Montana Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Montana has two laws governing the foreclosure process, which are: The Small Tract Financing Act (STFA) and the Montana Mortgage Act. While the STFA is applicable to the foreclosure of parcels of land that are less than or equal to 40 acres, the Montana Mortgage Act regulates foreclosures of parcels that are more than 40 acres. In this article, we’ll discuss foreclosure in Montana under both laws.

Foreclosure Process Overview

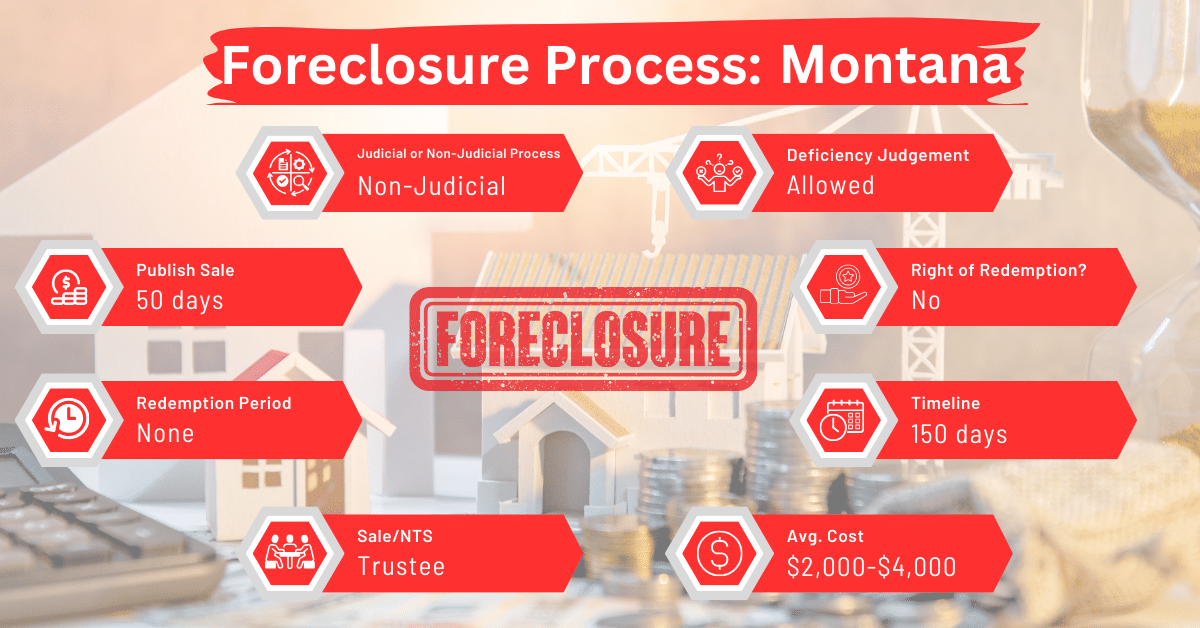

Montana’s approach to foreclosures includes both judicial and non-judicial methods. The process followed largely depends on whether the mortgage or deed of trust contains a power-of-sale clause.

The entire foreclosure process in Montana usually takes about 5-6 months, a duration that is fairly typical when compared to other states. In Montana, non-judicial foreclosures, which are conducted through a trustee sale, are the more frequently used method.

This preference for non-judicial foreclosures is due to their efficiency and streamlined process, making them a more expedient solution for handling foreclosures compared to the longer, court-involved judicial foreclosures.

Pre-foreclosure Period

In judicial foreclosures, the court determines the amount due to the lender and gives the borrower a set period to pay the debt. The pre-foreclosure window is usually 30 days long. If the borrower fails to pay, the lender issues a notice of foreclosure sale.

For non-judicial foreclosures, which are more prevalent, the lender starts the process by filing a notice of sale with the county recorder. The sale must occur at least 120 days after this notice is filed. The borrower can stop the foreclosure at any point before the sale by paying the full default amount plus costs and attorney’s fees.

Types of Foreclosures

In Montana, when a real estate mortgage includes a power of sale—granting either the mortgage holder or another designated person the authority to sell the property following a breach of the loan agreement—there are two enforcement options.

One can pursue a formal foreclosure action under the law, that is, a judicial foreclosure. As an alternative, one may proceed with a sale as outlined in the terms of the mortgage itself. This is called a non-judicial foreclosure. Facilitated by power-of-sale clauses, non-judicial foreclosures are more popular in Montana due to their efficiency.

Foreclosures under the STFA are usually non-judicial while those under the Montana Mortgage Act are judicial.

Notice and Sale Process Under the STFA

Notice of Sale

The trustee must provide notice of the sale at least 120 days before the scheduled sale date. The notice must be sent by certified mail to the following parties:

- The original borrower (grantor) at the address listed in the trust indenture. If the trust indenture does not specify an address, the notice should be sent to the grantor’s last known address.

- Each individual named in the trust indenture as entitled to receive a notice of sale, at the address specified in the indenture.

- Any individual who has formally requested a notice of sale, following the procedures outlined in this section, at the address provided in their request.

- Any successor to the grantor who has a recorded interest in the property as of the filing date and time of the notice of sale, at their recorded address.

- Any individual who holds a lien or has an interest in the property that was recorded after the trustee’s interest, at the address listed in their recorded documents as of the filing date and time of the notice of sale.

A copy of the recorded notice of sale must be visibly posted on the property that is being sold at least 20 days before the scheduled date of the trustee’s sale. This posting should be carried out by a sheriff or constable from the county where the property is located, if the trustee requests it.

The notice of sale must also be published in a newspaper that is widely read within any county where the property, or part of it, is located. This publication must occur once a week for three consecutive weeks. The final publication must be completed at least 20 days before the scheduled trustee’s sale.

If no newspaper of general circulation is available in the county, the notice must instead be posted in at least three public places within each county where the property, or any part of it, is located. Like the publication, the last posting must occur at least 20 days before the date fixed for the trustee’s sale.

Sale

On the date, time, and at the location specified in the notice of sale, the trustee or the trustee’s attorney will conduct a public auction, selling the property to the highest bidder. The property can be sold as a single parcel or in several parcels. Anyone, including the beneficiary under the trust indenture, may participate and bid at the auction, except for the trustee. The person conducting the sale reserves the right to postpone the sale for any reason they deem necessary.

Notice and Sale Process Under the Montana Mortgage Act

Notice of Sale

When real estate is sold under a power of sale clause in a mortgage, the sale must be advertised at least 30 days before the scheduled sale date. This advertisement should be placed in a newspaper within the county where the property is located. If there is no local newspaper, the notice should be posted in at least five visible places across the county, including:

- On the property itself.

- In two other prominent spots within the township where the property is located.

- In a prominent place that will likely inform interested parties.

- At the front door of the county courthouse.

At least 30 days before the sale, personal notices must be given to the current occupant of the property, the person who took out the mortgage (if they are in Montana), and anyone recorded as having an interest in the property who is in Montana.

Sale

During a judicial foreclosure in Montana, the court may decide:

- To sell the mortgaged property, or as much of it as necessary, to settle the debt.

- To use the money from the sale to cover any property taxes due at the time of foreclosure, court costs, sale expenses, and the amount owed to the plaintiff.

If the money from the sale isn’t enough to cover the debt, the court will issue a judgment for the remaining balance against the debtor(s). This remaining debt then becomes a lien on any real estate owned by the debtor(s), just like other debts enforced through legal actions.

If someone has a transfer or lien on the mortgaged property that isn’t officially recorded when the lawsuit begins, they don’t need to be included in the lawsuit. However, the court’s final decision will affect them just as if they had been included in the lawsuit. This ensures that the judgment is fair and conclusive, even if some interests in the property were not formally recorded.

Avoiding Foreclosure by Selling Your Mortgage Note

For homeowners in Montana facing foreclosure, selling their mortgage notes to a reputable buyer can be an effective alternative. This option can help them circumvent the foreclosure process.

Borrower Rights and Protections

During a foreclosure in Montana, the lender must alert the borrower of foreclosure process through detailed notices.

Redemption and Deficiency Judgments

Redemption Period and Deficiency Judgments Under the STFA

When a property to which the STFA applies is foreclosed in Montana, the borrower doesn’t enjoy a redemption period after the foreclosure sale. This means that once the property is sold, the borrower cannot reclaim it. Also, the lender isn’t allowed to pursue a deficiency judgment against the borrowers.

Redemption Period and Deficiency Judgments Under the Montana Mortgage Act

Properties whose foreclosures are governed by the Montana Mortgage Act can be redeemed within 365 days after the foreclosure sale. If the property is a residential building, the borrower can stay in the property throughout the redemption period. The lender can also pursue a deficiency judgment against the borrower.

Special Protections and Programs

Montana offers various programs and initiatives to assist homeowners facing foreclosure. These include loan modification options and government assistance programs, providing financial relief and alternative solutions.

Comparative Insights

Comparing Montana’s foreclosure rules to other states helps us see how Montana differs from these states in some respects, such as how long notices are, foreclosure costs, and how it affects credit scores.

Publish Sale Notice

Montana’s foreclosure process requires a 50-day notice period before the sale.which is comparatively longer than in some other states. Alabama, Arizona, Arkansas, California, Florida, Georgia, Idaho, Iowa, This extended notice period reflects Montana’s approach to giving borrowers ample time to respond to foreclosure proceedings.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Montana typically range from $2,000 to $4,000. This cost bracket is cheap compared to the cost of foreclosure in Colorado, Connecticut, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Maryland, Nebraska, New Jersey, New Mexico, New York, South Carolina, and Vermont. In these states, foreclosure costs start at $3,000.

Impact on Credit Score

Foreclosure in Montana can significantly impact a homeowner’s credit score, often leading to a decrease of 100 points or more. This negative effect is consistent across the United States.

Conclusion

Montana’s foreclosure laws and processes offer a balanced approach, with options for both judicial and non-judicial foreclosures. Homeowners in Montana will find that selling the mortgage note is financially safer and healthier than going through foreclosure.