Texas Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

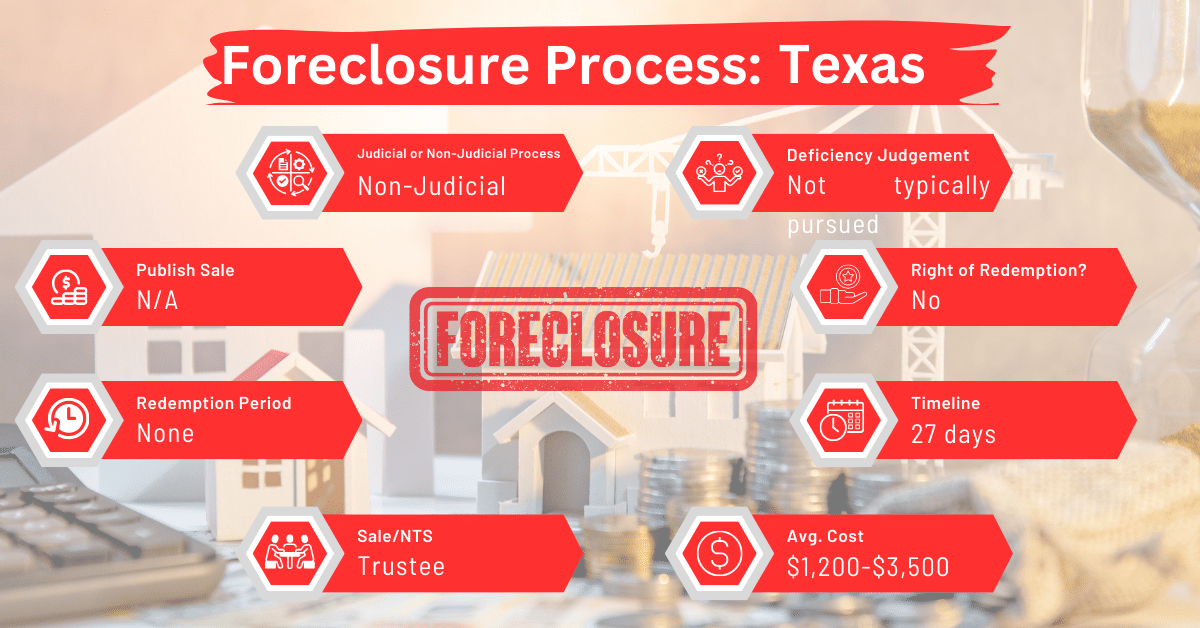

Texas allows both judicial and non-judicial foreclosures, but non-judicial foreclosures are more common due to their speed.

Foreclosure Process Overview

In Texas, most foreclosures are non-judicial, meaning they’re done without court supervision. This process, preferred for its rapid execution, takes approximately 27 days.

Pre-foreclosure Period

During the pre-foreclosure period in Texas, the mortgage servicer must send a written notice by certified mail to a debtor in default under a deed of trust or other contract lien on real property used as the debtor’s residence. This notice must inform the debtor that they are in default and provide at least 20 days to remedy the default before a notice of sale can be issued.

The day the notice is served is included in the 20-day notice period, regardless of the time it is served. However, the day the notice of sale is issued is not counted in this 20-day period.

Service of this notice is considered complete once the notice is deposited in the United States mail, with postage prepaid and addressed to the debtor at their last known address. An affidavit from a person knowledgeable about the facts stating that the service has been completed serves as prima facie evidence of service.

Types of Foreclosures

Non-judicial foreclosures are popular in Texas. For a lender to foreclose on a property non-judicially or without resorting to legal action, they must rely on a clause in the mortgage that lets the lender sell the property if the borrower can’t pay. But if this clause isn’t in the mortgage, then the lender must go through the courts, which takes longer and is more complicated. This court process allows the borrower to legally challenge the foreclosure.

Notice and Sale Process

Notice of Sale

In Texas, the lender or mortgage servicer must notify the borrower of the foreclosure sale must be made at least 21 days prior to the sale date by:

- Posting a written notice at the courthouse door in each county where the property is located, indicating the county where the property will be sold.

- Filing a copy of the posted notice in the county clerk’s office in each county where the property is located.

- Sending a written notice of the sale by certified mail to each debtor listed in the records of the mortgage servicer as being obligated to pay the debt.

If the courthouse or county clerk’s office is closed due to inclement weather, a natural disaster, or other unforeseen event, the required notice can be posted or filed up to 48 hours after the courthouse or county clerk’s office reopens.

Sale

A sale of real property under a power of sale granted by a deed of trust or other contractual lien must be conducted as a public auction between 10 am and 4 pm on the first Tuesday of a month. If the first Tuesday of a month falls on January 1 or July 4, the public sale must be held between 10 a.m. and 4 p.m. on the first Wednesday of the month.

Unless otherwise specified, this sale must occur at the county courthouse of the county where the property is located. If the property spans multiple counties, the sale can take place at the courthouse in any of the counties where the property is situated.

The Commissioners Court is responsible for designating a specific area at the courthouse for these sales and must record this location in the county’s real property records. The sale must take place in this designated area. If no area has been designated by the Commissioners Court, the notice of sale must specify the area where the sale will occur, and the sale must be held in that specified area.

Avoiding Foreclosure by Selling Your Mortgage Note

In Texas, if you’re facing foreclosure, you can sell your mortgage note to a trusted buyer instead. This means you give up your future mortgage payments in return for a one-time cash payment right away. This way, you can quickly ease your financial troubles and avoid a long, stressful foreclosure.

Borrower Rights and Protections

In Texas, once a house is sold in a foreclosure auction, the former owner can’t redeem it. This is because Texas law doesn’t allow for reclaiming the property after the sale.

Redemption and Deficiency Judgments

Texas law allows for deficiency judgments, where the borrower is liable for the difference between the sale price and the mortgage balance. However, the borrower’s right of redemption after the sale does not exist in Texas.

Special Protections and Programs

Texas does not offer specific state-level foreclosure protections or programs beyond the standard judicial and non-judicial processes. Therefore, borrowers may need to seek external assistance or legal counsel to navigate the foreclosure process.

Comparative Insights

In this section, we examine how Texas’s foreclosure procedures compare with those in other states in these areas: notice periods, costs, and the impact on credit scores.

Publish Sale Notice

In Texas, the foreclosure process includes a requirement to publish a sale notice 21 days before the auction. This duration is similar to the required timeframes in some states such as Alabama, California, Kansas, South Carolina, Pennsylvania, and Rhode Island.

Costs in a Range and Comparison to Other States

Foreclosure costs in Texas are between $1,200 and $3,500. This makes Texas one of the states where foreclosure is cheapest. Other states with low foreclosure costs include Arizona, Mississippi, Missouri, West Virginia, and Wyoming.

Impact on Credit Score

A foreclosure in Texas typically results in a significant decrease in the homeowner’s credit score, often by 100 points or more. This deduction stays on the borrower’s credit report for seven years but becomes less impactful over time with careful credit management.

Conclusion

Foreclosure in Texas may be judicial or non-judicial. Thankfully, by selling your mortgage note, you can avoid foreclosure without any financial scratches.