Understanding Hawaii’s Foreclosure Laws and Procedures

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Hawaii’s foreclosure laws are a mix of detailed rules and a caring approach, shaped by the state’s special legal and cultural background. To understand these laws, you’ll need to know both the specific rules and the local values that affect real estate in Hawaii. This guide can help you with that.

Foreclosure Process Overview

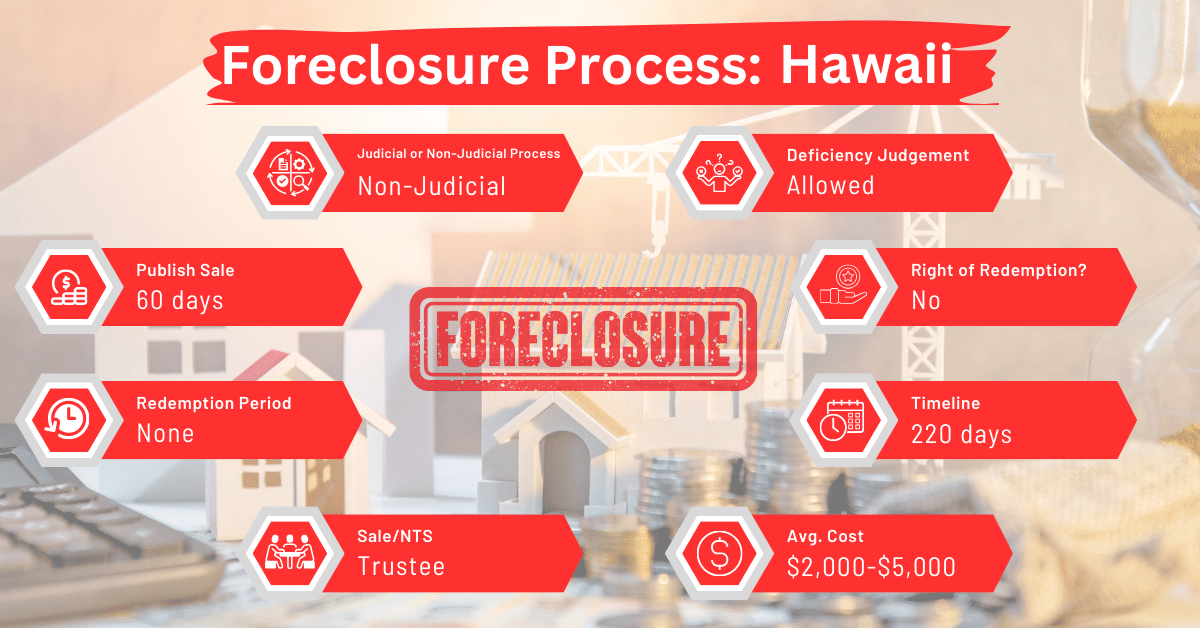

In Hawaii, both judicial and non-judicial foreclosures are available. Non-judicial foreclosures are more common, though. Despite the prevalence of non-judicial foreclosure in Hawaii, the foreclosure process takes about 220 days. This period is relatively longer compared to most states that primarily use non-judicial foreclosure, like Texas, Tennessee, Rhode Island, Missouri, Michigan, Georgia, and Massachusetts.

Pre-foreclosure Period

Hawaii’s pre-foreclosure period begins with the lender notifying the borrower of the default before initiating the foreclosure process. When a borrower doesn’t follow the terms of their mortgage agreement, the lender may decide to foreclose on the property without going to court (known as a power of sale foreclosure).

In this case, the lender must send a written notice to the borrower, any co-signers (guarantors), and other relevant parties. This notice of default and intention to foreclose must include the following information:

- The name and address of the current lender.

- The names and last known addresses of the borrower(s) and any co-signers.

- Details about the property being foreclosed, including its address or location description, tax information, and title numbers if it’s registered with the land court.

- A description of what the borrower did wrong (the default), including specific amounts owed if the default involves missed payments.

- What the borrower must do to fix the problem (cure the default), including how much they owe and an estimate of the lender’s legal fees and other related costs. The notice will also provide a deadline to fix these issues.

- The deadline to fix the default, which will be at least 60 days after the notice is sent.

- A warning that if the default isn’t corrected by the deadline, the full unpaid balance will be due. The lender will sell the property at a public auction without going to court. The notice will also state that the lender or anyone else can buy the property at this auction.

- Information on how and where the auction will be advertised, either in a newspaper or on a state website.

- Contact details for the attorney representing the lender, who must be licensed and located within the state.

- Information about the right of the owner-occupant to choose to participate in any other legal process available.

When a lender sends a notice of default and intention to foreclose, it must include certain documents to ensure the borrower fully understands the situation. Here’s what should be included in the notice:

- Original Mortgage Documents: The original mortgage agreement, any changes to that agreement (like new terms or conditions), and any transfers of the mortgage to another lender.

- Promissory Note: The original promissory note that the borrower signed, which outlines the promise to repay the borrowed amount, along with any endorsements or additions (allonges) to that note.

- Amendments: Any other documents that have modified the terms of the original mortgage or note, agreed upon by the borrower and the lender or any future holders of the mortgage.

Besides these, the notice must include contact information for approved housing counselors and credit counselors who can help the borrower understand their options and rights.

Delivery of the Notice

The lender must ensure this notice is properly delivered to:

- The borrower.

- Any other creditors with claims on the property that were made before the notice of default was recorded.

- The state’s director of taxation.

- The director of finance for the county where the property is located.

- The department of commerce and consumer affairs if required.

- Any other individual who has a legal right to be informed about the foreclosure.

Types of Foreclosures

Hawaii allows both judicial and non-judicial foreclosures. Judicial foreclosures involve court proceedings, while non-judicial foreclosures are based on the power of sale clause in the mortgage or deed of trust and do not require court intervention.

Notice and Sale Process

For non-judicial foreclosures, the notice of sale must be posted on the property and published in a local newspaper. The sale is conducted as an auction. The public sale of a foreclosed property must take place no sooner than 60 days after the initial public notice of the sale is distributed. Alternatively, it can occur at least 14 days after the third advertisement of the public notice.

Location of the Sale

The sale must be held in the county where the property is located. It should take place on state-administered property, designated by the department of accounting and general services. Below are specific places where the sale of the property may be conducted, depending on its location:

- If the property is In the city and county of Honolulu, the sale should be conducted at the state capitol.

- If the property is in the districts of Hamakua, North Hilo, South Hilo, or Puna, the sale should be held at a state facility in Hilo.

- If the property is in the districts of North Kohala, South Kohala, North Kona, South Kona, or Kau, the sale should be held at a state facility in Kailua-Kona.

- If the property is in the county of Maui, the sale should be held at a state facility in the county seat of Maui.

- If the property is in the county of Kauai, the sale should be conducted at a state facility in the county seat of Kauai.

The public sale cannot be held on judiciary-administered grounds or facilities. Also, it must take place during business hours on a business day. During the sale, a commissioner is appointed to sell the property at a public auction, with the highest bidder required to pay 10% of the bid in cash or cashier’s check.

Avoiding Foreclosure by Selling Your Mortgage Note

One option for homeowners facing foreclosure in Hawaii is to sell their mortgage notes to a reputable note buyer. This can provide a way to avoid foreclosure and its negative impacts.

Borrower Rights and Protections

In Hawaii, borrowers have specific rights and protections during the foreclosure process. These include:

Notification and Response

Borrowers must be notified of the foreclosure action. In judicial foreclosures, this involves a court filing and notification to the borrower. The borrower has 20 days to respond. In non-judicial foreclosures, the borrower receives a notice of default and impending sale.

Opportunity to Cure Default

Borrowers can stop the foreclosure sale by curing the default up to three days before the scheduled sale. This involves paying the overdue amount plus any additional costs.

Opportunity for Defense

The borrower, or any other lender who later takes on the mortgage, has the right to challenge the foreclosure process in court. They can present any legal or fair reasons why the foreclosure should not proceed.

Redemption and Deficiency Judgments in Hawaii

Hawaii does not offer redemption rights to borrowers after the foreclosure sale is confirmed. This means that once the sale is complete, the borrower cannot reclaim the property.

Deficiency Judgments

In Hawaii, lenders may seek a deficiency judgment in both judicial and non-judicial foreclosures if the sale price does not cover the mortgage balance. This holds the borrower liable for the difference.

Special Protections and Programs

Hawaii has a foreclosure mediation program designed to help borrowers and lenders find a resolution to avoid foreclosure. This program provides a platform for negotiation and potential alternatives to foreclosure.

Comparative Insights

In Hawaii, foreclosure notice periods, costs, and credit score impacts align with national averages.

Publish Sale Notice

In Hawaii, the law requires that the notice of sale be published at least 60 days before the actual sale date. This timeframe is typical compared to other states. Providing this advance notice gives potential buyers time to get ready and allows borrowers a chance to look into other options.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Hawaii typically range from $2,000 to $5,000. This range is within the average compared to other states. These costs can include legal fees, publication costs, and other administrative expenses involved in the foreclosure process.

Impact on Credit Score

A foreclosure in Hawaii, as in other states, can significantly impact a borrower’s credit score, often leading to a decrease of 100 points or more. This negative mark remains on the credit report for 7 years but becomes less impactful over time if the borrower rebuilds their credit.

Conclusion

For homeowners in Hawaii facing foreclosure, understanding these laws and processes is crucial. Selling the mortgage note can be a viable option to avoid foreclosure. It’s important to explore all available options and seek professional advice to make informed decisions.