Foreclosure Laws and Process in Idaho

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

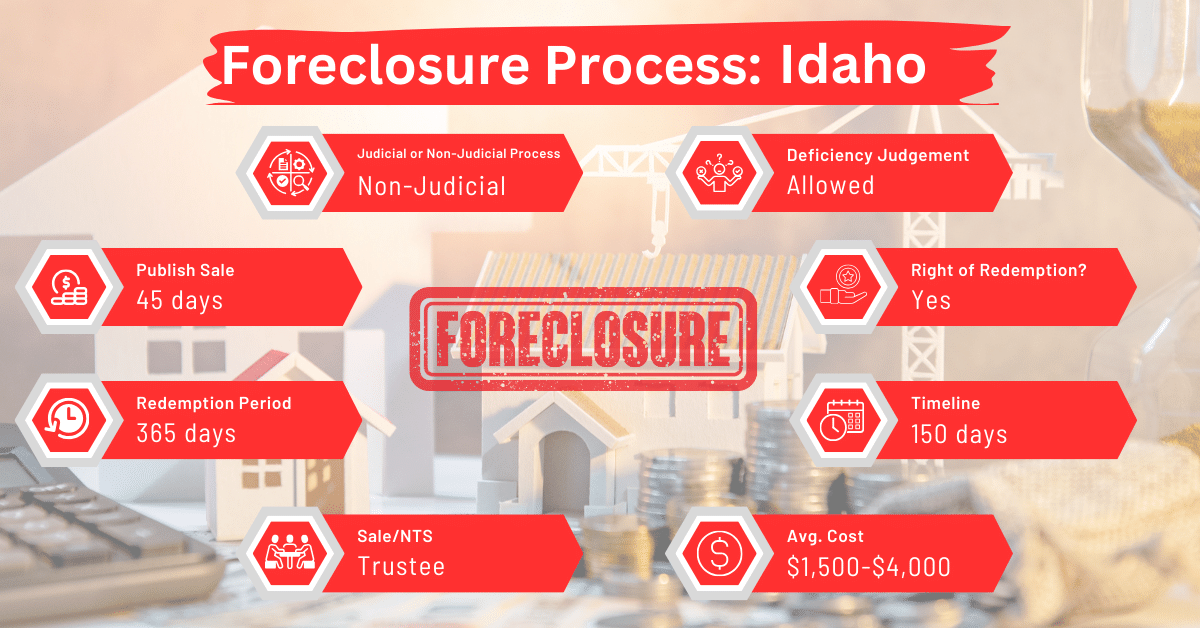

Non-judicial foreclosure is more common than judicial foreclosure in Idaho. This method is quick and efficient, typically wrapping up in 150 days. When you compare this timeline to the foreclosure processes in Montana, Oregon, and South Carolina, it’s pretty standard. Those states also have foreclosure timelines of 150 days.

Pre-foreclosure Period in Idaho

Before a lender forecloses on a property in Idaho, they must mail a notice of default to the borrower. The borrower has at least 115 days to resolve the default. The lender also files a notice of default with the county recorder. If the borrower doesn’t cure the default within 115 days, the foreclosure sale can be scheduled and advertised.

Types of Foreclosures in Idaho

Idaho allows both judicial and non-judicial foreclosures. However, non-judicial foreclosures are more common. A non-judicial foreclosure usually involves a trustee who handles the foreclosure process without taking it to court.

Notice and Sale Process

Notice

At least 120 days before the sale is scheduled to take place, a notice of the sale must be sent by registered or certified mail to the last known address of certain people or their legal representatives. These include:

- The grantor or the borrower (the person who took out the loan secured by the trust deed).

- Anyone who has taken over the grantor’s interest in the property, provided their interest was recorded before the notice of default was issued, or if the trustee or beneficiary knows about their interest.

- Anyone who has a legal claim or lien on the property that was recorded before the notice of default or is otherwise known to the trustee or beneficiary.

If a person who is supposed to receive a notice of sale is disabled, declared legally incompetent, or has passed away, the trustee can still sell the property. All he has to do is to properly send the required notice. This means the notice must be mailed according to legal requirements. It could be mailed to someone legally designated to receive it on behalf of the disabled or incompetent person, or to the person managing the estate if the intended recipient has died.

Contents of the Notice of Sale

The notice of sale for a property will include the following information:

The names of the person who took out the loan (grantor or borrower), the person managing the sale (trustee), and the person or entity receiving the benefits (beneficiary) of the trust deed.

- A detailed description of the property that the trust deed covers.

- The specific location in the county’s mortgage records (book and page number or the recorder’s instrument number) where the trust deed is listed.

- The reason why the property is being foreclosed.

- The total amount of money still owed on the loan secured by the trust deed.

- The date, time, and location of the foreclosure sale, which will be scheduled between 9:00 a.m. and 4:00 p.m., at a specified place within the county or one of the nearby counties where the property is located.

Attempts to Deliver the Notice of Sale

At least three attempts must be made to personally deliver a sale notice to someone living at the property. These attempts should be spread over at least seven days but must start at least 30 days before the sale date.

Each time an attempt is made, the notice should also be posted in a visible spot on the property. If the notice is still clearly displayed from a previous attempt, you don’t need to post it again.

If the person is successfully given the notice in person and a notice is also posted on the property, no further attempts or postings are required. If the person who receives the notice in person is the same one who was supposed to get it by mail, then no further posting on the property is needed.

Publication of the Notice of Sale

The notice must also be published in a local newspaper once a week for four consecutive weeks. The final publication should be made at least 30 days before the sale.

Recording the Delivery of the Notice of Sale

Documents proving that the notice was mailed, posted, and published need to be officially recorded, at least 20 days before the sale. Such documents are recorded in the property records of the county where the property is located.

Sale

The sale will take place on the date, time, and location specified in the notice of sale, or in a notice of a rescheduled sale if one is issued. The trustee will auction the property, either as one whole parcel or in separate pieces, to the highest bidder. Anyone, including the person or entity that benefits from the trust deed, can place a bid at this auction. The trustee’s attorney may manage the auction and act as the auctioneer.

The winning bidder must immediately pay the bid amount. Once the payment is received, the trustee will sign and give a deed to the purchaser, officially transferring ownership. If the winning bidder refuses to pay after the auction, the official conducting the sale has the legal right to either resell the property or reject any future bids, similar to what happens in sales carried out due to court orders.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Idaho facing foreclosure have the option to sell their mortgage note to a reputable note buyer. Taking advantage of this alternative can help them avoid the unsavory consequences of foreclosure.

Borrower Rights and Protections

Idaho law requires that borrowers be adequately notified of the foreclosure process. Borrowers have the right to cure the default up to the public sale date. They also have legal recourse if they believe their rights have been violated.

Redemption Period

Idaho does not provide redemption rights for the borrower after a non-judicial foreclosure sale.

Deficiency Judgments

Lenders in Idaho may seek a deficiency judgment if the sale price does not cover the mortgage balance. However, courts are limited in how much they can order the borrower to pay if the sale of the property doesn’t cover the debt.

The maximum amount that the court can order the borrower to pay to the lender is the difference between the total mortgage debt plus any foreclosure and sale costs and the property’s reasonable value. The court determines the property’s reasonable value based on evidence presented during the case.

Special Protections and Programs

Idaho doesn’t provide any programs dedicated to foreclosure mediation. Fortunately, borrowers facing the prospect of foreclosure can still turn to legal aid organizations for help. These organizations primarily support those who might not have the financial means to hire private legal counsel by providing free or low-cost services such as:

- Advice on foreclosure laws

- Representation in negotiations with lenders

- Assistance in understanding the various legal documents and proceedings involved in the foreclosure process.

Comparative Insights

Let’s look at how foreclosure works in Idaho under the Idaho Code and see how it compares to foreclosure processes in other U.S. states.

Publish Sale Notice

In Idaho, the notice of a foreclosure sale must be published within 45 days before the sale takes place. This is a relatively short period compared to some other states. For instance, states like Alaska, Colorado, Delaware, Hawaii, Montana, and Nevada require that such notices be published between 50 and 90 days before the sale. Meanwhile, Indiana’s laws require that the notice should be published within 120 days before the sale.

Costs in a Range and Comparison to Other States

Foreclosure costs in Idaho typically range from $1,500 to $4,000. This cost bracket is in line with the average in Alaska, Georgia, Iowa, Michigan, New Hampshire, North Carolina, Rhode Island, and Tennessee. These costs generally cover legal fees, publication charges, and administrative expenses associated with the foreclosure process.

Impact on Credit Score

Like in other states, a foreclosure in Idaho can often decrease the borrower’s credit score by 100 points or more. This negative impact remains on the credit report for 7 years but gradually diminishes if the borrower takes steps to rebuild their credit.

Conclusion

Understanding the rules governing foreclosure in Idaho will help you know your rights and the potential fallout from a foreclosure. To sidestep these serious consequences, you could sell your mortgage note. This move could settle your mortgage troubles before they escalate into a full-blown foreclosure.