Colorado Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

If you’re dealing with property in Colorado, it’s really important to get a good grasp of the foreclosure scene. This guide breaks down the Colorado foreclosure process, giving you a closer look at the legal details, how long things take, and what kind of protections are out there for borrowers.

Overview of Colorado Foreclosure

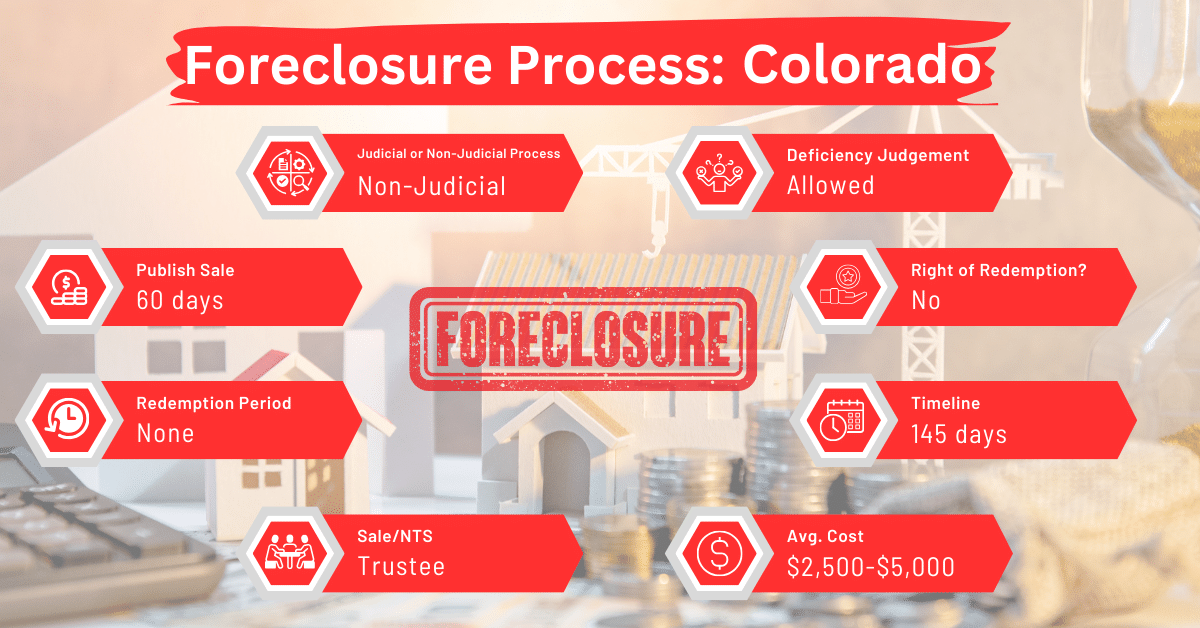

In Colorado, foreclosure proceedings can follow both judicial and non-judicial paths. However, the non-judicial route, managed by a public trustee, is more common due to its efficiency and shorter timeline.

Pre-foreclosure Period in Colorado

The pre-foreclosure period in Colorado offers a critical window for homeowners to address loan defaults and avoid foreclosure. Once a lender initiates foreclosure by filing the necessary documents with the county’s public trustee, the clock starts ticking. Homeowners have until noon the day before the scheduled sale to cure the default and halt the foreclosure process, providing a tangible opportunity for Colorado residents to save their homes.

Types of Foreclosures in Colorado

Colorado’s foreclosure landscape is primarily dominated by non-judicial foreclosures due to their streamlined process. Unlike judicial foreclosures, which require court involvement and tend to be lengthier, Colorado’s non-judicial process allows for a quicker resolution, typically within about 145 days.

Notice and Sale Process in Colorado

Under the Colorado Revised Statutes, the public trustee in charge of the foreclosure sale may schedule the sale for 110 to 125 days after the notice of election and demand is recorded.

When they’ve scheduled the sale date, they must mail the first combined notice of sale to the borrower or other relevant parties within 20 days after the notice of election and demand was recorded. The second combined notice of sale must be mailed between 45 and 60 days after the notice of election and demand was recorded.

If the borrower intends to cure the default by paying the sums due under the mortgage or deed of trust, they must notify the lender of their intention at least 15 days before the first sale date.

Where the borrower doesn’t intend to cure the default, the public trustee may proceed with the foreclosure sale. For the sale to be conducted, the trustee must obtain a court order authorizing the sale two business days before the sale date. However, a lienor (a person who has a lien on the property) may redeem it from the purchaser after it has been sold.

Borrower Rights and Protections

Colorado foreclosure laws provide several protections for borrowers, including the right to be notified of the foreclosure action and the opportunity to cure the default. However, it’s important to note that Colorado does not offer a redemption period for the previous owner after a foreclosure sale.

Foreclosure Assistance and Resources in Colorado

- Colorado Legal Services: Non-profit organizations like Colorado Legal Services offer free legal assistance to low-income individuals facing foreclosure. They can provide legal advice, representation, and help in negotiating with lenders.

- Housing Counseling Agencies: Approved by the U.S. Department of Housing and Urban Development (HUD), these agencies offer counseling services that include foreclosure prevention, loss mitigation, and debt management. They can guide homeowners through the process and help them understand their options.

- Colorado Foreclosure Hotline: This hotline provides homeowners with access to professional housing counselors who can offer guidance on avoiding foreclosure. The Colorado Revised Statutes mandate anyone who’s authorized to initiate the foreclosure process to mail a notice containing the Colorado foreclosure hotline to the borrower.

- Colorado Emergency Mortgage Assistance Program: This program utilizes federal money to offer emergency financial assistance to homeowners struggling to make mortgage payments.

- Non-Profit Organizations: Numerous non-profit organizations in Colorado sometimes provide financial assistance to homeowners facing foreclosure. For example, the Colorado Housing Assistance Corporation helps homeowners who’re late on their mortgage payments to cure their defaults.

Are There Redemption Periods and Deficiency Judgments in Colorado?

In Colorado foreclosure, there is no redemption period post-sale. Regarding deficiency judgments, Colorado law permits lenders to seek judgments against borrowers if the sale price does not cover the mortgage balance. To qualify for a deficiency judgment, the lender must have bid for a fair price for the property at the foreclosure sale. Under Colorado law, the lender has up to six years to institute an action for a deficiency judgement.b

Special Protections and Programs

Colorado has implemented measures to ensure fair and transparent foreclosure processes, including the requirement for a Rule 120 hearing. Rule 120 gives homeowners a chance to contest the foreclosure if they believe it is unwarranted.

Avoiding Foreclosure: Selling Your Mortgage Note

For those seeking alternatives to foreclosure, selling your mortgage note to a reputable buyer presents a viable option. This route can provide immediate financial relief and avoid the lengthy and stressful foreclosure process.

Comparative Insights

Colorado’s foreclosure process is notably efficient compared to states that rely heavily on judicial foreclosures. The streamlined non-judicial process, managed by a public trustee, typically concludes within six months. This Colorado foreclosures quicker than the foreclosures in other states that implement non-judicial foreclosures. These states include Arizona, Alabama, Georgia, Hawaii, Michigan, Mississippi, Missouri, North Carolina, Oregon, Tennessee, Utah, Washington, and Wyoming.

Additionally, foreclosure costs in Colorado, ranging from $2,500 to $5,000, are influenced by the non-judicial nature of most proceedings.

Conclusion

For homeowners facing foreclosure in Colorado, it’s crucial to be proactive, understand your rights, and explore all available options to address the situation. The non-judicial process, while efficient, offers a limited window for action. So, if you receive a fire color notice in Colorado, it’s best to act on it as soon as possible.