North Carolina Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Foreclosure in North Carolina follows a set of rules. In this blog post, you’ll find a simplified explanation of North Carolina’s foreclosure process.

Foreclosure Process Overview in North Carolina

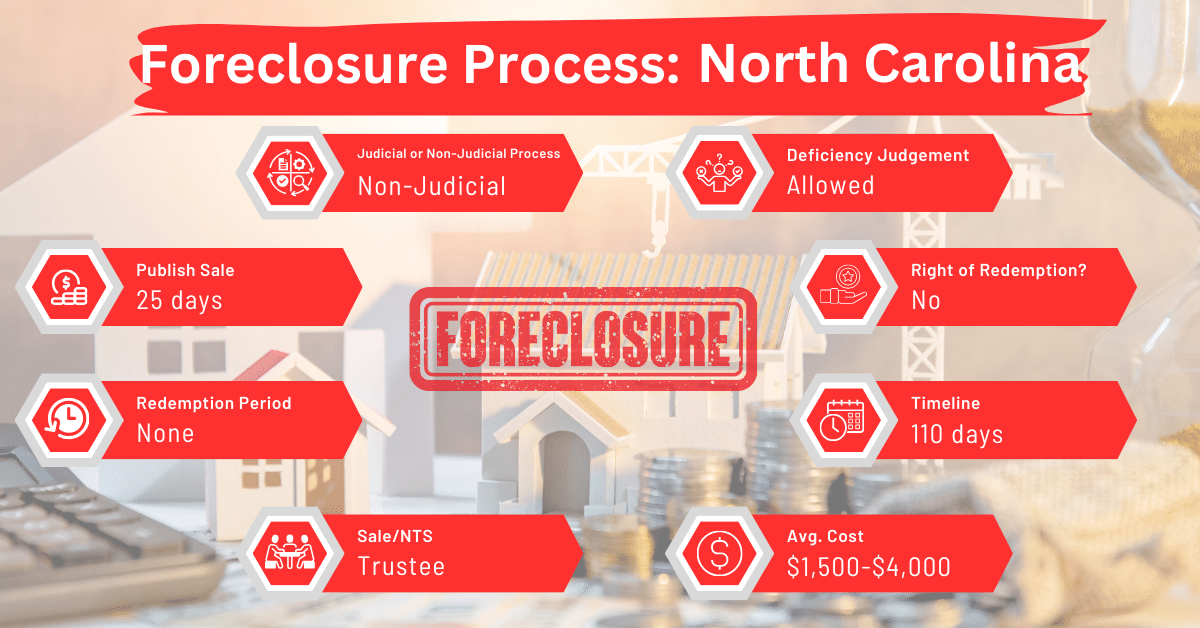

The North Carolina General Statutes provide for judicial and non-judicial foreclosures. Non-judicial foreclosures are more common, though. The typical foreclosure timeline in North Carolina is approximately 110 days.

This is relatively long for a non-judicial foreclosure state. In most states where non-judicial foreclosures are popular, such as Alabama, Georgia, Massachusetts, Michigan, Missouri, New Hampshire, Rhode Island, Tennessee, Texas, and Wyoming, the process takes under 90 days.

Pre-foreclosure Period in North Carolina

Before a lender can exercise their power to sell the mortgaged property pursuant to the power-of-sale clause in the mortgage agreement, they must file a notice of hearing with the court clerk. This notice is to inform all interested parties that the court will conduct a hearing to determine if the foreclosure will take place.

Once filed, this notice must be served on each party entitled to receive it, detailing the time and place for the hearing with the clerk of court. This service must occur at least 10 days before the hearing date. The notice can be served in any way allowed by the Rules of Civil Procedure, but it must include registered or certified mail with a return receipt.

If allowed, the notice can be served on the borrower by prominently posting the notice on the property at least 20 days before the hearing. The sheriff is responsible for posting the notice.

If service is achieved through posting, an affidavit must be submitted to the court clerk detailing the reasons for using this method.

Types of Foreclosures in North Carolina

North Carolina primarily practices non-judicial foreclosures. Judicial foreclosures are less common and are typically reserved for cases with specific complications, such as title issues.

Notice and Sale Process in North Carolina

The notice of sale must include:

- Instrument Description: The notice should outline the legal document authorizing the sale, identifying the original borrowers and the registration details of the document. If the current owner of the property differs from the original borrowers, their name should be listed based on the most recent data from the register of deeds, updated within the last 10 days before posting the notice. If there is a known current owner who is not listed in the records, their details should also be included.

- Sale Timing and Location: The notice must specify the date, time, and location of the sale, ensuring these details align with the legal document and applicable laws.

- Property Description: The property must be described in terms that clearly communicate to the public what is for sale. This may use general terms or refer to the description in the legal document that grants the power of sale. If the document mentions any parts of the property that are not for sale, these should be clearly identified so potential buyers understand what is excluded.

- Sale Terms: The notice must detail the terms of the sale as specified in the legal document, including any required cash deposit from the highest bidder at the time of sale.

- Tax and Assessment Information: It must clearly state that the property is being sold subject to any taxes and special assessments, if applicable.

- Subordinate Rights and Interests: The notice should inform about any subordinate rights or interests that come with the property, ensuring these are adequately identified, and specify whether the property is being sold subject to these rights or together with them.

This notice is mailed to the borrower and relevant parties at least 20 days before the sale date.

Also, it must be posted in the designated public notice area by the clerk of superior court in the county where the property is located at least 20 days before the sale. In addition, it should be published in a newspaper authorized for legal advertising in the county. If no such newspaper exists, the publication should occur in a newspaper with general circulation in the county. This publication should happen once a week for two consecutive weeks.

Beyond standard newspaper advertising, the clerk may authorize additional advertising if requested by any interested party. The period of publication in the newspaper should span at least seven days, including Sundays. No more than 10 days before the sale, the notice should be published for the final time.

Regarding the sale, it will start at the time stated in the notice of sale, or as soon after that as possible. But, it must begin no later than one hour after the designated time unless delayed by other sales happening at the same location. The sale must take place between 10 am and 4 pm on any day that the clerk’s office is open for business.

The sale is conducted at the courthouse and the property is sold to the highest bidder.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in North Carolina facing foreclosure may avoid foreclosure by selling their mortgage notes to a reputable note buyer.

Borrower Rights and Protections in North Carolina

In North Carolina, borrowers have certain protections during the foreclosure process. This includes the right to be notified of the foreclosure proceedings and the opportunity to contest the foreclosure at a preliminary hearing.

When the lender buys the property, and later seeks to obtain a deficiency judgment against the original borrower (mortgagor, trustor, or maker of the obligation), the borrower can also defend against this judgment.

The borrower can argue in defense (not as a counterclaim) that at the time of the sale, the property was worth at least the amount of the debt secured by it, or that the sale price was significantly lower than its true value. If the borrower can successfully demonstrate this, they may be able to prevent the deficiency judgment or reduce the amount they owe.

Redemption and Deficiency Judgments in North Carolina

Borrowers in North Carolina have a 10-day right of redemption after the sale by paying the owed amount plus any sale costs. Lenders can also seek deficiency judgments, where the borrower has to pay the difference between the sale price and the mortgage balance.

Special Protections and Programs in North Carolina

Pre-foreclosure Notices

At least 45 days before filing a notice of hearing in a foreclosure proceeding on a primary residence, a mortgage servicer or lender must mail a pre-foreclosure notice to the borrower’s last known address. This notice should inform the borrower about resources available to help avoid foreclosure. It should include:

- A detailed list of all overdue amounts that have led to the default on the loan.

- A detailed list of any additional fees that need to be paid to make the loan current.

- A statement informing the borrower that there are alternatives to foreclosure and that they can discuss these options with the mortgage lender, the mortgage servicer, or a counselor approved by the U.S. Department of Housing and Urban Development (HUD).

- Contact details for the mortgage lender, mortgage servicer, or their authorized agent who can work with the borrower to prevent foreclosure.

- Contact information for one or more HUD-approved counseling agencies in North Carolina that assist borrowers in avoiding foreclosure.

- Contact details for the State Home Foreclosure Prevention Project of the Housing Finance Agency.

State Home Foreclosure Prevention Project

The aim of the Project is to find ways to prevent home loan foreclosures. The Housing Finance Agency manages the project. Contributions from HUD-approved housing counselors, community organizations, the Credit Union Division, other state agencies, mortgage lenders, mortgage servicers, and various partners also help to push the Project forward.

Extension of the Pre-foreclosure Period

The Housing Finance Agency may determine that the State Home Foreclosure Prevention Project has a reasonable chance of preventing foreclosure on primary residences after thoroughly reviewing:

- The loan details

- The mortgage servicer’s efforts to mitigate losses

- The borrower’s ability and desire to remain in the home, and other relevant factors.

In this situation, the Executive Director of the Housing Finance Agency has the authority to delay the filing date for any foreclosure proceeding on a primary residence by up to 30 days beyond the initial date set by the pre-foreclosure notice.

Comparative Insights

While comparing North Carolina’s foreclosure processes with those of other states, we observe some differences and similarities in notice periods, foreclosure costs, and the impact of foreclosure on the borrower’s credit score.

Publish Sale Notice

In North Carolina, the notice of sale must be published at least 25 days before the sale. This period is way shorter than the notice timeframes in other states where judicial foreclosures are more common. Some of these states are: Alaska, Arizona, Colorado, Hawaii, Idaho, Massachusetts, Michigan, Mississippi, Montana, Nevada, Washington, and West Virginia.

Costs in a Range and Comparison to Other States

Foreclosure costs in North Carolina typically range from $1,500 to $4,000. These costs are relatively lower than in states with judicial foreclosure processes, like Connecticut, Delaware, Florida, Illinois, New Jersey, New York, and Ohio.

Impact on Credit Score

Like in other states, foreclosure in North Carolina can significantly affect a homeowner’s credit score, often leading to a decrease of 100 points or more.

Conclusion

Understanding North Carolina’s foreclosure laws and processes is beneficial for homeowners and investors. For those on the brink of foreclosure, selling the mortgage note can provide an alternative to losing the property.