Pennsylvania Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

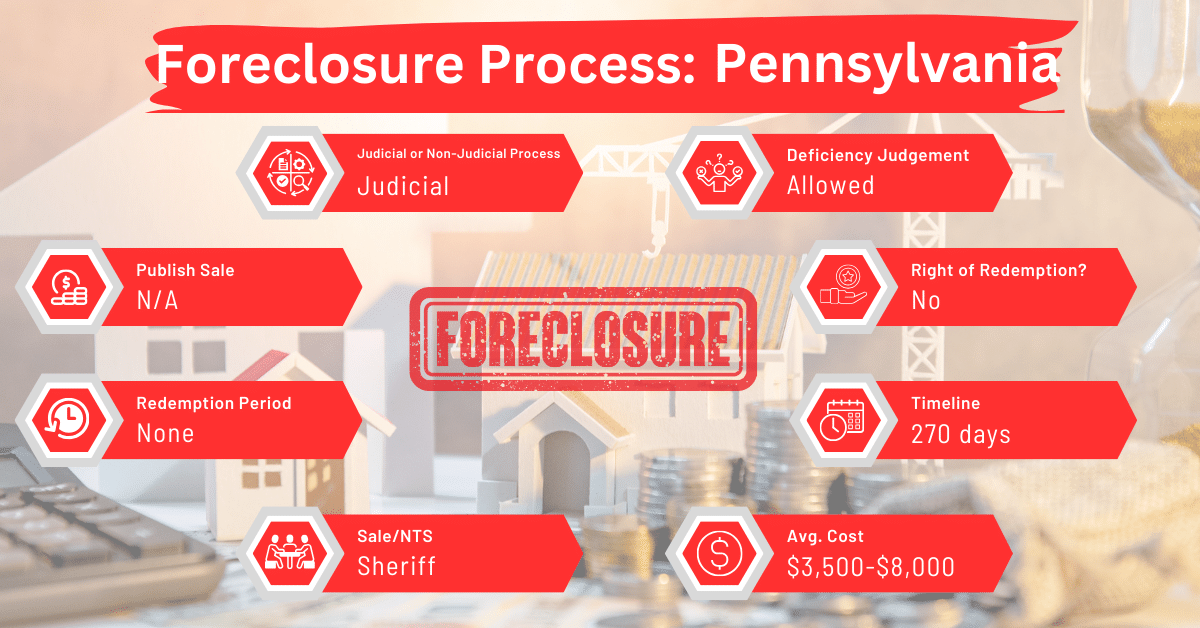

In Pennsylvania, all foreclosures are processed through the court system. The foreclosure process in Pennsylvania typically takes about 10 months, excluding the pre-foreclosure period.

Foreclosure Process Overview

Foreclosure begins in Pennsylvania when a borrower is at least 60 days late on payments. Before starting the foreclosure, the lender must send two notices to the borrower, offering options to prevent or avoid it.

If the borrower does not find a way to prevent the foreclosure, the lender files a lawsuit. Then, the creditor must notify the borrower of the foreclosure action, giving them about one month to respond before the court orders the property to be sold.

Pre-foreclosure Period

The pre-foreclosure period is a 2-4 month window during which the borrower can find a solution to prevent foreclosure.

Types of Foreclosures

As stated earlier, Pennsylvania practices only judicial foreclosures, involving court proceedings where the lender files a lawsuit against the defaulting borrower. If the court rules in favor of the lender, it orders the appropriate person to sell the property at a public auction.

Notice and Sale Process

The county sheriff gives notice of the sale at least 30 days prior by posting a handbill on the property and delivering a copy to the borrower. The sale is advertised in local newspapers for three consecutive weeks.

One to two months after the court’s order regarding the sale of the property, the county sheriff oversees a public auction for the sake of the property. The sheriff sells the property to the highest bidder, and completes the necessary documents to transfer ownership.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Pennsylvania facing foreclosure may consider selling their mortgage note to a reputable note buyer. This can help avoid the foreclosure process and its negative impacts on credit and homeownership.

Borrower Rights and Protections

Borrowers in Pennsylvania have the right to be notified of the foreclosure and to respond to the court filing. They also have the opportunity to prevent the sale by paying the full amount owed up to one hour before the sale.

Redemption and Deficiency Judgments

There is no right of redemption for borrowers following the sale in Pennsylvania. Meanwhile, creditors can pursue deficiency judgments, requesting the court to order borrowers to pay the difference between the sale price and the mortgage balance.

Special Protections and Programs

Pennsylvania has mandatory pre-foreclosure diversion programs in some counties. For example, the Pennsylvania Housing Finance Agency spearheads the Homeowners Emergency Mortgage Assistance Program (HEMAP).

The HEMAP process starts when your lender sends you an Act 91 Notice. This notice informs you of your right to apply for a loan from HEMAP, which can cover your overdue payments and possibly provide monthly assistance if your household income isn’t enough.

To be eligible, you must live in the property, have fallen behind on payments due to reasons beyond your control, and be able to demonstrate that you can resume full mortgage payments within 24 months at most. Once you receive an Act 91 Notice, it’s important to contact a counseling agency as specified in the notice. If you apply within 33 days from the date of the notice, your lender cannot proceed with any further actions.

After meeting with a counselor, they have 30 days to submit your application to HEMAP. Once HEMAP receives your application, they have 60 days to decide. You’ll be informed of the decision by mail. As long as you follow these timelines, your lender cannot start foreclosure proceedings.

Comparative Insights

Comparing Pennsylvania’s foreclosure approach with other states reveals some variations in notice periods, costs, and credit impacts.

Publish Sale Notice

The process of publishing the sale notice in Pennsylvania involves advertising in local newspapers for three weeks. This duration is consistent with the requirements in some judicial foreclosure states such as Alabama, California, Kansas, South Carolina, Rhode Island, and Texas.

Costs in a Range and Comparison to Other States

Foreclosure costs in Pennsylvania typically range from $3,500 to $8,000. These costs put Pennsylvania on the higher end of the cost spectrum, next to New York and New Jersey, where judicial foreclosure costs between $5,000 and $10,000.

Impact on Credit Score

Like in other states, foreclosure in Pennsylvania can decrease a borrower’s credit score 100 points or more.

Conclusion

Now that you understand Pennsylvania’s foreclosure laws and processes and the rights and protections available to borrowers, you can safely navigate foreclosure in this state. For those facing foreclosure, selling the mortgage note can be a viable option to avoid the process and its repercussions.