South Dakota Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

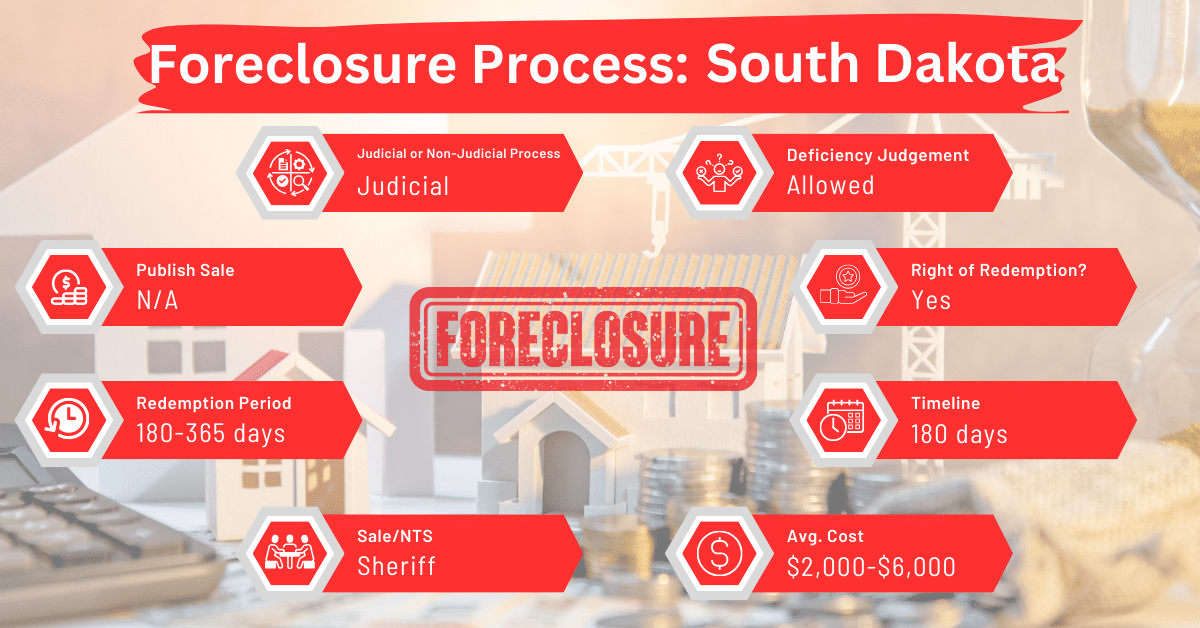

Certain mortgages in South Dakota may be foreclosed either in court or via advertisement, though the latter is less common. Foreclosure in South Dakota usually takes about 150 days. This is slightly longer than in some states such as Alabama, Alaska, Arizona, Arkansas, Delaware, Maryland, Massachusetts, Michigan, Rhode Island, and Tennessee, but still within a normal range.

Foreclosure Process Overview

In South Dakota, the lender starts the foreclosure process by filing a complaint in court regarding the borrower’s default. The borrower has 30 days to respond to the court filing before the process continues.

Pre-foreclosure Period

During the pre-foreclosure period, South Dakota does not mandate lenders to send a default notice to the borrower before initiating the foreclosure process. However, many mortgages have clauses that require such a notice.

Types of Foreclosures

In South Dakota, foreclosures can be either judicial or non-judicial. Judicial foreclosures are more common and are chosen based on the mortgage’s terms or if the lender wants a court’s decision. Non-judicial foreclosures are quicker and cheaper, used when the mortgage allows for it.

Notice and Sale Process

Once the court allows the foreclosure to proceed, the lender must publish a notice of foreclosure sale in a local newspaper. They must also deliver a written copy to the borrower and any lien holders at least 21 days before the sale.

The county sheriff conducts the sale, and anyone, including the lender, can bid. The winning bidder receives a sale certificate and is entitled to a deed transferring ownership after the redemption period.

Avoiding Foreclosure by Selling Your Mortgage Note

Instead of going through foreclosure in South Dakota, you can sell your mortgage note to a reputable note buyer. This option provides immediate financial relief and avoids the lengthy and stressful foreclosure process.

Borrower Rights and Protections

Borrowers in South Dakota have the right to redeem the property and void the sale by repaying the total amount owed. If the property is the borrower’s primary residence, they have six months to redeem it. If not, the redemption period is only two months.

Redemption Period

As mentioned earlier, borrowers in South Dakota can redeem the property depending on the property’s status and the foreclosure method.

Deficiency Judgments

Generally, a deficiency judgment is a verdict ordering the borrower or whoever is liable for the balance of the mortgage debt, to pay to the lender any difference between the sale price of the property and the mortgage balance.

Deficiency Judgments in Judicial Foreclosure

Should there be a remaining deficiency after a judicial foreclosure sale in South Dakota, the mortgage holder can only seek a general execution for this deficiency by applying to the court where the judgment was issued.

Deficiency Judgments in Non-judicial Foreclosure

Before any deficiency judgment against the mortgagor, trustor, or maker of the obligation can be issued, the court must ensure that the sale price reflected the property’s true market value at the time of the sale.

If the property sold for less than its true market value, the court will subtract the difference between the sale price and the market value from the remaining mortgage debt to determine the amount of the deficiency judgment.

Special Protections and Programs

South Dakota does not offer specific state-level foreclosure protections or programs for borrowers.

Comparative Insights

Let’s see how South Dakota’s foreclosure procedures compare with those in other states.

Publish Sale Notice

In South Dakota, the lender must publish a sale notice 23 days before the auction. This duration is slightly longer compared to some states like Indiana, Washington, and West Virginia.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in South Dakota, including legal fees, publication costs, and other related expenses, are between $2,000 and $6,000. This range is closest to the cost of foreclosure ($2,500 to $6,000) in Oklahoma.

Impact on Credit Score

The impact of foreclosure on a credit score in South Dakota mirrors the effects seen across the United States. A foreclosure typically leads to a significant decrease in the homeowner’s credit score, often by 100 points or more. This decrease stays on the credit report for seven years, but its effect may decline over time with responsible credit management.

Conclusion

Navigating foreclosure in South Dakota requires an understanding of its judicial process and the rights and protections afforded to borrowers. If you’re wondering how to avoid foreclosure in South Dakota, consider selling your mortgage note.