Minnesota Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

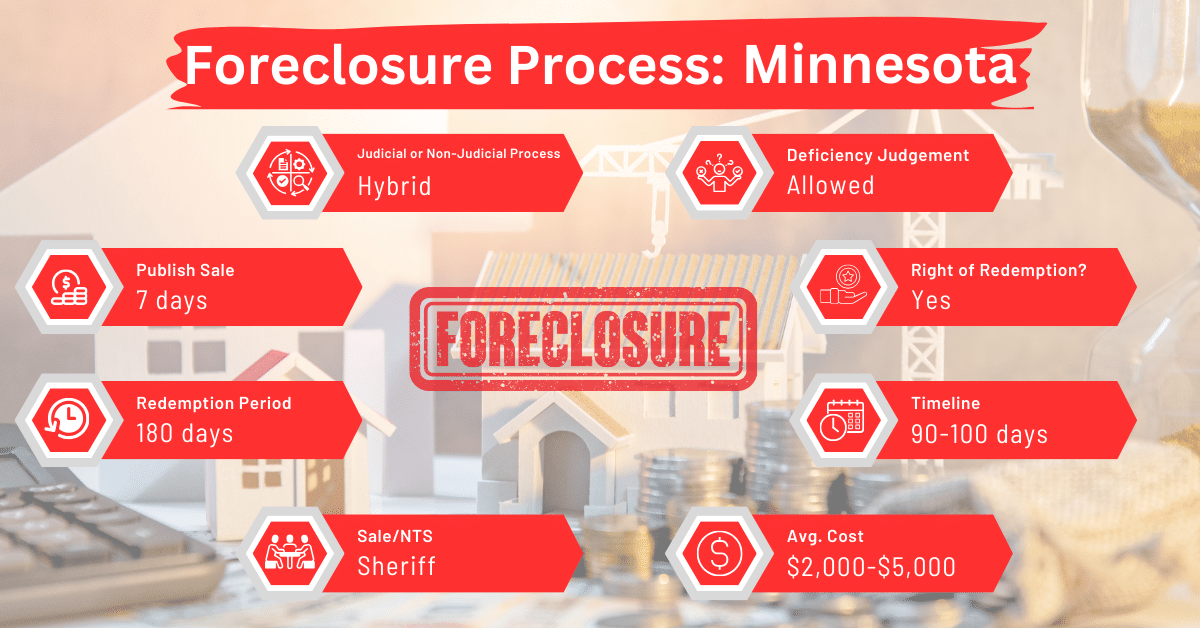

The Minnesota Statutes provide for judicial and non-judicial foreclosure proceedings. In this guide to Minnesota’s foreclosure laws and processes, we’ll examine both types of foreclosures.

Foreclosure Process Overview

Minnesota employs both in-court (judicial) and out-of-court (non-judicial) foreclosure proceedings. Non-judicial foreclosures are more common, though. The usual timeline for a foreclosure in Minnesota, excluding the redemption period, is around four months.

Pre-foreclosure Period

In Minnesota, if the foreclosure goes through the courts, it begins with a legal case against the borrower. Where the foreclosure is non-judicial, the lender is usually required to send a default notice by mail before they can set a date to sell the property. No matter the type of foreclosure used, borrowers have a chance to stop the foreclosure process by paying off the overdue amount along with any additional fees and costs, until the property is sold.

Types of Foreclosures

Minnesota’s foreclosure process is a hybrid system, allowing both judicial and non-judicial foreclosures. The choice of process depends on the mortgage terms and the lender’s preference. Non-judicial foreclosures, facilitated by a power-of-sale clause in the mortgage, are more prevalent due to their efficiency.

Notice and Sale Process

When a mortgage is set to be foreclosed by selling the property or part of it, a notice must first be published for six weeks, announcing the impending foreclosure sale. Publishing a notice of sale for a foreclosed property is considered valid under two conditions:

- Local Publication: The notice can be published in a newspaper that is based in the same county as the property or part of the property that is being sold.

- Adjacent County Publication: If no suitable newspaper exists in the property’s county, the notice can be published in a newspaper from a neighboring county. However, this is only acceptable if the newspaper provides evidence (through a sworn affidavit) that a significant number of its readers are from the county where the property is located.

After using either of the options above, the newspaper must submit an affidavit of publication. This document must confirm the location of the newspaper’s office and verify that the newspaper meets the requirements for publishing legal notices for properties in that specific county.

If the property in question is occupied, the foreclosure notice must be served to the occupier at least four weeks before the scheduled sale.

Sale

The sale of the property will be conducted by the sheriff or a deputy sheriff. It will take place at a public auction where anyone can bid, and the property will be sold to the highest bidder. This auction will occur in the county where the property, or at least part of it, is located.

Between 9:00 am and 4:00 pm on the scheduled date, the auction should be held. The winning bidder receives a certificate of sale. This certificate transfers ownership and possession rights to the bidder after the redemption period.

Avoiding Foreclosure by Selling Your Mortgage Note

For homeowners in Minnesota facing foreclosure, selling their mortgage notes to a reliable buyer is a good option. It can help them skip the foreclosure process and prevent negative effects like harm to credit scores and loss of their home. This choice offers quick financial relief, helps pay off debts, and gives homeowners more control over their finances.

Borrower Rights and Protections

Under Minnesota law, lenders must ensure that borrowers are adequately informed about ways to navigate the foreclosure process through detailed notices. For example, they must let the borrower know that there are foreclosure prevention counseling services available through approved agencies.

The party foreclosing the mortgage must also send the homeowner’s name, address, and phone number to an approved foreclosure prevention agency. Finally, borrowers have the right to stop the foreclosure by settling the default amount before the sale.

Redemption and Deficiency Judgments

In Minnesota, borrowers typically have a six-month redemption period post-foreclosure sale. The period may be extended to 12 months for certain properties and mortgages.

During this phase, the borrower can redeem the property by paying the bid amount plus interest and costs.

Deficiency Judgments

When a lender goes on to seek a deficiency judgment, they ask for the remaining debt that the sale of the property didn’t cover. The original borrower or another party responsible for the mortgage is obligated to pay the lender the requested amount.

If the property is sold in a non-judicial foreclosure, the defendant has some solid defenses they can use. For one, can argue that the property was worth the entire debt at the time of sale. They can also argue that the sale price was much lower than the property’s actual value. If they can prove either case, it could significantly reduce or completely cancel out the deficiency judgment.

Kindly note that deficiency judgments don’t affect the rights of other buyers or innocent third parties. They also don’t affect the lender’s ability to transfer financial documents like notes or bonds secured by the mortgage. These judgments won’t alter the ownership of the property by the person who bought it at the foreclosure sale.

Unfortunately, a lender in a judicial foreclosure can’t seek a deficiency judgment.

Special Protections and Programs

Minnesota offers various programs and initiatives to assist homeowners facing foreclosure. These include loan modification options and government assistance programs, providing financial relief and alternative solutions.

Comparative Insights

While Minnesota’s foreclosure laws have some distinct features like a shorter notice period and a mix of judicial and non-judicial processes, they still have similar financial effects and steps as seen in other states’ foreclosure laws.

Publish Sale Notice

In Minnesota, lenders are required to publish a final notice of sale at least 7 days before the actual sale takes place. This is the shortest notice period required by any state in the U.S. for such a sale. Following Minnesota, Missouri has the second shortest period, where lenders must publish the final sale notice at least 10 days before the sale.

Costs in a Range and Comparison to Other States

In Minnesota, the typical costs for handling a foreclosure range from $2,000 to $5,000. This puts Minnesota in the middle when it comes to foreclosure expenses across the U.S.

To put things into perspective, states like Alabama, Arizona, Arkansas, Mississippi, Missouri, Texas, West Virginia, and Wyoming are on the lower end, with foreclosure costs between $1,000 and $3,500.

Meanwhile, states like Connecticut, Illinois, Louisiana, Maryland, Nebraska, New Jersey, New York, Ohio, Pennsylvania, and Vermont have higher costs, ranging from $3,000 to $10,000.

Impact on Credit Score

Foreclosure in Minnesota can significantly impact a homeowner’s credit score, often leading to a decrease of 100 points or more. This negative effect is common across the United States.

Conclusion

Minnesota’s foreclosure laws and processes balance judicial and non-judicial foreclosures. Homeowners threatened with foreclosure in this state could consider selling their mortgage note to avoid the process and its negative outcomes.