Delaware Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

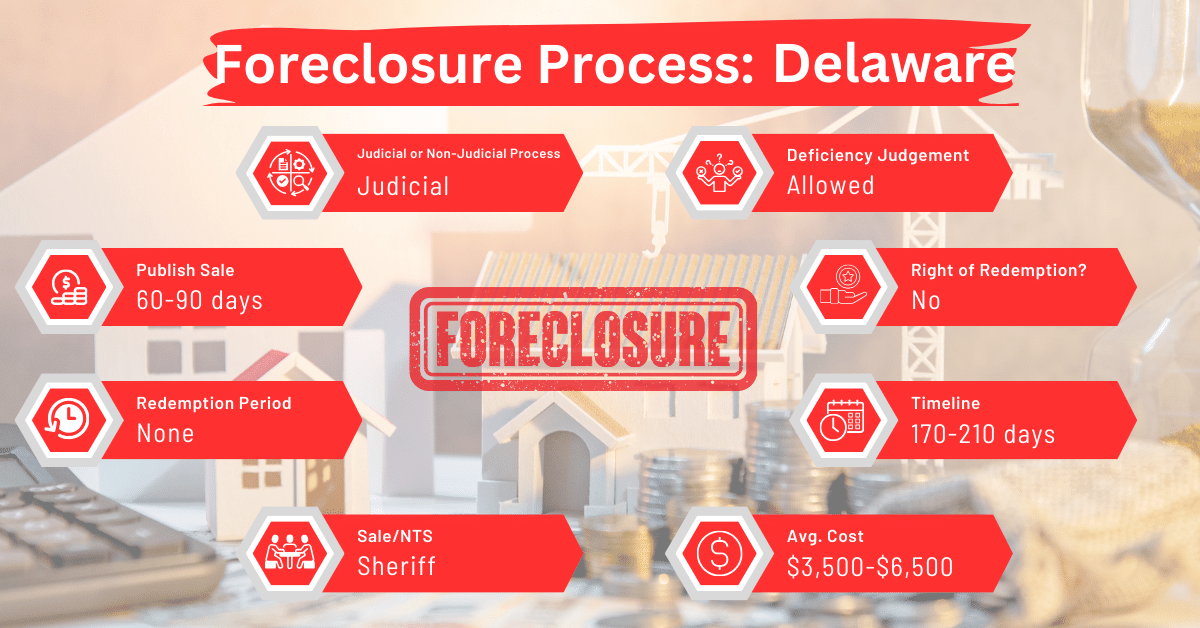

In Delaware, all foreclosures go through the courts. So if you fall behind on your mortgage, the process kicks off when your lender files a court complaint against you. Typically, this whole ordeal takes anywhere from 170 to 210 days. This timeframe is pretty middle-of-the-road compared to other states that primarily use judicial foreclosures, like New Mexico, Wisconsin, Florida, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Nebraska, New Jersey, New York, North Dakota, Ohio, Pennsylvania, South Carolina, and Vermont. Once everything’s said and done, the property is sold by a sheriff, and unfortunately, there’s no grace period for you to reclaim your home after the sale.

Pre-foreclosure Period

During the pre-foreclosure period, the lender files a complaint in court following a borrower’s default. The borrower is then given 20 days to appear in court and argue why the foreclosure should not proceed. This notice period could extend up to three months if the borrower cannot be located. Failure to appear in court within the stipulated time allows the court to declare the borrower in default, leading to a sheriff’s sale of the property.

Types of Foreclosures

As mentioned, Delaware practices judicial foreclosure, requiring court intervention. This process ensures that all foreclosure proceedings are legally scrutinized, offering protections for the borrower but also extending the timeline for foreclosure.

Notice and Sale Process

The sheriff takes on the duty of advertising and announcing the sale, a process that typically spans 2-3 months. Notices are put up on the property and in public spots at least 14 days before the sale. They are also sent directly to the borrower at least 10 days beforehand. Additionally, the sale notice appears in two local newspapers, selected by the sheriff, for two weeks before the sale takes place.

Avoiding the Foreclosure

Homeowners have the option to sell their mortgage note to a reputable note buyer as a way to avoid foreclosure. This can provide a lump sum of money to the homeowner, potentially allowing them to pay off their mortgage and avoid the foreclosure process altogether.

Borrower Rights and Protections

Delaware law provides several protections for borrowers, including the requirement for a judicial review of the foreclosure process. However, once the sale is confirmed, Delaware does not offer a right of redemption. This implies that the borrower cannot reclaim their property by paying off the debt after the sale.

Redemption and Deficiency Judgments

Like we mentioned earlier, there is no redemption period after the foreclosure sale in Delaware. However, the state allows for deficiency judgments, where the lender can pursue the borrower for any remaining debt if the sale of the property does not cover the mortgage balance.

Special Protections and Programs

Delaware offers an Automatic Residential Mortgage Foreclosure Mediation Program for borrowers facing foreclosure. This program aims to find a mutually agreeable solution between the lender and borrower, potentially avoiding foreclosure.

Comparing Delaware’s Foreclosure Process to Foreclosures in Other States

- Publish Sale Notice: The process takes 60-90 days, which is relatively moderate compared to other states.

- Costs: Foreclosure costs in Delaware range from $3,500 to $6,500. These costs place Delaware on the higher end compared to other states.

- Impact on Credit Score: The impact of foreclosure on credit scores is similar across all states.

Conclusion

Delaware’s judicial approach provides borrower protections but navigating the legal system is challenging. Homeowners should explore every avenue, like selling their mortgage note or joining mediation programs, to effectively handle foreclosure. Investors, on the other hand, should be mindful of state-specific nuances that affect the timeline and costs involved in acquiring foreclosed properties.