Oklahoma Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

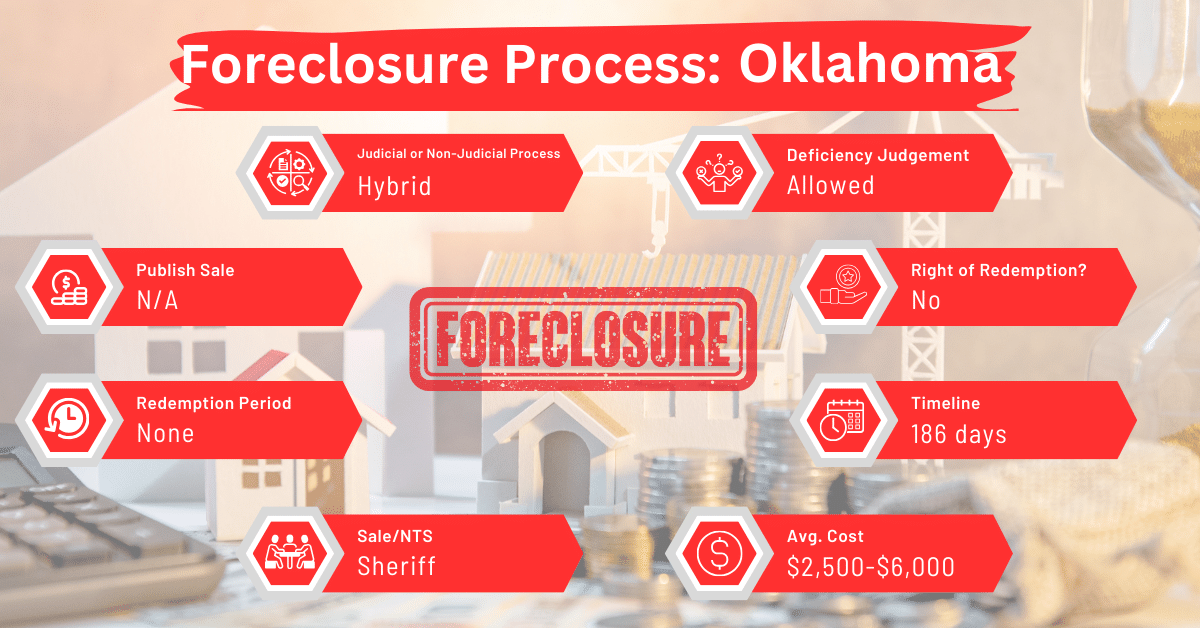

Oklahoma’s Statutes provide for judicial and non-judicial processes. Generally, foreclosure in Oklahoma could take about six to seven months.

Foreclosure Process Overview

In Oklahoma, foreclosures can be conducted either through the court system (judicial) or outside of it (non-judicial), depending on the terms of the mortgage or deed of trust. The judicial process is preferred, which is why foreclosure in this state takes up to 186 days.

Pre-foreclosure Period

The pre-foreclosure period in Oklahoma starts when the lender files in court against the borrower for default on the loan. The borrower is then notified of this action, usually in person and by mail, and typically has 20 days to respond. If the court rules against the borrower, the property is scheduled for public sale. Non-judicial foreclosures are rare in Oklahoma due to legal restrictions.

Types of Foreclosures

Foreclosure may be judicial or non-judicial in Oklahoma.

Non-judicial Foreclosure

The mortgagor may grant the mortgagee the power to sell the mortgaged real estate directly through the mortgage. This power allows the mortgagee to sell the property and the interests of other persons in it after a breach or default in the contract for which the property serves as security, or a default in the mortgage itself.

Where the mortgaged property is the debtor’s residence, they may notify the mortgagee by certified mail at least ten days before the property is sold under the power of sale. They may also choose judicial foreclosure. In this case, the mortgagee must pursue foreclosure through court proceedings. However, the mortgagee can challenge the homestead claim in court.

If the debtor opts out of a deficiency judgment, the mortgagee cannot pursue a deficiency judgment personally against them if the property is sold under the power of sale. However, the mortgagee can still enforce liens on other collateral. The mortgagee has 90 days to challenge the homestead claim or seek a deficiency judgment after recording the deed.

A purchaser at a foreclosure sale via power of sale may seek a writ of assistance from a competent court, to convert the non-judicial foreclosure to a judicial foreclosure.

Judicial Foreclosure

Judicial foreclosures are common due to state laws that make them easier to do. This is why most lenders in Oklahoma choose the judicial method .

Notice and Sale Process

Notice of Sale

The sheriff executes a written notice of the sale, including the legal description of the property, and the date, time, and place of the sale. At least ten days before the sale date, this notice must be mailed by first class mail with postage prepaid, to:

- The judgment debtor,

- Any recorded interest holders whose rights are to be extinguished,

- Anyone else known to claim a lien or interest in the property.

The public is informed of the sale date, time, and place through notices published for two consecutive weeks in a local newspaper in the county where the property is located. If no newspaper is available in the county, then in one with general circulation there.

An advertisement must be placed on the courthouse door and in five other public places within the county. At least two of these places must be in the township where the property is located.

Furthermore, the party in charge of the sale must file an affidavit proving the mailing and publication or posting of notices.

Sale

The sale cannot occur less than thirty days after the first notice publication. It must take place at the courthouse in the county where the property is located, unless a judge with jurisdiction over the case designates a different location within the county. Alternatively, these sales can be conducted by public auction online or through other electronic means.

Neither the sheriff nor any other officer conducting the property sale, nor any appraiser or online auction marketplace, may purchase the property being sold, either directly or indirectly. Any such purchase will be considered fraudulent and void.

If the online auction marketplace is a corporation, limited liability company, limited liability partnership, or partnership, this restriction also applies to any director, officer, employee, managing member, or partner of the appraiser or online auction marketplace.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Oklahoma who are at risk of foreclosure can consider selling their mortgage notes to a trusted note buyer as a strategic alternative. This option offers a practical solution to circumvent the foreclosure process, which can have detrimental effects on credit scores and the ability to retain homeownership.

By selling their mortgage note, homeowners can receive immediate financial compensation, allowing them to settle their outstanding mortgage debts. This approach not only helps in avoiding lengthy and public foreclosure proceedings but also mitigates the potential long-term financial repercussions associated with a foreclosure record.

Borrower Rights and Protections

In Oklahoma, borrowers have the right to be clearly informed about foreclosure actions against them. They receive a formal notice and can respond to it in court. They also have a chance to pay off their debt, including the mortgage and other costs, before the sale of the property is finalized.

Redemption and Deficiency Judgments

While Oklahoma does not offer a post-sale statutory right of redemption, borrowers can redeem the property before the sale is confirmed.

Deficiency judgments, where the borrower is liable for the difference between the sale price and the mortgage balance, are permitted in Oklahoma. However, they’re subject to some restrictions. For instance, in a non-judicial foreclosure, a lender can’t pursue a deficiency judgment against a borrower if the borrower has opted out of the deficiency judgment.

Special Protections and Programs

Oklahoma has updated its laws to make foreclosures fairer. One important change is that now, all the necessary and correct documents must be presented before a foreclosure can start. This rule helps prevent unfair foreclosures caused by missing or wrong paperwork.

Comparative Insights

Oklahoma’s foreclosure processes are different from those of other states in terms of timelines, documentation requirements, credit score impacts.

Publish Sale Notice

Oklahoma law stipulates that sale notice must be advertised in a local newspaper for four consecutive weeks. This duration is shorter than in other states that favor judicial foreclosure, such as: Alaska, Arizona, Colorado, Hawaii, Idaho, Massachusetts, Michigan, Mississippi, Montana, Nevada, Washington, and West Virginia.

Costs in a Range and Comparison to Other States

Foreclosure costs in Oklahoma typically range from $2,500 to $6,000. This cost bracket is similar to judicial foreclosure costs in Indiana and Wisconsin.

Impact on Credit Score

Like in other states, foreclosure in Oklahoma can significantly affect a borrower’s credit score, usually resulting to a decrease of 100 points or more.

Conclusion

Oklahoma’s foreclosure processes are easy to navigate once you understand the laws governing them. Under Oklahoma’s laws, one way to avoid foreclosure is by selling the mortgage note.