Iowa Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

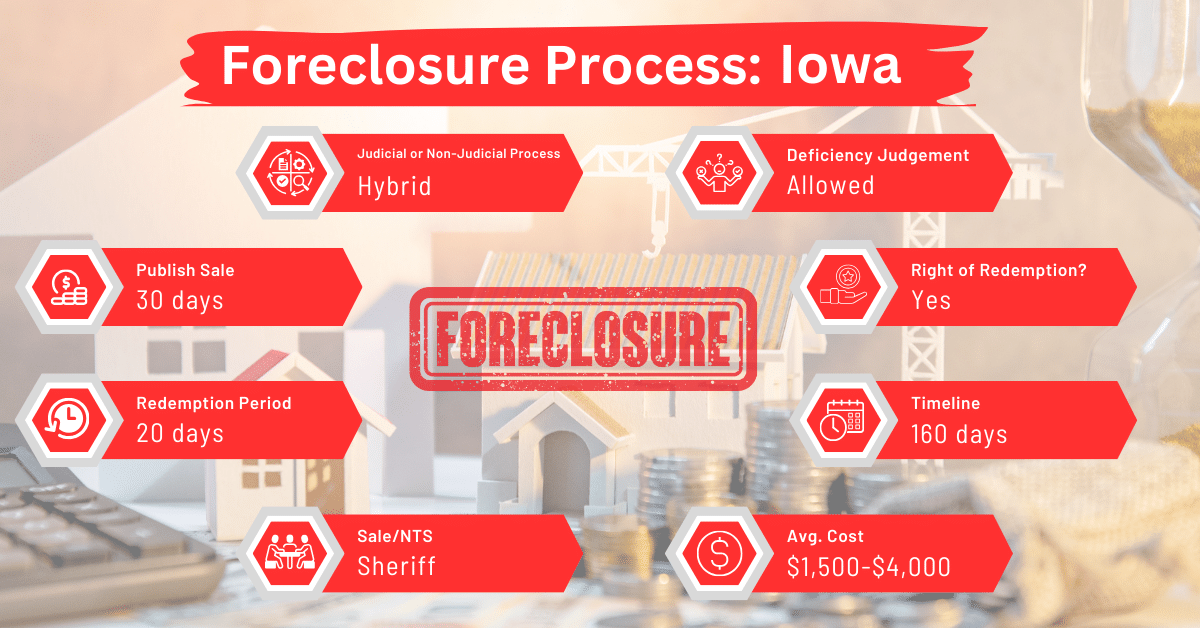

As a hybrid foreclosure state, Iowa permits both judicial and non-judicial foreclosure procedures. By the end of this article, you’ll thoroughly understand the foreclosure process in Iowa and how it compares to the processes in other states.

Foreclosure Process Overview

Iowa’s foreclosure process is distinctive as it allows both judicial and non-judicial foreclosures. The typical foreclosure process in Iowa lasts about 4 to 6 months. This is relatively quick compared to states that use only judicial foreclosures, such as Illinois, Indiana, Louisiana, Kentucky, New Jersey, New Mexico, New York, Ohio, North Dakota, South Dakota, Pennsylvania, and Wisconsin, where the process tends to take longer.

Pre-foreclosure Period

In Iowa, the pre-foreclosure period can vary based on the type of foreclosure method used. For judicial foreclosures, this process can happen with or without the possibility for the borrower to redeem the property, and it really depends on how the lender wants to handle it. Usually, lenders kick things off by sending a 30-day notice of default to the borrower.

This notice spells out how much is owed and gives a deadline for payment. If the borrower doesn’t cure the default by paying up, the lender moves forward with the foreclosure. At that point, the court steps in, issues a judgment for the total amount owed, and orders the sale of the property.

Types of Foreclosures

Iowa uses a hybrid approach to foreclosure, mixing both judicial and non-judicial methods. In judicial foreclosures, the lender starts by filing a lawsuit, and the whole process is under court supervision. On the other hand, non-judicial foreclosures, also known as trustee sales, happen outside the court system. These can go forward regardless of whether the borrower agrees to them or not.

Notice and Sale Process

The sheriff has the job of getting the word out about the sale of the property. They need to post the sale notice in three public spots, including the courthouse. Plus, it has to be published in a local newspaper twice a week, starting at least four weeks before the actual sale date. If the borrower lives on the property, they must be informed at least 20 days before the sale happens.

The sheriff runs the sale, which usually goes down between 9:00 a.m. and 4:00 p.m. They also accept sealed written bids from potential buyers.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Iowa dealing with the threat of foreclosure have a solid alternative: they can sell their mortgage note to a trusted buyer. This move can offer quick financial relief and help dodge the harsh effects of foreclosure.

Borrower Rights and Protections

Borrowers in Iowa are backed by specific rights and protections. They’re entitled to proper notice and a chance to fix any defaults before foreclosure kicks off. Besides, the state provides redemption periods, which give borrowers a window to reclaim their property under certain conditions.

Redemption and Deficiency Judgments

In Iowa, the length of the redemption period during a foreclosure varies depending on the foreclosure type. For judicial foreclosures that allow redemption rights, this period can vary from 30 days up to a full year. If the lender seeks a deficiency judgment, the borrower gets a one-year period to redeem the property. However, if the lender waives his right to pursue a deficiency judgment, the redemption period drops to six months.

Special Protections and Programs

One of the special programs that the lender and the borrower must participate in is mediation. This process is designed to help both borrowers and lenders find common ground and avoid foreclosure. Discussions in a mediation are facilitated by a neutral third party who helps facilitate the discussions between the two sides.

The main goal of mediation is to thoroughly explore every option available to prevent foreclosure. This includes discussing loan modifications, setting up repayment plans, or even considering short sales.

Comparative Insights

Iowa’s hybrid approach to foreclosure has some features that distinguish it from other states. Among these features are the following:

Publish Sale Notice

Iowa requires a four-week notice period before the foreclosure sale. The notice of sale must be published twice weekly in a local newspaper. When comparing Iowa’s notice period to those in other states, it closely aligns with the timeframes in Georgia, Maine, and Maryland. In these states, lenders have up to 32 days to send a notice of sale to the borrower.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Iowa, primarily legal fees and court costs, are between $1,500 and $4,000. We believe that this range is particularly low due to the availability of non-judicial foreclosures.

This contrasts with states that only allow judicial foreclosures, like Connecticut, Delaware, and Florida, where the involvement of the court system typically results in higher associated costs.

Impact on Credit Score

The impact of foreclosure on credit scores is a common concern across the United States. In Iowa, as in other states, foreclosure can lead to a significant decrease in credit scores, often by 100 points or more. The duration of the foreclosure process, which can be shorter in Iowa due to its non-judicial option, might influence the time it takes for a borrower’s credit score to start recovering.

Conclusion

Iowa’s hybrid approach offers flexibility but also requires careful consideration of the available alternatives and implications of foreclosure. What if you want to avoid the consequences of foreclosure in Iowa altogether? Selling your mortgage note could be the way out.