Mississippi Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Overwhelmed by the complicated provisions of the Mississippi Code regarding foreclosure? This guide simplifies Mississippi’s foreclosure laws and process, disclosing key information for homeowners and investors. It explains the legal steps and important timelines in the foreclosure process. While reading it, also discover the rights you have as a borrower or lender in Mississippi.

Foreclosure Process Overview

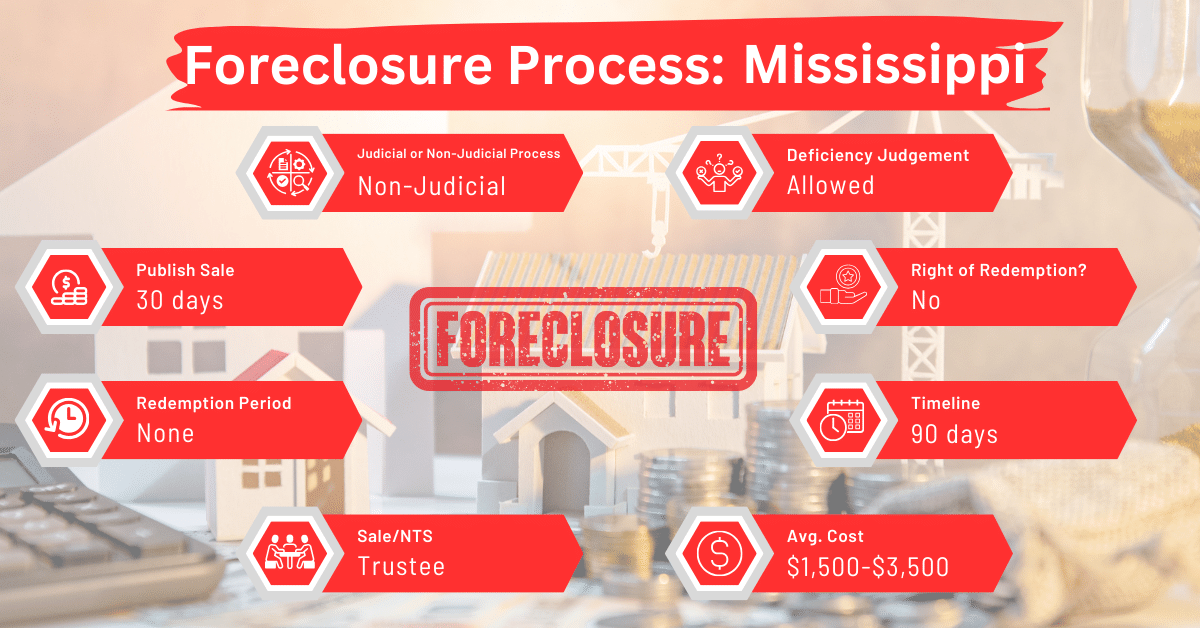

Mississippi’s foreclosure system accommodates both judicial and non-judicial foreclosures. The latter is the more prevalent route. On the average, foreclosure in Mississippi takes around 90 days. Compared to the timelines in other states such as Alaska, California, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Maine, New Jersey, New Mexico, and New York, Mississippi’s timeline is quite short.

Pre-foreclosure Period

Mortgage agreements and deeds of trust in Mississippi may include clauses stating that if any payment, interest, tax, or insurance premium is missed, the entire amount owed can become due immediately. When the borrower misses a payment, they’ll receive a default notice from the lender at least 30 days before the foreclosure sale date. Their receipt of the notice of default marks the beginning of the pre-foreclosure period.

During this period, the borrower can stop the sale. To do this, they must pay the amount that is currently overdue (including any related legal costs and fees) as well as any unpaid taxes or insurance premiums, with interest. This payment will reset the debt to its original terms, as if the default had never happened, and stop the immediate sale of the property.

Types of Foreclosures

Deeds of trust, which include power-of-sale clauses, are popular in Mississippi. As a result, lenders can sell properties used as collateral without court intervention in the event of borrower default. This is why judicial foreclosures are less common than non-judicial ones in Mississippi.

Notice and Sale Process

The notice of sale in Mississippi must be posted at the county courthouse and published weekly for three consecutive weeks in a local newspaper. Both the newspaper and courthouse notices must include the names of the original borrowers named in the deed of trust or mortgage.

The sale will not be considered legal unless these advertising requirements are met, even if a different process was agreed upon in any contract. As for the sale, it is conducted by a trustee at the courthouse, and the property is sold to the highest bidder. This sale is final.

If a deed of trust or mortgage includes a power of sale but doesn’t specify where, when, or how the sale should be advertised, the property can be sold for cash after a default occurs. The sale must follow the same notification rules and timing as a sheriff’s sale of similar properties.

However, the sale must take place in the county where the property is located or in the county where the owner (or one of the owners) lives. If the property spans more than one county, the parties involved can agree to hold the sale in any of those counties, for all or part of the property.

Avoiding Foreclosure by Selling Your Mortgage Note

Facing foreclosure in Mississippi? Selling your mortgage note to a reputable buyer is an effective alternative to going through foreclosure. This option can circumvent the foreclosure process and mitigate its impacts, such as a reduction in your credit score and the loss of your property.

Borrower Rights and Protections

Mississippi law requires lenders to adequately inform borrowers about the foreclosure process through detailed notices.

Redemption and Deficiency Judgments

In Mississippi, there is no redemption period after the foreclosure sale. This means that once the property is sold, the borrower cannot reclaim it.

Deficiency Judgments

Under Mississippi law, any lawsuit related to a mortgage or deed of trust must be filed within one year of the property’s foreclosure or sale. This includes actions where a lender seeks a deficiency judgment, which is the remaining balance owed if the foreclosure sale does not cover the full debt. If a year passes after the foreclosure sale, the lender is no longer allowed to pursue this deficiency judgment against the borrower.

Special Protections and Programs

Mississippi offers various programs and initiatives to assist homeowners facing foreclosure. Some of these are loan modification options and government assistance programs.

Comparative Insights

Why is an entire section of this article dedicated to comparing Mississippi to other states? By seeing how Mississippi compares to other states, you can get a clearer picture of its foreclosure practices and what they mean for homeowners and investors.

Publish Sale Notice

In Mississippi, you have to give a 30-day notice before foreclosing on a property. This timeframe is shorter than in places like Colorado, Washington, and Massachusetts, where the notice periods are 60, 90, and 41 days, respectively. However, it’s similar to Maryland and Oregon, where the notice period is also 30 days.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Mississippi typically range from $1,500 to $3,500. This cost bracket is relatively cheap when compared to other states in the US.

Impact on Credit Score

Foreclosure in Mississippi can significantly impact a homeowner’s credit score, often leading to a decrease of 100 points or more. This negative effect is a common consequence across the United States.

Conclusion

Although Mississippi’s foreclosure laws and processes allow judicial and non-judicial foreclosure, the latter is more common because it’s faster and cheaper than the former. For homeowners facing foreclosure, selling the mortgage note can be a way out of foreclosure.