Missouri Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Missouri’s foreclosure laws and process can be a bit complicated, but this guide will make them easier for you to understand. It clearly explains the legal steps, important timelines, and your rights as a borrower and a lender during a foreclosure in Missouri.

Foreclosure Process Overview

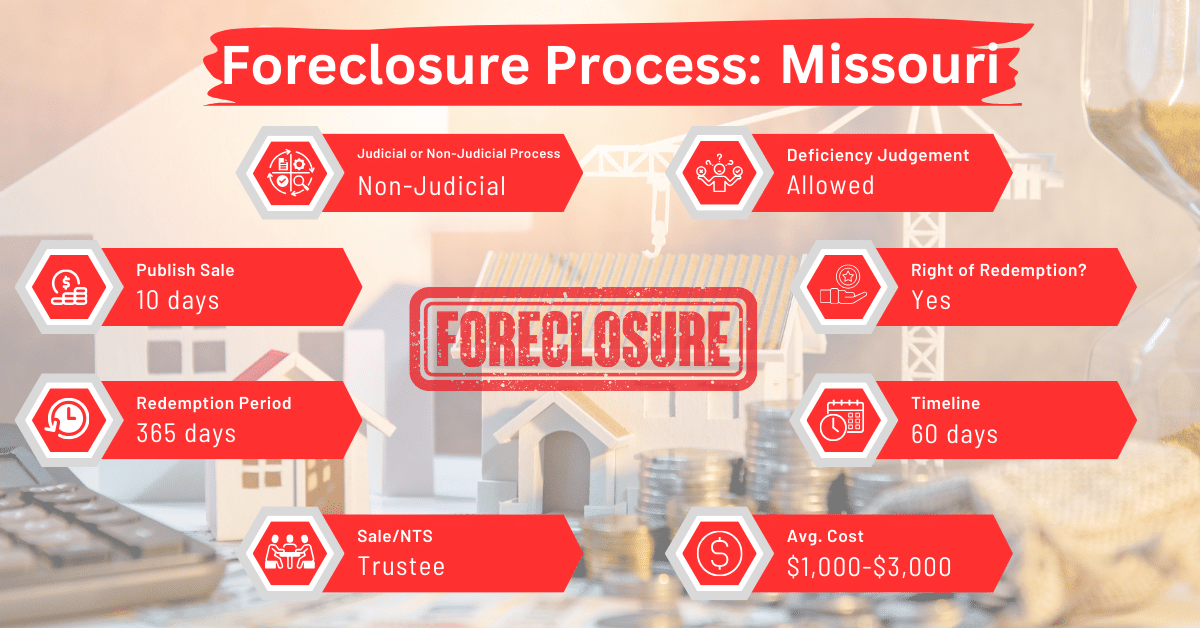

Missouri’s law supports both judicial and non-judicial foreclosure. The average duration of the foreclosure process in Missouri is approximately two months. This quick progression is primarily attributed to the state’s inclination towards non-judicial foreclosures. Out-of-court processes are typically faster and involve less bureaucracy than judicial proceedings.

Pre-foreclosure Period

The borrower receives a default notice, usually at least 30 days before the foreclosure sale is scheduled. This window is sn opportunity for the borrower to halt the foreclosure process by paying the amount due, along with any foreclosure expenses.

Types of Foreclosures

Deeds of trust for land in Missouri can be foreclosed either by going to court or through a trustee’s sale, depending on what the lender prefers. When a deed of trust is foreclosed by going to court, that foreclosure is judicial. Meanwhile, a foreclosure done through a trustee’s sale is non-judicial.

Judicial Foreclosure in Missouri

Anyone who holds a mortgage on real estate or a security interest in personal property—including leases—where the amount owed is $50 or more can file a petition in the circuit court. This petition should be filed against the person who owes the money (the debtor) and anyone currently occupying or using the property.

The petition must detail the agreement that created the mortgage or security interest and request a court judgment for the owed amount. It should also ask the court to eliminate the debtor’s right to reclaim the property (foreclose the equity of redemption) and to allow the property to be sold to pay off the debt.

If the borrower isn’t directly summoned to court but is instead notified through a public announcement, and doesn’t show up in court, the court can rule in favor of the lender. When the borrower is properly summoned to court or shows up voluntarily, the court may still decide in favor of the lender.

The court will issue a special type of court order called a “special fieri facias,” based on the judgment. This order directs the seizure of property to satisfy a debt. It should be carried out and completed like other standard legal orders in civil lawsuits.

The ruling would state that the lender is entitled to recover the owed debt and any additional damages, plus legal costs. This amount will be collected by selling the property or collateral that was listed in the mortgage or security agreement.

Non-judicial Foreclosure in Missouri

If the foreclosure is non-judicial, the property can be sold in the same way properties are sold under mortgages that include a power of sale. Also, any property sold through a non-judicial foreclosure sale can be bought back by the original owner or their heirs within a a year from the date of the sale. A person who has inherited or been given the rights to the property can redeem it too within a year from the sale date.

Notice and Sale Process

The notice of sale in Missouri must be posted at the county courthouse and published weekly for three consecutive weeks in a local newspaper. The notice includes details about the property, the deed of trust, the parties involved, and the terms of the sale.

The sale is conducted by a trustee, typically at the courthouse, and the property is sold to the highest bidder. The foreclosure sale in Missouri is final, with a redemption period of 365 days.

Notice

The notice must include specific details such as:

- The date the mortgage or deed of trust was recorded (including book and page numbers).

- The names of the people who granted the mortgage or trust.

- The time, terms, and location of the sale.

- A description of the property to be sold.

The following rules regulate how the notice of sale must be advertised:

- In cities with populations of 50,000 or more, the notice should be published in a daily newspaper at least twenty times, continuing up to the day of the sale.

- In counties without large cities, the notice should appear in a weekly newspaper for four consecutive issues. Alternatively, it can be published once a week for four weeks in a daily, triweekly, or semiweekly newspaper. The last publication should be made no more than one week before the sale.

- If no suitable newspaper is available locally, the notice should be published in the nearest newspaper in the state.

The advertisement must appear on the same day each week. If the property crosses city limits into a city of 50,000 or more, or extends across two or more counties, the notice should be published in a daily newspaper in that city or in newspapers in each affected county, following the same rules above.

Sale

Missouri law dictates that real estate sales under the power granted by a mortgage or deed of trust signed after August 28, 1989, must occur in the county where the property is located. If the property spans multiple counties, the sale can take place in any county that includes a part of the property.

Before foreclosure sales are made, the borrower must be given at least twenty days’ notice, regardless of whether the mortgage or deed of trust mentions this requirement.

The trustee who is responsible for selling property can choose a sale time that makes sense for business, unless the agreement specifies a particular time. Generally, a sale time is considered reasonable if it’s set between 9:00 am. and 5:00 pm. on the day of the sale.

If the notice of sale doesn’t mention a specific time, the sale will take place at the usual time for such sales in that county. However, if the trustee mentions a specific time in the notice, the sale must occur at that time unless the law provides otherwise.

Avoiding Foreclosure by Selling Your Mortgage Note

For homeowners in Missouri facing foreclosure, selling their mortgage notes to a reputable buyer can be an effective alternative. This option can circumvent the foreclosure process and mitigate its impacts, such as credit score damage and loss of property.

Borrower Rights and Protections

Missouri law requires lenders to properly inform borrowers are about the foreclosure process through detailed notices. Borrowers must also be given sufficient time to act upon the notices.

Redemption and Deficiency Judgments

Redemption Period

The person eligible to redeem a property that has been sold through a power-of-sale clause in Missouri must notify the seller in writing at the sale or at least ten days before the sale is advertised.

If they decide to redeem the property after it has been sold, they must pay off the debt and interest (or any other obligations) secured by the deed of trust within 365 days.

In addition to these, they need to refund any amounts the new owner or the holder of the debt has paid. Such sums include payments toward previous debts tied to the property, taxes, assessments, and any legal fees and costs related to the sale.

To redeem a property after a foreclosure sale, the person intending to redeem must meet these requirements:

- Written Notice: The interested party must have given the required written notice as specified in the section.

- Security Deposit: Within twenty days after the sale, the person wanting to redeem the property must provide security, approved by the circuit court in the county where the land is located. This security is to ensure the payment of:

- Interest on the debt secured by the mortgage or deed of trust for the year following the sale.

- All legal charges and costs of the sale.

- Any accrued interest on prior encumbrances that the buyer of the property pays, plus interest for the upcoming year.

- All property taxes and assessments, including interest and costs, accrued or due during the year of redemption, whether these were paid by the purchaser or not.

- A 6% annual interest on all amounts paid by the purchaser related to these items.

- Extra Security for Damages: The security must also cover potential damages for any physical damage to the property (referred to as ‘waste’) caused or allowed by the person attempting to redeem during that year.

- Bond Requirement: The security is typically provided through a bond, executed by the person(s) eligible to redeem, along with at least one reliable surety. The amount should be large enough to cover all the payments listed above, excluding the principal debt but including damages and interest.

- Payment for Redemption: To complete the redemption, all these sums, including additional interest as specified, must be paid. If the redemption does not occur, the bond amount will serve as compensation for damages to the purchaser.

Deficiency Judgments

Deficiency judgments, where borrowers owe the remaining mortgage balance after the sale, are allowed in Missouri under certain conditions.

Special Protections and Programs

Missouri offers various programs and initiatives to assist homeowners facing foreclosure. These include loan modification options and government assistance programs, providing financial relief and alternative solutions.

Comparative Insights

Comparing Missouri’s foreclosure laws with other states shows how they differ in time taken, costs, and effects on credit scores.

Publish Sale Notice

In Missouri, you only need to give a 10-day notice before a sale. This is one of the shortest notice periods in the country. Only Minnesota has a shorter period, requiring just 7 days.

Compared to these states, others require much longer notice periods. For instance, Alabama, California, and Rhode Island all set their notice periods at 21 days. Delaware requires a notice period ranging from 60 to 90 days, and in Indiana, it’s around 120 days.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Missouri are between $1,000 to $3,000. This cost bracket is lower than the cost ranges in other states in the US except Arizona.

Impact on Credit Score

Similar to other states, foreclosure in Missouri can result in a decrease of 100 points or more. This is why it’s a good idea to consider alternatives to foreclosure for long-term financial health.

Conclusion

Missouri’s foreclosure laws allow for both judicial and non-judicial foreclosures, but the non-judicial route is more common. For homeowners at risk of foreclosure, selling the mortgage note can help them avoid the foreclosure process and its negative effects.