Rhode Island Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Dealing with foreclosure in Rhode Island can be very stressful and confusing. Through this article, you’ll clearly understand how foreclosure works in Rhode Island, the legal steps involved in foreclosure and what rights and choices homeowners have.

Foreclosure Process Overview

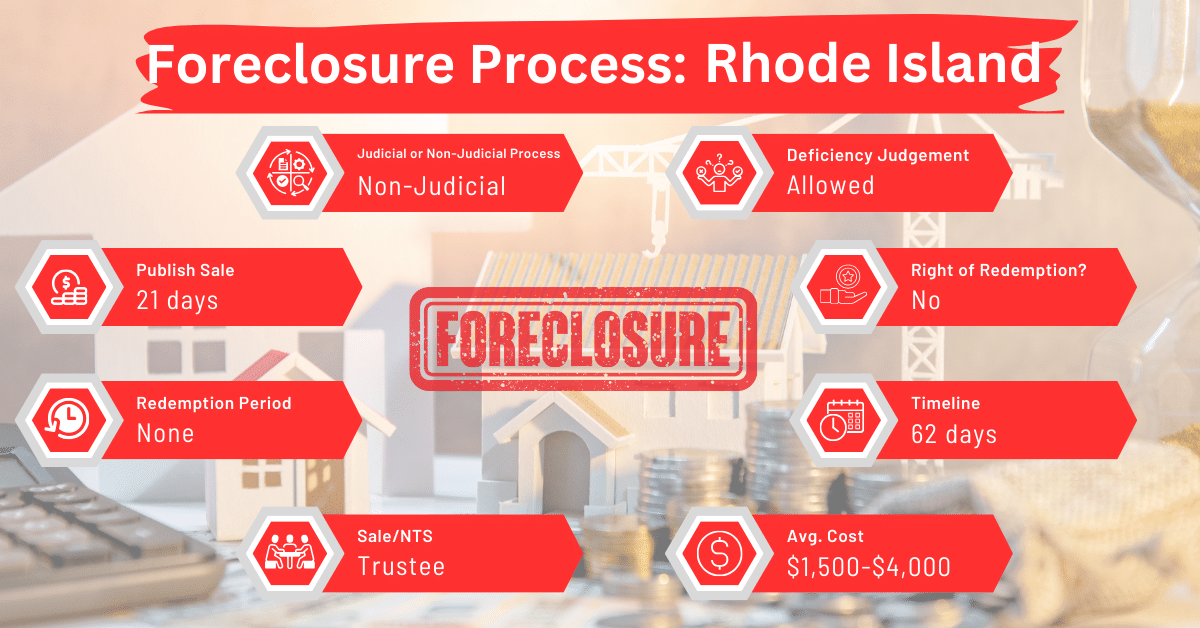

In Rhode Island, most foreclosures are non-judicial, taking approximately 62 days. This duration is relatively short compared to other judicial foreclosure states, such as Alabama, Alaska, Arizona, Arkansas, Delaware, Maryland, Massachusetts, Michigan, Rhode Island, and Tennessee.

Pre-foreclosure Period

The pre-foreclosure period in Rhode Island begins when the borrower is at least 60 days late on payments. The lender usually sends two notices to the borrower before starting the foreclosure. The owner has 2-4 months to find a solution to the default before the lender takes further action.

If the borrower does not prevent the foreclosure, the lender files suit against the borrower for the amount due. The borrower is notified of the foreclosure action in person or by publication and mailing if necessary. They have about one month to respond before the court directs the property to be sold to recover the amount due.

Types of Foreclosures

In Rhode Island, the predominant method for handling foreclosures is non-judicial, which involves a trustee sale. This process allows lenders to sell the property directly, bypassing court involvement, and making it quicker and more straightforward.

Judicial foreclosures, which require court proceedings, are much rarer in Rhode Island and are generally used only in specific situations where non-judicial foreclosure is not applicable.

Notice and Sale Process

At least 30 days before the sale, the county sheriff gives notice of the sale by posting a handbill on the property and delivering a copy to the borrower. The sale is advertised in local newspapers for three consecutive weeks. The sale, a public auction overseen by the county sheriff, takes place one to two months after the court’s order. The property is sold to the highest bidder, and the sheriff completes the transfer documents. There is no right of redemption for borrowers following the sale.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Rhode Island facing foreclosure should consider selling their mortgage note to a trusted buyer. This can help them avoid foreclosure, protect their credit score, and prevent losing their home.

Borrower Rights and Protections

Borrowers in Rhode Island have the right to be notified of the foreclosure and to respond to the court filing. They also have the opportunity to prevent the sale by paying the full amount owed up to one hour before the sale.

Redemption and Deficiency Judgments

Rhode Island does not offer a post-sale statutory right of redemption. However, borrowers can prevent the sale by paying off the full amount owed before the sale. Deficiency judgments, where the borrower is liable for the difference between the sale price and the mortgage balance, are allowed in Rhode Island.

Special Protections and Programs

Rhode Island offers mediation programs to assist homeowners facing foreclosure, providing an opportunity for borrowers and lenders to explore alternatives to foreclosure.

Comparative Insights

When comparing Rhode Island’s foreclosure methods with those in other states, notable variations in timelines, expenses, and effects on credit scores stand out, showcasing its unique non-judicial foreclosure system.

Publish Sale Notice

The process of publishing the sale notice in Rhode Island involves advertising in local newspapers for three weeks. This duration is shorter than many judicial states.

Costs in a Range and Comparison to Other States

Foreclosure costs in Rhode Island typically range from $1,500 to $4,000. These costs are relatively lower than in judicial foreclosure states, due to the efficiency of the non-judicial process.

Impact on Credit Score

Like in other states, foreclosure in Rhode Island can significantly affect a borrower’s credit score, often leading to a decrease of 100 points or more.

Conclusion

Surviving Rhode Island’s foreclosure processes requires an understanding of the state’s non-judicial system and the rights and protections available to borrowers. For those facing foreclosure, selling the mortgage note is a way to avoid the process and its setbacks.