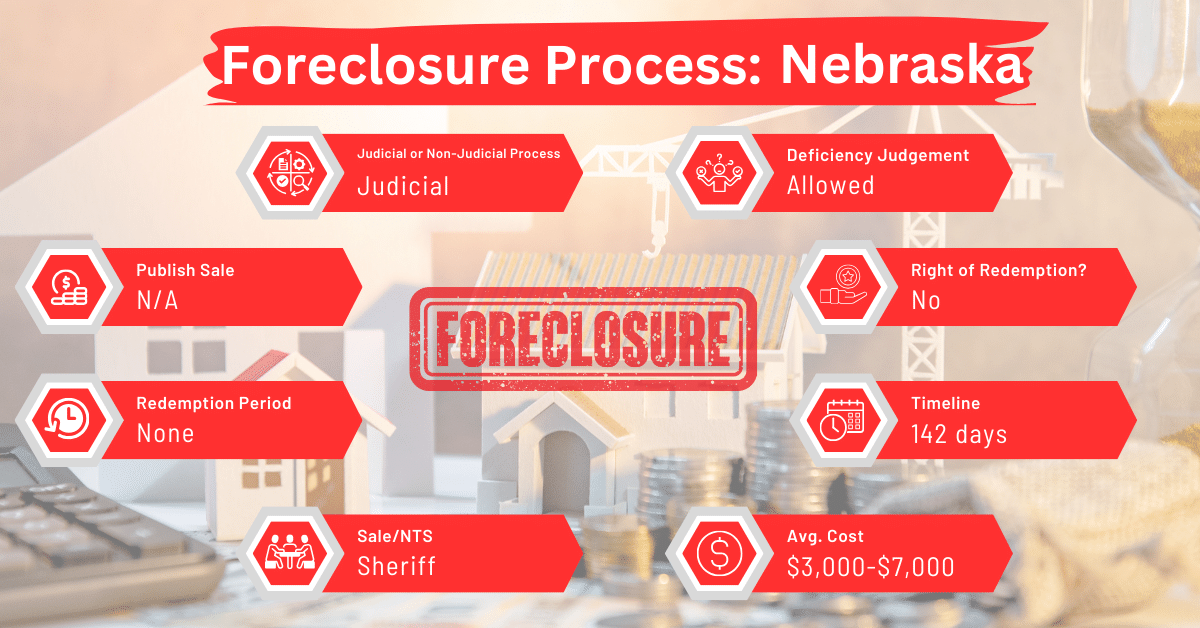

Nebraska exclusively uses judicial foreclosures. The typical foreclosure process in Nebraska can last approximately 142 days, which is relatively standard compared to other judicial foreclosure states like Colorado, Kentucky, and North Dakota.

Pre-foreclosure Period

Over the term of a deed of trust in Nebraska, the principal amount owed or any part of it secured by a trust deed may become due before its scheduled maturity date. Some reasons for the accelerated maturity could be: missing payments on interest or principal, failing to pay taxes, insurance premiums, or other advances required by the trust deed.

In this situation, the borrower can remedy the default within a month from the date they receive the notice of default. They can do so by paying the full amount owed under the trust deed within one month of the notice of default being recorded. This payment must include all costs and fees that arise from enforcing the agreement. However, the payment mustn’t exceed $50 or 0.5% of the total unpaid principal, whichever is greater. The payment should not include any part of the principal that would not yet be due if the default had not occurred.

Once the default is corrected, all related legal actions must be dropped. The terms of the original trust deed and obligation will be restored as though no breach had occurred. If the default is resolved as described, the borrower arranges for the trustee to cancel the recorded notice of default. If the beneficiary fails to do this within thirty days of such a request, they are liable for any damages caused by their refusal.

In the event that the borrower doesn’t cure the default, the lender can take legal action to foreclose on the property.

Types of Foreclosures

Nebraska’s foreclosure process is exclusively judicial. All foreclosure cases need to be processed through the court system. While potentially lengthier than the non-judicial approach, judicial foreclosure aims to ensure fairness and due process in the foreclosure proceedings.

Notice and Sale Process

Notice

Before the sale, the trustee is required to issue a detailed written notification that outlines the date, time, and location of the upcoming property sale. It should include a precise description of the property to be auctioned.

The notice must be published in a newspaper widely read throughout each county where the property, or any part of it, is situated. This publication must be made at least five times a week for five consecutive weeks. Between 10 and 30 days before the foreclosure sale, the notice must be published for the last time.

Sale

A judicial foreclosure sale in Nebraska takes place at the time and location specified in the notice. It must be held between 9 am and 5 pm. and may be conducted at one of three places:

- Directly on the premises for sale.

- At the county courthouse in the county where the property, or a part of it, is located.

- Within a public building in the same county that houses one or more county offices.

On the specified date, time, and place mentioned in the sale notice, the trustee will auction the property to the highest bidder at a public auction. The trustee’s attorney is also authorized to conduct the sale. Anyone, including the beneficiary, is eligible to bid at the auction. Each bid is considered a final and irrevocable offer.

If a winning bidder fails to pay the bid amount for the property they won at the auction, the trustee has the right to resell the property to another highest bidder at any future time. However, this subsequent sale must be announced in the same way as the initial sale was advertised. The bidder who fails to fulfill their payment obligation will be held responsible for any financial losses incurred from their failure to pay.

Avoiding Foreclosure by Selling Your Mortgage Note

For homeowners in Nebraska facing foreclosure, selling their mortgage notes to a reliable buyer is a good option. By doing so, they can skip the long and complicated foreclosure process and prevent negative effects like harm to credit scores and losing their homes.

Borrower Rights and Protections

Nebraska law ensures that borrowers are adequately informed about the foreclosure process through detailed notices and court proceedings.

Redemption and Deficiency Judgments

Redemption

After a foreclosure sale in Nebraska, the trustee’s deed will transfer to the purchaser all rights to the property sold, including the trustee’s title and any rights, titles, interests, and claims held by the borrower, their successors, and anyone claiming through them.

This transfer is absolute, with no option for redemption. It encompasses all rights, titles, interests, and claims that the borrower or their successors might have acquired in the property after the trust deed was initially executed.

Deficiency Judgments

Within three months after a property is sold under a trust deed, the lender can file a legal action to recover any remaining debt that the trust deed secured. In this lawsuit, the lender must state:

- The total debt secured by the trust deed,

- The sale price of the property and its fair market value at the time of sale.

- Interest on the debt from the sale date.

- All costs and expenses related to the sale and exercise of the power of sale.

Before the court can issue a deficiency judgment in Nebraska, it must determine the fair market value of the property at the time of sale. The judgment amount cannot exceed the difference between the total debt (including interest and sale-related costs and trustee’s fees) and the property’s fair market value on the sale date.

Special Protections and Programs

Nebraska provides resources including loan modification options, which can adjust the terms of a mortgage to make payments more manageable. Government assistance programs also offer various forms of financial aid.

Comparative Insights

Comparing Nebraska’s foreclosure laws with other states shows differences in how long it takes, the costs involved, and effects on credit scores.

Publish Sale Notice

Nebraska’s foreclosure process, being judicial-only, requires a notice period of approximately four weeks before the foreclosure sale. This duration is in line with many states that use judicial foreclosures, such as Arkansas, Georgia, Iowa, Maine, Maryland, Michigan, Mississippi, Oregon, and Virginia.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Nebraska typically range from $3,000 to $7,000. Compared to other states like Alabama, Arizona, Texas, Wyoming, and West Virginia, these costs are high.

Impact on Credit Score

In Nebraska, foreclosure can significantly impact a homeowner’s credit score, often leading to a decrease of 100 points or more. This negative effect is a common consequence across the United States.

Conclusion

Nebraska’s foreclosure laws operate strictly through the judicial system, which means every case goes through the courts. This structured approach provides oversight but doesn’t mitigate the tough consequences of foreclosure. For homeowners at risk of foreclosure, selling the mortgage note can help them sidestep the foreclosure process and its negative fallout.