Kansas Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Kansas is one of the states that allow only judicial foreclosures. Others on the only-judicial-foreclosure list are: Connecticut, Florida, Illinois, Indiana, Kentucky, Louisiana, Maine, Nebraska, New Jersey, New York, North Dakota, Ohio, Pennsylvania, South Carolina, and Vermont. However, Iowa has its own set of laws regulating the processes involved in judicial foreclosures. This article provides an in-depth look into them.

Foreclosure Process Overview

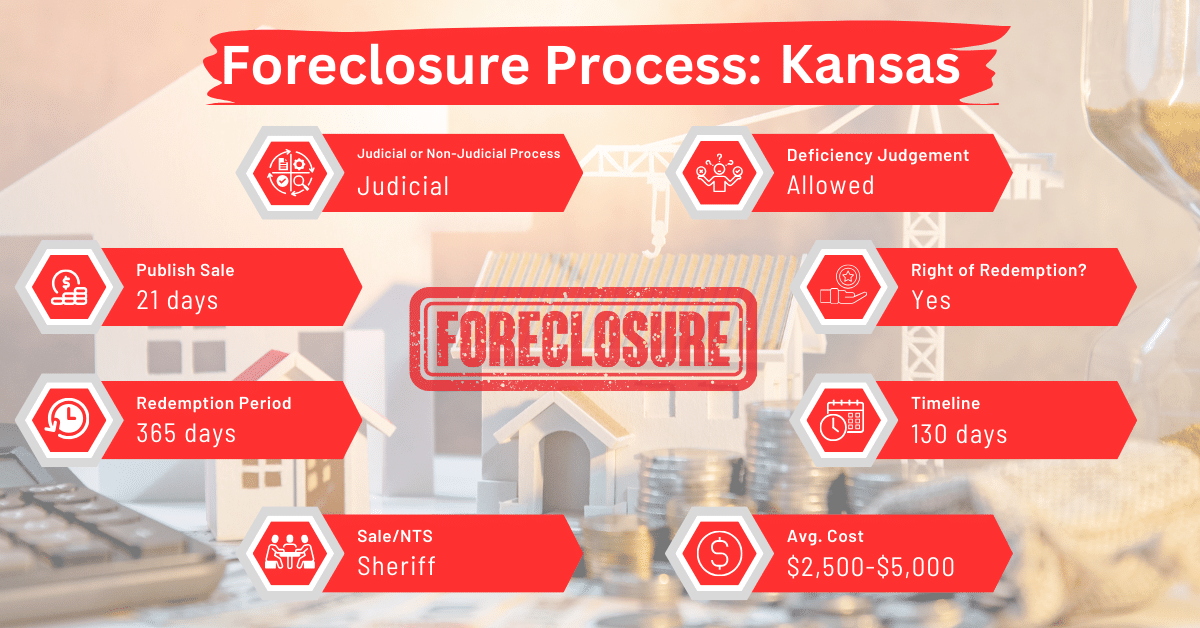

Foreclosure in Kansas is strictly a judicial process, meaning it is administered through the courts. The process can lead to a property sale in as little as 60 days. However, due to the redemption period, the issuance of a sheriff’s deed may take anywhere from three months to 12 months after the sale. The typical process period for a foreclosure in Kansas is around 130 days. This is relatively shorter compared to states that have longer judicial processes.

Pre-foreclosure Period

Before a lender can foreclose a borrower’s note and mortgage in Kansas, a title search must be done. This search identifies any liens that appear senior to the lender’s lien, which must be addressed before foreclosure. All junior lienholders must be named as defendants in the lender’s foreclosure suit to ensure the title is free of liens at the time of the foreclosure sale.

Types of Foreclosures

Kansas exclusively uses judicial foreclosures, involving the court system. This process begins when the lender files a petition for mortgage foreclosure with the court. The petition is then served on the borrower and any other named defendants. If a defendant cannot be found, Kansas law allows for service by publication.

Notice and Sale Process

Upon a borrower’s default, and after the court proceedings, a notice of sheriff’s sale is published in a local newspaper in the county where the property is located, once a week for three weeks.

The sale is held between seven and 14 days after the final notice of sale is published. Typically, the lender provides the opening bid. Whoever is the highest bidder at the sale receives a Certificate of Purchase.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners battling foreclosure in Kansas could sell their mortgage notes to a reputable note buyer like Amerinote Xchange.

Borrower Rights and Protections

Borrowers in Kansas have the right to be properly served with foreclosure documents and to respond to the complaint in court. They also have a redemption period, which varies depending on the amount of the principal balance paid.

Redemption and Deficiency Judgments

The redemption period in Kansas begins on the sale date. If more than one-third of the principal balance of the loan has been paid, the borrower has 12 months to redeem the property. Otherwise, the redemption period is three months. To redeem the mortgage, the borrower must pay the highest bid amount plus applicable interest and fees.

Special Protections and Programs

There aren’t special state programs to stop foreclosure in Kansas. But, homeowners struggling with foreclosure could get assistance under the now suspended Kansas Homeowners Assistance Fund (KHAF). This program provided financial assistance to homeowners who have experienced economic hardship due to the COVID-19 pandemic.

Funded by the federal government as part of the American Rescue Plan Act, the KHAF helped in preventing mortgage delinquencies, foreclosures, and displacement of homeowners suffering from financial setbacks during the crisis.

Eligibility for the KHAF was determined based on factors such as income, financial hardship due to the pandemic, and risk of housing instability or homelessness. The program prioritized aid to those with lower incomes and those who have been unemployed for an extended period.

Comparative Insights

Let’s compare how Kansas’s judicial-only approach works to the judicial foreclosures in other states.

Publish Sale Notice

Kansas requires a 21-day notice period before the foreclosure sale. The notice of sale must be published once a week for three consecutive weeks in a local newspaper. This requirement is the most lenient when compared to the requirements of other judicial foreclosure states. For example, Indiana’s laws provide that the lender must notify the borrower of the foreclosure sale within 120 days before the sale, while Delaware permits the lender to notify the borrower within 60 to 90 days.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Kansas, primarily legal fees and court costs, are between $2,500 and $5,000. This aligns with the cost of foreclosure in Maine, which is also a judicial foreclosure state.

Impact on Credit Score

In Kansas, as in other states, foreclosure can lead to a significant decrease in credit scores, often by 100 points or more. This negative impact is a consistent feature of foreclosures, regardless of the state. However, the duration of the foreclosure process, which is relatively shorter in Kansas due to its efficient judicial process, might influence the time it takes for a borrower’s credit score to start recovering.

Conclusion

The judicial nature of the process in Kansas offers certain protections to borrowers but also necessitates a thorough understanding of the legal proceedings involved. Remember, if you’re not sure if you should go through with foreclosure in Kansas, you can always sell your mortgage note.