Foreclosure Process Overview in Alaska

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

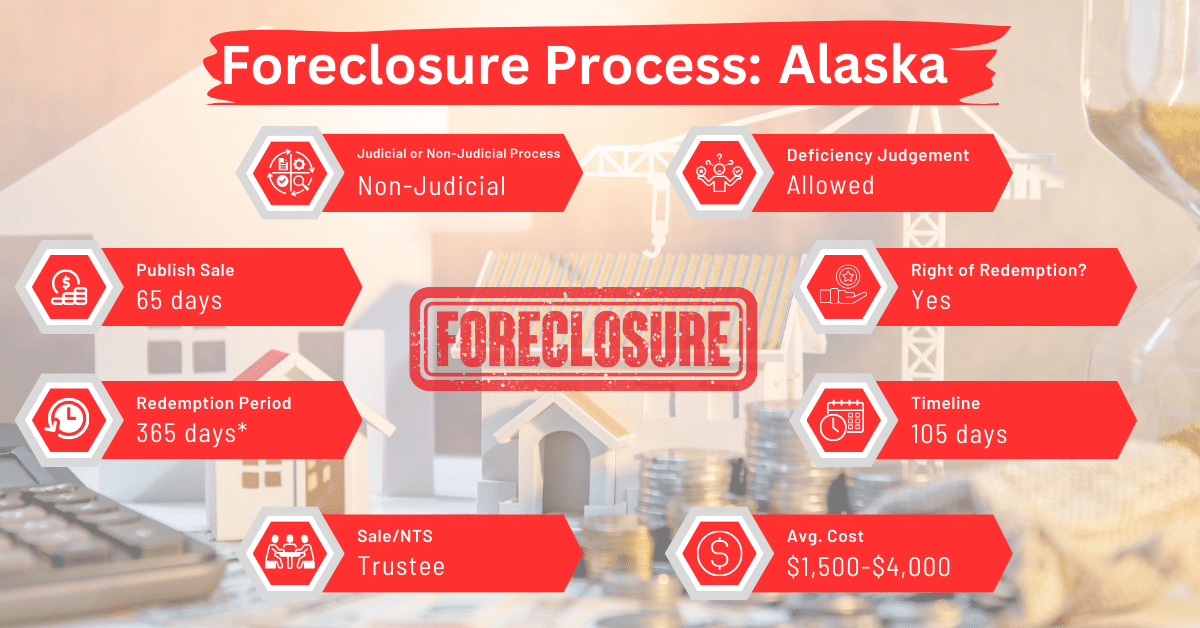

Alaska adopts both judicial and non-judicial foreclosures. However, most people in Alaska opt for non-judicial foreclosure because it’s faster and less expensive. Generally, the foreclosure process in Alaska wraps up in about 105 days.

Pre-foreclosure Period in Alaska

If you fall behind on your mortgage in Alaska, your lender will send you a breach letter. This letter alerts you to the default and warns you that your loan might be accelerated. It serves as an official notification of your delinquency and outlines possible next steps from the lender.

Where this happens, don’t ignore your lender’s efforts to communicate with you. Contacting your lender after missing a payment is highly recommended. Keeping the lines of communication open can help delay or even prevent foreclosure. Your lender might offer loss mitigation options to help you get back on track, such as loan modifications, repayment plans, or short sales.

Types of Foreclosures in Alaska

In Alaska, the foreclosure process can be either judicial or non-judicial, depending on the specifics of the loan agreement and the circumstances surrounding the default. This flexibility allows for different approaches to be taken based on the particular situation.

Judicial Foreclosure

Where the mortgage or deed of trust doesn’t include a power of sale clause, lenders in Alaska must go through the courts to start a foreclosure, filing a lawsuit to get a foreclosure order. Judicial foreclosures are less common here because they take longer and cost more. In these situations, borrowers don’t have the option to redeem the property after it’s sold.

Non-Judicial Foreclosure

Most foreclosures in Alaska are non-judicial. This positions Alaska alongside states like California, Idaho, Massachusetts, Montana, and Rhode Island, where non-judicial foreclosure is the go-to method.

Non-judicial foreclosure is generally quicker and less costly. It works through a power of sale clause included in the mortgage or deed of trust, which allows the property to be sold directly to pay off the loan balance if it goes into default. The non-judicial process does follow strict rules, though, including requirements to notify the borrower of the default and upcoming sale.

Notice of Default

In a non-judicial foreclosure, the seller must record a notice of default in the appropriate recording district. Then, they must send this to the borrower, detailing the default and their intention to sell the property.

Sale Process

After the notice period, the lender sells the property at a public auction conducted by a trustee. This sale is open to all bidders. During a non-judicial foreclosure auction, lenders frequently use a credit bid, where they offer to buy the property back for the amount the borrower owes. This strategy allows the lender to potentially acquire the property without spending extra money, especially if there are no higher bids from other participants.

Borrower Rights and Protections in Alaska

Right to Reinstate

Alaska law gives borrowers the right to stop the foreclosure sale. They can do so by paying the overdue amount plus any additional fees and costs before the sale date. This right to reinstate the loan offers a last-minute opportunity for borrowers to retain their property and avoid foreclosure

Notice Requirements

Alaska law mandates that borrowers must receive adequate notice of all significant foreclosure actions. These include notice of default and the notice of sale. These notices must be published in a manner that gives the borrower sufficient time to respond or take action to prevent the foreclosure. The notice may be published in newspapers and, in some cases, online postings.

Special Protections

Alaska offers special protections for certain borrowers, including those with military service. For example, the state extends federal protections under the Servicemembers Civil Relief Act (SCRA) to members of the Alaska National Guard. Besides the SCRA, Alaska offers additional safeguards for military personnel facing foreclosure. These protections may include postponements of foreclosure proceedings and other benefits aimed at those serving on active duty.

Mediation Program in Alaska

Alaska has implemented a mediation program that allows borrowers and lenders to discuss potential alternatives to foreclosure under the guidance of a neutral third party. This program is designed to facilitate solutions that can benefit both parties, such as loan modifications, repayment plans, or other loss mitigation options, potentially avoiding foreclosure altogether.

Redemption and Deficiency Judgments in Alaska

Redemption Period

Unlike many states, Alaska does not offer a statutory right of redemption for non-judicial foreclosures. This means that once the foreclosure sale is finalized, the borrower cannot reclaim the property by paying the full amount owed. However, for judicial foreclosures, a redemption period of 365 days is allowed, giving borrowers a chance to redeem the property under certain conditions.

Deficiency Judgments

As explained above, Alaska allows lenders to seek deficiency judgments following a foreclosure sale. However, this is only applicable to judicial foreclosures. The Alaska Statutes prohibit trustees from filing any further action against borrowers after a non-judicial foreclosure sale to recover any difference between the sale price of the property and its actual value.

Avoid Foreclosing by Selling Your Mortgage Note

Homeowners in Alaska can avoid foreclosure by selling their mortgage notes to a reliable buyer. This can quickly ease financial stress and skip the long foreclosure process. It’s a good way to avoid problems like credit damage and losing your home. This option helps homeowners pay off their mortgage and maintain financial stability without going through the difficulties of foreclosure.

Comparing Alaska’s Foreclosure Process with Foreclosure Processes of Other States

When comparing Alaska’s foreclosure laws and processes with those of other states, several key aspects stand out, such as:

- Process Timeline: Alaska’s foreclosure process takes approximately 105 days for non-judicial foreclosures. This positions the state in the moderate range nationally.

- Publish Sale Notice: The requirement for a 65-day notice period before the sale is longer than in many states, offering borrowers additional time to address the foreclosure.

- Costs: The costs associated with foreclosure in Alaska ranges from $1,500 to $4,000. These amounts are within the average range compared to other states. Costs include legal fees, publication costs, and other expenses related to the foreclosure process.

Conclusion

Alaska has shaped its foreclosure laws to ensure a process that is both fair and clear, carefully balancing the rights of borrowers and lenders. The state softens the harsh impacts of foreclosure on both borrowers and lenders through various methods. Some of these are mediation, giving extended notice periods, and offering extra protections for military service members.