South Carolina Foreclosure Laws and Processes

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Foreclosure in South Carolina’s real estate market is regulated by the South Carolina Code of Laws. This article will explore these foreclosure laws and provide relevant insights on the foreclosure process in South Carolina.

Foreclosure Process Overview

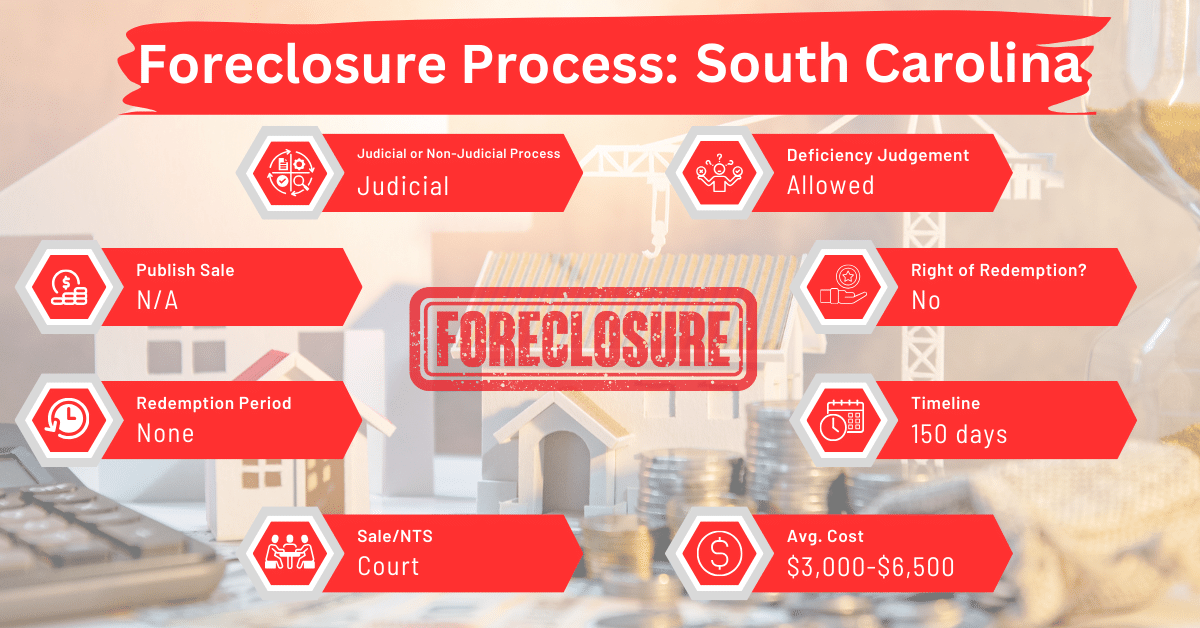

In South Carolina, foreclosures are judicial, meaning they require court proceedings. The process typically spans around 150 days. This is quite shorter compared to other judicial foreclosure states like Delaware, Illinois, Indiana, Louisiana, Maine, New Jersey, New York, New Mexico, Ohio, Pennsylvania, and South Dakota.

Pre-foreclosure Period

The pre-foreclosure period in South Carolina begins when the lender files a lis pendens, signaling their intent to foreclose. The borrower receives a foreclosure notice within 20 days, either personally or through publication if they are unreachable. Borrowers have 30 days to respond, failing which the case moves to a hearing officer who orders the property’s sale.

Types of Foreclosures

In South Carolina, foreclosures are handled only through the courts. This means the court ensures that all the required steps are followed carefully, including submitting the right documents on time and protecting the rights of both the homeowner and the lender.

Notice and Sale Process

Before selling property by order of an execution or mortgage, the sheriff of each county must publicly advertise the property for three weeks leading up to the sale. The advertisement must list the property to be sold, the sale’s time and place, the owner’s name, and the party initiating the sale.

The sheriff must post this advertisement in three public places within the county, including the courthouse door. If the county has a local newspaper, the sheriff must also publish the advertisement in it before the sale day.

A judicial foreclosure sale in South Carolina is usually slated for the first Monday of each month. If the first Monday is a legal holiday, the sale moves to the following Tuesday. The sale can also take place at other times if a court of competent authority orders it or an order of reference directs it. The South Carolina Code of Laws directs that judicial foreclosure sales must occur between eleven in the morning and five in the afternoon at the county courthouse.

Avoiding Foreclosure by Selling Your Mortgage Note

An alternative to foreclosure in South Carolina is selling your mortgage note to a reputable note buyer. This option can provide immediate financial relief and avoid the lengthy and stressful foreclosure process.

Borrower Rights and Protections

In South Carolina, if a lender waives the right to a deficiency judgment, the borrower has no redemption rights post-sale. However, if the lender seeks a deficiency judgment, the sale is open for 30 days for upset bids, offering a window for the borrower to potentially reclaim the property.

Redemption and Deficiency Judgments

Redemption Period

In all judicial real estate sales for foreclosure and execution in South Carolina, bidding remains open until the thirtieth day after the sale date, excluding the day of the sale itself. This 30-day window served as a redemption period.

During this thirty-day period, anyone other than the highest bidder at the sale, or their representative, can submit a higher bid by complying with the sale terms and making a deposit as proof of their good faith. The highest bid during this period, accompanied by the necessary deposit, determines the successful purchaser.

If the thirtieth day falls on a Sunday, bidding closes on the following Monday. On day 30, the officer conducting the sale will reopen bidding at 11 am. Bidding will continue until the property is officially sold to the highest bidder who complies with the sale terms. The sales officer will announce when the bidding is about to close and will accept the final bids in the order they choose.

Deficiency Judgment

If the lender requests it, the court can order the mortgagor to pay any remaining mortgage debt that the sale of the mortgaged property does not cover, if the mortgagor is personally liable for the debt. If someone other than the mortgagor is obligated under the mortgage, the lender can include that person in the lawsuit relating to the deficiency judgment. Then the court can order this person to pay any remaining debt after the property sale.

Special Protections and Programs

In South Carolina, there are no unique state-specific programs or protections for individuals facing foreclosure, apart from the standard judicial process.

Comparative Insights

Below, we explore how South Carolina’s foreclosure process aligns with or differs from other states in specific areas.

Publish Sale Notice

In South Carolina, the law mandates a three-week notice period before the foreclosure sale. This is similar to many other states including Alabama, California, Kansas, and Rhode Island.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in South Carolina are between $3,000 and $6,500. This range is the same as that in Kentucky.

Impact on Credit Score

A foreclosure can lead to a significant decrease in the homeowner’s credit score, often by 100 points or more. This negative impact remains on the credit report for seven years. Thankfully, its effect diminishes over time with responsible credit management.

Conclusion

Foreclosure in South Carolina is strictly judicial. For those facing foreclosure, selling the mortgage note can be a viable alternative, providing a way to avoid the process altogether.