Understanding Georgia’s Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

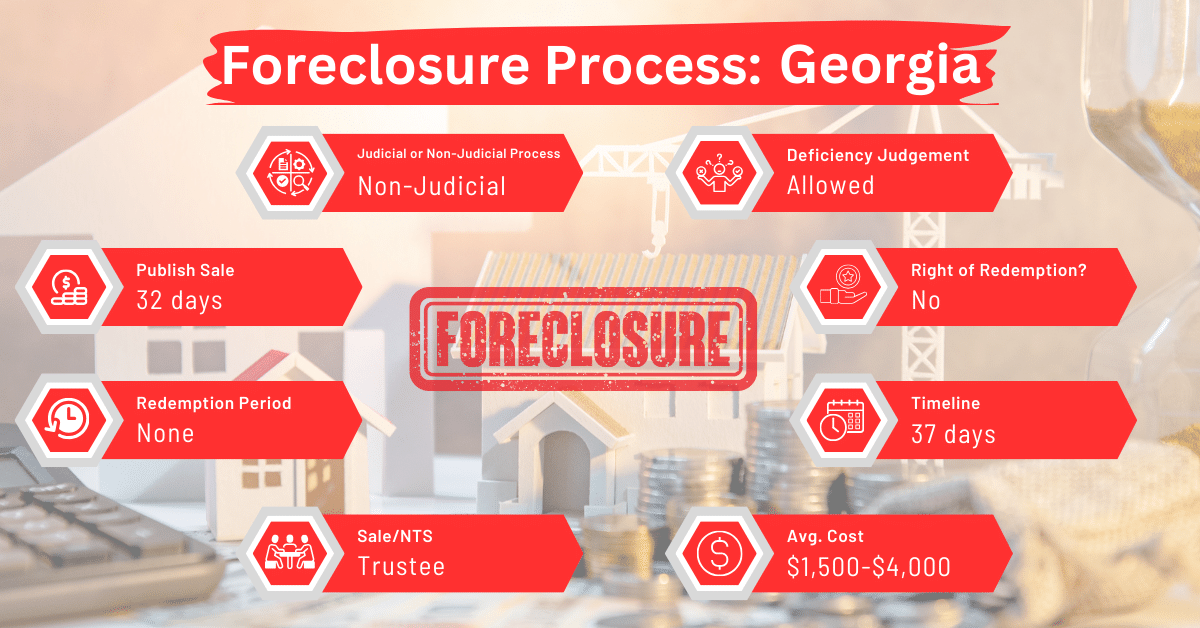

Georgia’s foreclosure laws permit judicial and non-judicial foreclosure. This approach means you can resolve foreclosure issues without getting tangled up in lengthy legal battles, unless there’s a specific reason to go to court. This guide will break down how Georgia’s foreclosure processes work, what protections you have as a borrower, and what you can do if you’re facing foreclosure.

Foreclosure Process Overview

In Georgia, the majority of foreclosures are executed outside of court. The process is initiated following a homeowner’s default on their mortgage. Historically, Georgia’s foreclosure timeline has been among the fastest in the United States, averaging approximately 37 days.

Pre-foreclosure Period

The pre-foreclosure period features the lender mailing a notice of his preparation to sell the property to the delinquent homeowner within 30 days before the sale. This notice must detail the authority of the lender to negotiate the mortgage terms. However, the mention of the lender’s authority to modify the terms of the mortgage doesn’t place him under any obligation to actually vary the loan terms.

Types of Foreclosures and Notice Requirements

While both judicial and non-judicial foreclosures are permissible, the latter dominates due to its efficiency and cost-effectiveness. The process involves a series of notifications, including a public sale announcement and direct communication with the borrower. These notices must include comprehensive details about the sale, the property, and the parties involved.

Meanwhile, if the lender wants to foreclose on the mortgage judicially, they or their lawyer must file a petition with the superior court in the county where the property is located. This petition should explain the situation, state how much money is owed, and describe the property.

Once the petition is filed, the court will issue an order that the money owed (both the principal and interest, plus any court costs) must be paid into the court. This order needs to be published in a local publication twice a month for two months or personally delivered to the person who took out the mortgage (or their representative or attorney) at least 30 days before the payment is due.

Avoiding Foreclosure – Sell Your Mortgage Note

Homeowners seeking to avoid foreclosure have several options, including the sale of their mortgage note. Selling a mortgage note to a reputable buyer can provide immediate financial relief and avoid the consequences of foreclosure. This option is particularly appealing for those looking to resolve their financial difficulties without enduring the foreclosure process.

Borrower Rights and Protections

Georgia law offers limited reinstatement rights, primarily dictated by the terms of the mortgage or deed of trust. Borrowers may halt the foreclosure by settling the default amount plus any applicable fees, although state law does not guarantee this right.

Furthermore, borrowers involved in judicial foreclosures in Georgia may raise the defense of verification. Here’s how this works: when there is an initial court order (rule nisi) to start the foreclosure of a mortgage on real estate, the person who took out the mortgage, or their representative or attorney, can respond. They must show up in court at the designated time when the money is supposed to be paid and can file objections to the foreclosure.

They have the opportunity to present any legal defense they would normally use in a lawsuit related to the debt or demand that the mortgage secures. This can include arguments that the person asking for the foreclosure doesn’t have the right to do so or that the amount of money they claim is owed isn’t actually due. However, any defense they present must be backed up with a sworn statement (affidavit) from the mortgage holder or their representative at the time they file these objections.

Redemption and Deficiency Judgments

Post-sale, Georgia does not afford homeowners the right to redeem their property. However, lenders may pursue deficiency judgments if the sale price falls short of the property’s fair market value, subject to court approval and a review of the foreclosure proceedings.

Special Protections and Programs

Recent legal milestones, such as the case of Reese v. Provident Funding Associates, have introduced such the requirement for notices of foreclosure to disclose the “secured creditor.” These changes enhance transparency and protect borrowers.

Comparative Insights

In this section, we compare some aspects of foreclosure procedures in Georgia to those of other states. Our focus is on the publication of sale notices, associated costs, and the impact on credit scores across various states.

Publish Sale Notice

When compared to other states, Georgia’s requirement for a 32-day notice period before the sale is on the shorter end of the spectrum. For instance, states like Nevada and Washington mandate a longer notice period of 80 and 90 days respectively. This is a stark contrast to Georgia’s more rapid approach.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Georgia can range from approximately $1,500 to $4,000. This cost spectrum is relatively moderate when compared to other states.

For example, in states like New York and New Jersey, foreclosure costs can soar to between $5,000 and $10,000, largely due to the judicial nature of their foreclosure processes and the associated legal fees. On the other end, states like Texas and Alabama, with non-judicial processes similar to Georgia, tend to have lower foreclosure costs, ranging from about $1,200 to $3,500.

Impact on Credit Score

The impact of foreclosure on a homeowner’s credit score is significant across the United States, with a potential decrease of 100 points or more. This negative effect is consistent across all states, including Georgia, and remains on a homeowner’s credit report for seven years. However, the degree to which this impacts an individual’s future borrowing capabilities can vary based on their overall credit history and recovery efforts.

Conclusion

Homeowners in Georgia dealing with foreclosure need to get a handle on the state’s specific laws and procedures. One practical option could be selling a mortgage note, which might pave the way for financial stability. As foreclosure laws keep changing, it’s advisable to stay updated and consider every available option to effectively manage these tough situations.