Nevada Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Have you found yourself wondering how to navigate foreclosure in Nevada? This article provides a clear overview of the foreclosure process in Nevada, outlining the legal framework, timelines, and options available to homeowners.

Foreclosure Process Overview

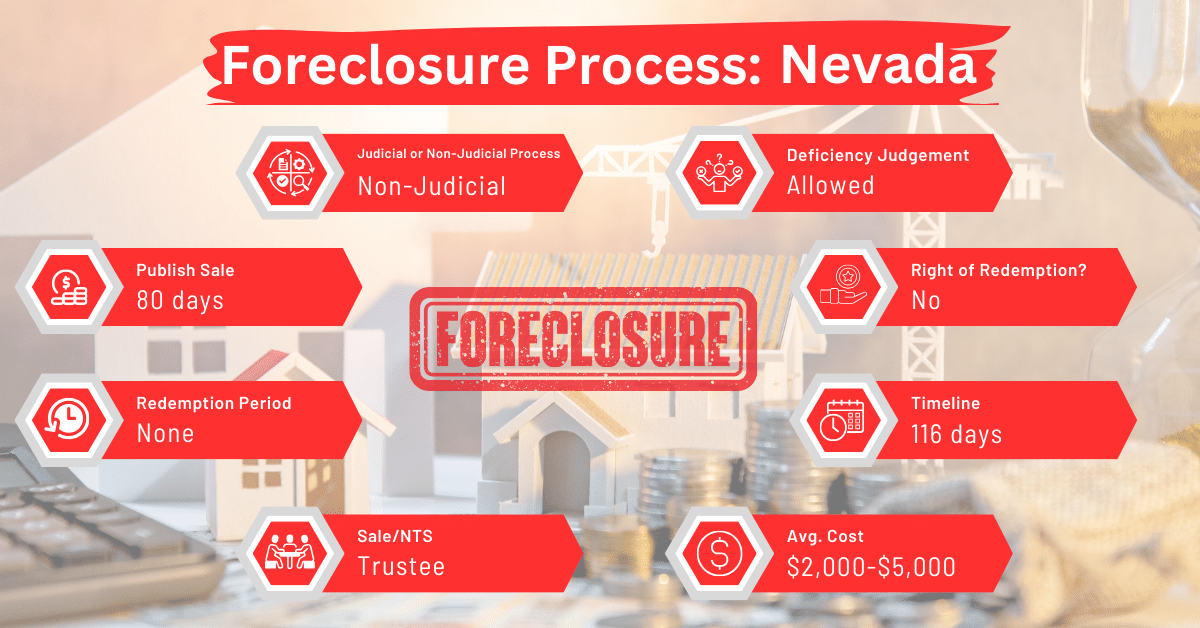

Nevada’s foreclosure system features both judicial and non-judicial processes, with most cases concluding within approximately four months. This swift process is a result of the state’s inclination towards non-judicial foreclosures, which are managed through a trustee sale. These types of foreclosures are quicker than judicial ones, as they bypass lengthy court procedures.

Pre-foreclosure Period

The right to sell a property under a deed of trust in Nevada can only be exercised after meeting the following conditions:

- For deeds effective between July 1, 1949, and July 1, 1957, the grantor, titleholder, any beneficiary of a subordinate deed of trust, or any other party with a lesser claim on the property must have failed to correct a payment or performance deficiency for 15 days.

- For deeds effective on or after July 1, 1957, these parties must have failed to address the deficiency for 35 days.

The 15- or 35-day period begins the day after the notice of default and intention to sell is recorded at the county recorder’s office where the property is located. On the same day the notice is recorded, a copy must be sent by registered or certified mail, return receipt requested, and with prepaid postage, to either the grantor or the person who officially holds the title as of the date the notice is recorded. At least three months must pass after the breach notice has been filed before the sale can proceed.

If proper notice is not given to the grantor, the person holding the title on the date the notice of default and election to sell is recorded, each trustor, or any other person entitled to such notice, the individual who did not receive the notice may initiate legal action. This legal action must be taken within 90 days following the sale date.

When a residential property is being foreclosed upon, the following requirements must be met regarding the posting and content of the notices of default and sale:

Notices must be visibly posted on the property within these specific timeframes:

- The notice of default and election to sell must be posted at least 100 days before the sale date.

- The notice of sale must be posted at least 15 days before the sale date.

Both notices must clearly include:

- The physical address of the property.

- The contact information for the trustee or the individual responsible for conducting the foreclosure, who can provide updates on the foreclosure status.

A separate notice must be both visibly posted on the property and mailed to any tenants or subtenants (excluding the grantor or the grantor’s successors) who currently reside on the premises. This notice must be sent at least 15 days before the sale date. For the mailing, a certificate of mailing must be obtained from the United States Postal Service or another mail delivery service to verify that the notice has been sent.

Types of Foreclosures

Nevada’s foreclosure process is primarily non-judicial, facilitated through a deed of trust that includes a power-of-sale clause. This clause enables the lender to sell the property without court intervention in the event of borrower default. Judicial foreclosures, while available, are less common in Nevada.

Notice and Sale Process

For non-judicial foreclosures, a notice of sale is posted at least 20 days before the trustee sale date in three public places and published in a local newspaper once a week for three weeks. The notice of sale is also mailed to affected parties.

All foreclosure sales in Nevada must occur through an auction, where the property is sold to the highest bidder. These auctions can only be held between 9 am and 5 pm. The agent conducting the sale is prohibited from purchasing any property at the auction or having any interest in any purchase made during the auction. These sales must take place at a public location within the county, specifically designated by the county’s governing body for this purpose.

Avoiding Foreclosure by Selling Your Mortgage Note

For homeowners in Nevada facing foreclosure, selling their mortgage notes to a reputable buyer can be an effective alternative. This option can circumvent the foreclosure process and mitigate its impacts, such as credit score damage and loss of property.

Borrower Rights and Protections

Adequate Notification

Nevada law mandates lenders or trustees to thoroughly notify borrowers about the foreclosure process.

Notarized Affidavit of Authority

Assembly Bill 284, effective from October 2011, requires lenders to provide a notarized affidavit of authority to exercise power of sale under a deed of trust in order for the foreclosure sale to be valid.

Foreclosure Prevention Alternatives

The mortgage servicer must personally or by telephone assess the borrower’s financial situation and discuss options to avoid foreclosure. Some of the things they must do include:

- Informing the borrower of their right to a follow-up meeting, which must be scheduled within 14 days of the request, if made.

- Providing the borrower with the toll-free phone number from the U.S. Department of Housing and Urban Development for locating certified housing counseling services.

Borrowers can authorize, in writing, a HUD-certified housing counseling agency, an attorney, or another advisor to communicate with the mortgage servicer on their behalf about their financial situation and foreclosure avoidance options.

If the borrower opts for a foreclosure prevention alternative, they must send an application for a foreclosure prevention alternative to the mortgage servicer, mortgagee, or beneficiary.

Within five business days of receiving an application or any related document for a foreclosure prevention alternative, the mortgage servicer, mortgagee, or beneficiary of the deed of trust must send the borrower a written acknowledgment confirming the receipt of the application or document.

The initial acknowledgment of receipt should include the following information:

- That the mortgage servicer, mortgagee, or beneficiary must either reject the application or make a written offer for a foreclosure prevention alternative within 30 calendar days of receiving a complete application.

- That if a written offer is made, the borrower has 14 calendar days from receipt of the offer to accept or reject it. The offer will be considered rejected if not accepted or explicitly rejected within this timeframe.

- Any critical deadlines related to the application process, particularly any deadlines for submitting additional or missing documentation.

- Expiration dates for any documents the borrower has submitted.

Redemption and Deficiency Judgments

In Nevada, there is no redemption period after a non-judicial foreclosure sale. However, for uncommon judicial foreclosures, there is a one-year redemption period. Deficiency judgments, where borrowers owe the remaining mortgage balance after the sale, are not pursued in non-judicial foreclosures.

Special Protections and Programs

Nevada offers various programs and initiatives to assist homeowners facing foreclosure. For example, homeowner who is living in the property secured by the mortgage or deed of trust can request mediation for a loan modification if the following conditions are met:

- The homeowner must be certified by a local housing counseling agency approved by the United States Department of Housing and Urban Development, confirming that:

- They are experiencing a documented financial hardship;

- They are at imminent risk of defaulting on their loan.

- The homeowner must:

- Submit a petition to the district court declaring their choice to undergo mediation as specified in this section;

- Pay a $25 fee to the court clerk at the time of filing the petition;

- Cover their portion of the mediation fee as set by subsection 12 of NRS 107.086;

- Send a copy of the petition to Home Means Nevada, Inc., or its successor, and to the beneficiary of the deed of trust. This must be done via certified mail with a return receipt requested, or by electronic transmission if agreed upon by all involved parties.

- Upon receiving the petition:

- Home Means Nevada, Inc., or its successor, will inform the mortgage servicer of the homeowner’s request to participate in mediation. This notification will also be made by certified mail or electronic transmission, as permitted.

- The district court will assign the case to a senior justice, judge, hearing master, or another designated official and schedule the mediation.

- Home Means Nevada, Inc., or its successor, must notify any other interested parties by certified mail or electronic transmission of the homeowner’s intention to engage in mediation.

Comparative Insights

As we compare Nevada’s foreclosure laws with those of other states, we’ll uncover differences in notice periods, costs, and credit impacts.

Publish Sale Notice

Nevada’s foreclosure process requires an 80-day notice period before the sale. This is notably longer than in many states including Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, New Hampshire, North Carolina, Rhode Island, and Tennessee.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Nevada typically range from $2,000 to $5,000. Compared to other states, these costs are within the average range.

Impact on Credit Score

Similar to other states, foreclosure in Nevada can result in a decrease of 100 points or more. This negative effect emphasizes the importance of taking alternatives to foreclosure for maintaining financial health.

Conclusion

Foreclosures in Nevada are mostly non-judicial. For homeowners facing foreclosure, selling the mortgage note can be a strategic alternative to avoid the process and its consequences.