Understanding Massachusetts Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Massachusetts, with its rich history and diverse real estate market, follows specific procedures for foreclosures. Homeowners and investors need to understand these laws and processes to profitably participate in Massachusetts’ real estate market. In this article, you’ll learn how foreclosure works in Massachusetts.

Foreclosure Process Overview

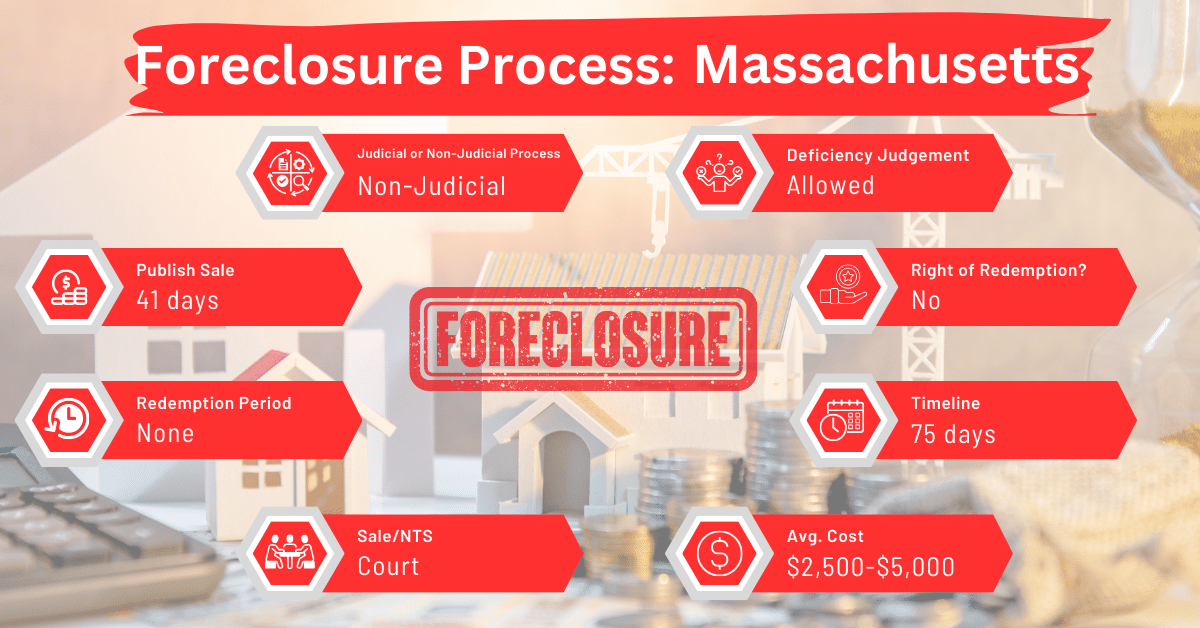

Massachusetts allows for both judicial and non-judicial foreclosures, but the majority of foreclosures in this state are judicial.

Pre-foreclosure Period

When a homeowner misses a payment in Massachusetts, the lender (mortgagee) or any subsequent holder of the mortgage can’t demand early payment of the remaining balance or take other enforcement actions because of this missed payment. However, before foreclosing on the property, they must wait at least 90 days after sending the homeowner a written notice.

This notice can be considered delivered when it is either handed directly to the homeowner or sent through first-class and certified mail, or a similar service, to the homeowner’s last known address.

The notice must inform the homeowner of several things, which are:

- Nature of the Default: What the specific missed payment or issue is, and the homeowner’s right to fix (cure) this default by paying the necessary amount.

- Deadline to Cure the Default: The exact date by which the homeowner needs to pay the overdue amount to prevent acceleration of the mortgage, foreclosure, or other actions. This date must be at least 90 days after the notice is served. The notice should also include contact information for the person who will accept this payment.

- Consequences of Not Curing the Default: If the homeowner does not address the default by the specified date, the lender may begin processes to take ownership of the property through foreclosure.

- Contact Information for Disputes: Information about how to contact the lender if the homeowner disagrees with the claimed default or the calculated amount needed to fix it, including the name and address of the lender and a contact number.

- Broker Information: Names of any current or past mortgage brokers or loan originators associated with the mortgage.

- Assistance Options: Information on how to contact the Massachusetts Housing Finance Agency and other bodies for assistance, including phone numbers.

- Selling the Property: The homeowner’s option to sell the property before foreclosure and use the proceeds to settle the mortgage.

- Redeeming the Property: The homeowner can avoid foreclosure by paying off the total debt owed before the foreclosure sale.

- Post-foreclosure Eviction: The possibility of eviction following a foreclosure sale.

- Extra Rights: Depending on their mortgage terms, the homeowner might have the right to refinance the loan or voluntarily transfer ownership of the property to the lender instead of facing foreclosure.

Types of Foreclosures

While judicial foreclosures are predominant, non-judicial foreclosures are also possible in Massachusetts. Here’s an easy-to-understand explanation of how both foreclosures are done in Massachusetts:

Judicial Foreclosure

When a lender (mortgagee) takes legal action to regain possession of a property, they can claim that they currently have control over the property because it is under mortgage. If the court decides that the lender has the right to take possession due to a breach of any of the conditions of the mortgage, the court can issue what’s known as a conditional judgment. This judgment can be requested by either the lender or the borrower unless stated otherwise in the law.

If the court decides to issue a conditional judgment in a property dispute, here’s what happens:

- Determining the Debt: The court will first calculate how much the defendant owes the plaintiff, including the principal, interest, and any legal costs related to the mortgage.

- Opportunity to Pay: The defendant will then have two months to pay this total amount to the plaintiff.

- Outcome if Paid: If the defendant pays in full within the two-month period, the mortgage will be considered settled, and the defendant will own the property free and clear of the mortgage.

- Outcome if Not Paid: If the defendant does not pay within the two months, the plaintiff has the right to take over possession of the property and to recover any associated costs.

If a court has made a conditional judgment on a mortgage that includes a power of sale clause, the court will not issue a writ of possession directly to the lender. Instead, if the lender (plaintiff) requests it, the court will order that the property be sold using the power of sale included in the mortgage. The lender must then carry out the sale according to the rules set out in the mortgage or any additional instructions given by the court.

Non-judicial Foreclosure

It’s possible for a borrower in Massachusetts that doesn’t meet their mortgage obligations to lose their property without being sued. When this happens, it’s called a non-judicial foreclosure. Non-judicial foreclosures work in two ways:

Direct Repossession of the Property

When a borrower fails to meet the terms of their mortgage, the lender (mortgagee) has the right to take back the land. The lender can do this by simply entering the property peacefully, as long as the borrower (mortgagor) or anyone else who might claim the property doesn’t oppose this action.

If the lender peacefully possesses the property for three years from the time they record a specific legal document about their entry, the borrower permanently loses the right to reclaim the property.

This legal document referred to above can be a note added to the mortgage deed and signed by the borrower (or someone claiming rights under the borrower). It can also be a statement made under oath by two reliable witnesses verifying the entry.

Whichever document the lender obtains, they must file in the land records office of the county or district where the property is located. If the mortgage is also recorded in this same registry, the document affirming the lender’s repossession of the property and the mortgage document should be cross-referenced.

Failure to properly record this documentation invalidates the lender’s repossession of the property.

Foreclosure Sale

In a non-judicial foreclosure in Massachusetts, the lender, or someone with legal rights to the property, or an authorized representative, can sell the property without going to court. This process is called a “power of sale.”

Notice and Sale Process in a Non-judicial Foreclosure

To make sure the non-judicial foreclosure sale is legal and binding, a couple of important steps need to be followed:

- Advertising the Sale: The sale needs to be announced in a local newspaper once a week for three weeks in a row. The first announcement should appear at least 21 days before the sale date.

- Notifying the Owners: In addition to the newspaper, a notice must be sent by registered mail to the last known owners of the property. This notice must be sent at least 14 days before the sale but not more than 30 days before it. This gives the owners a fair chance to pay off what they owe and stop the sale. For a non-judicial foreclosure, the notice of sale containing the sale’s time, place, and date.

- Sale: The property must be sold to the highest bidder at a public auction.

Post-sale Review

After a property is sold in a non-judicial foreclosure in Massachusetts, the person who conducted the sale must, within ten days, submit a detailed report of the sale and their actions to the clerk’s office. This report must be sworn to be true. The court will then review this report and can either approve the sale or reject it and order a new sale.

Anyone with an interest in the sale, such as an owner or creditor, can attend the court session or be officially summoned to appear. Once the court approves the sale, its decision serves as definitive proof that the sale was conducted properly and according to the rules, preventing any further disputes over the legitimacy of the sale process.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners facing foreclosure have the option to sell their mortgage notes to a reputable note buyer. This can be a viable alternative to avoid the foreclosure process and its impacts.

Borrower Rights and Protections

Massachusetts law requires lenders to make a good-faith effort to avoid foreclosure. A creditor is assumed to have made a good faith effort to avoid foreclosure if they take the following steps before announcing a foreclosure sale:

- Assess Borrower’s Payment Ability: The creditor must evaluate how much the borrower can currently afford to pay each month.

- Identify Possible Loan Modifications: The creditor must find a modified mortgage plan that fits the borrower’s budget. This plan could involve lowering the principal amount, reducing the interest rate, or extending the time over which the loan is paid back (amortization period). However, the amortization period should not be extended by more than 15 years, and the total period shouldn’t exceed 45 years.

- Perform a Financial Analysis: The creditor must conduct an analysis to compare the financial outcomes of modifying the mortgage versus proceeding with foreclosure. This analysis needs to follow accepted guidelines such as those from the Home Affordable Modification Program, the Federal Deposit Insurance Corporation’s Loan Modification Program, any recognized program by major financial oversight bodies, or similar federal programs.

- Decide on Loan Modification Based on Analysis: If the analysis shows that modifying the loan (according to the borrower’s new payment ability) will bring in more money than foreclosure would, the creditor must agree to modify the loan.

On the other hand, if modifying the loan would result in less money than foreclosure, or if it doesn’t meet the borrower’s payment needs, the creditor must inform the borrower that the loan won’t be modified. They must provide a written explanation showing why, based on their financial analysis and the borrower’s ability to pay, after which they can continue with the foreclosure process.

Redemption and Deficiency Judgments

Unfortunately, Massachusetts laws don’t grant borrowers a right of redemption once the foreclosure process is complete. This aspect of Massachusetts foreclosure law contrasts with some other states, such as Alabama, Arkansas, California, Idaho, Illinois, Iowa, Kentucky, Michigan, Minnesota, Missouri, New Jersey, New Mexico, North Dakota, and Oregon, where such rights are available.

Deficiency Judgments

Massachusetts laws allow a lender to seek deficiency judgments after a foreclosure sale, whether the sale was judicial or non-judicial. For the purposes of this article, a deficiency is the remaining debt after a property is sold at foreclosure but the proceeds aren’t enough to cover the mortgage.

However, no one in Massachusetts can claim a deficiency after June 30, 1946, from a foreclosure sale that occurred after January 1, 1946, unless specific steps were followed. These steps are:

- Notice Requirement: The lender must have sent a written notice to the borrower (the defendant). This notice must state the lender’s intention to foreclose and warn of potential liability for any remaining debt. It needs to be sent by registered mail, with postage prepaid and requiring a return receipt, to the borrower’s last known address.

- Timing of the Notice: This notice must be sent at least 21 days before the foreclosure sale is scheduled.

- Affidavit Requirement: Within 30 days after the foreclosure sale, the lender must sign and submit an affidavit. This document must confirm that the notice was mailed as described.

If these conditions are met, the notice is considered adequate. The affidavit submitted on time is treated as proof that the notice was properly mailed.

Special Protections and Programs

The state has introduced various programs, such as the Distressed Properties Indentification and Revitalization Grant (DPIR) in 2013. Under this program, the then Attorney-general of Massachusetts, Martha Coakley, gave a $1 million grant program for rehabilitating bank-owned properties that had been foreclosed.

Comparative Insights

While unique in certain aspects, Massachusetts’ foreclosure laws and processes are similar to those of other states in some areas.

Publish Sale Notice

In Massachusetts, the lender must give the borrower 41 days’ notice before they sell a foreclosed property. That’s the same amount of time they give you in Arizona, but it’s actually shorter than in a lot of other states.

States like Colorado, Delaware, Hawaii, Nevada, Montana, Alaska, and Washington usually have notice periods that range from about 50 to 90 days. Massachusetts has this shorter timeframe because the state aims to make the foreclosure process a bit quicker.

Costs in a Range and Comparison to Other States

In Massachusetts, the costs tied to going through a foreclosure usually fall between $2,500 and $5,000. Interestingly, it’s about the same in Kansas and Maine, where you’d also be looking at shelling out between $2,500 and $5,000 for a foreclosure.

Impact on Credit Score

The impact of foreclosure on credit scores in Massachusetts aligns with the national trend. A foreclosure can lead to a decrease of 100 points or more in a credit score. This decrease remains on the credit report for 7 years, but its effect diminishes over time with responsible credit management.

Conclusion

Although foreclosure laws and processes in Massachusetts protect the borrower and the lender equally, they don’t ease the negative effects of foreclosure. For those facing foreclosure, selling the mortgage note can help in avoiding the foreclosure process and its consequences.