Foreclosure Laws in Arizona: An Overview

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

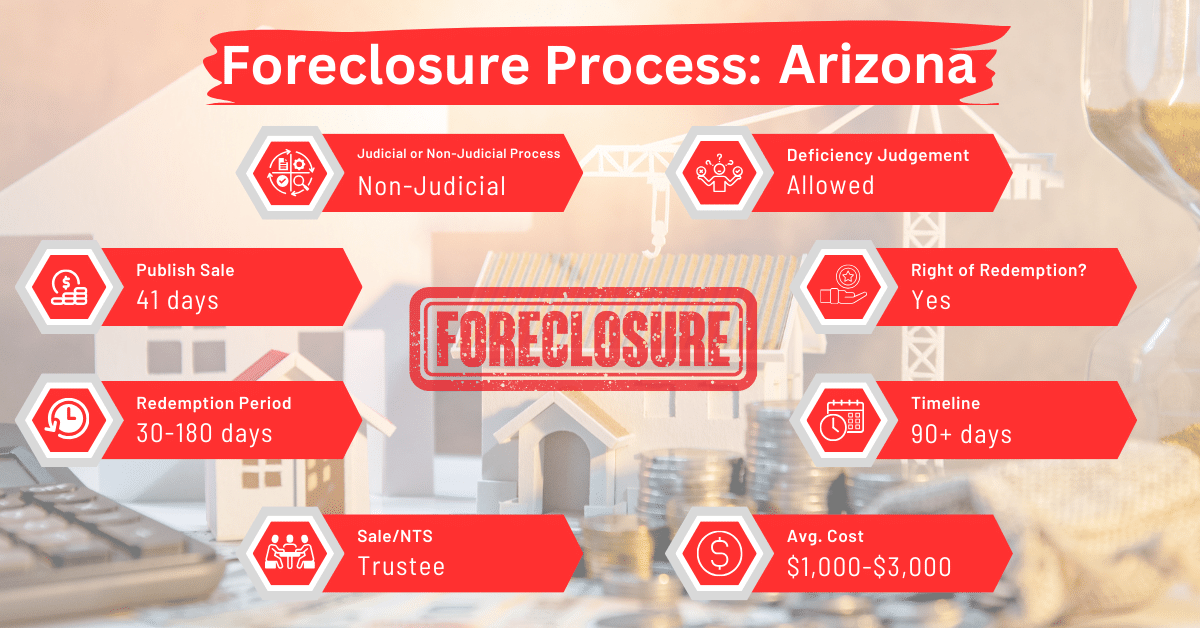

In Arizona, the real estate market primarily uses non-judicial foreclosures because they are quick and efficient. This is akin to the situation in Alabama, Hawaii, Alaska, California, Georgia, Idaho, Massachusetts, Michigan, Mississippi, Missouri, Montana, Rhode Island, Tennessee, Utah, Virginia, and Wyoming. A non-judicial foreclosure in Arizona typically wraps up within 90 days from when the foreclosure notice is issued to the sale of the property. Although less frequent, judicial foreclosures are also an option for those who need a court-supervised pathway to foreclosure.

Pre-foreclosure Period in Arizona

The pre-foreclosure period marks the phase between the first missed mortgage payment and the initiation of the foreclosure process. During this period, borrowers are likely to receive a breach letter from their lender, notifying them of the default and potential acceleration of the loan if they don’t cure the default.

Top 3 Opportunities to Avoid Foreclosure in Arizona

- Loan Modification: Borrowers may negotiate with their lenders for a loan modification that makes the terms of the loan more manageable.

- Forbearance Agreement: In some cases, the borrower and the lender may reach a temporary forbearance agreement to allow the borrower to catch up on missed payments or seek alternative solutions without the immediate threat of foreclosure.

- Short Sale or Deed in Lieu: Homeowners may also explore the possibility of a short sale or a deed in lieu of foreclosure.

Types of Foreclosures in Arizona

Foreclosure in Arizona may be judicial or non-judicial. That said, the latter is more prevalent due to its streamlined nature.

Judicial Foreclosure

To carry out judicial foreclosure in Arizona, the lender must file a lawsuit against the borrower. If the court rules in favor of the lender, the property is ordered to be sold at auction. Due to its lengthy timeline, judicial foreclosure provides borrowers with ample time to contest the foreclosure or find solutions to stop the process.

Non-Judicial Foreclosure

This method does not require court intervention. A trustee holds the property title, and upon default, the lender can instruct the trustee to initiate the property’s sale. Since the court isn’t involved, non-judicial foreclosures are generally faster and less costly than judicial foreclosures.

Despite the non-involvement of the court, the lender lacks the leeway to do as they please in a non-judicial foreclosure. They are still subject to specific notice requirements and waiting periods as defined by state law.

Notice and Sale Process in Arizona

The process begins with the lender or their agent filing a notice of default at the county recorder’s office. This notice serves as a formal declaration of the borrower’s failure to meet the mortgage obligations.

After filing, the borrower and any other affected parties must be notified of the default and the impending foreclosure. This notification typically includes details about the default, the amount owed, and the deadline for curing the default to avoid foreclosure.

Following the notice of default, a notice of trustee’s sale is then issued, specifying the time and place of the foreclosure sale. This notice must be published in a local newspaper for a certain period, usually once a week for four consecutive weeks, to ensure public awareness.

In addition to publication, the notice is physically posted on the property and in a public place within the county where the property is located.

Once the relevant parties have taken the steps above, they may proceed with the foreclosure sale. The sale is conducted as a public auction, where bidders compete for the property, with the property typically being sold to the highest bidder.

When necessary, the trustee can postpone the sale. In this situation, he’s required to announce the new sale date and time publicly.

If the sale price does not cover the outstanding mortgage balance, Arizona law allows lenders to seek a deficiency judgment against the borrower under certain conditions, including the following:

- The property’s size is larger than 2.5 acres

- The property isn’t a single one-family or two-family dwelling.

Borrower Rights and Protections in Arizona

Right to Notice

Homeowners are entitled to receive notice of the lender’s intent to foreclose on the property. This includes a notice of default and a notice of sale, giving borrowers ample time to respond or cure the default. The notice period also provides an opportunity for homeowners to explore loss mitigation options such as loan modifications or short sales.

Arizona’s Right to Reinstatement

Before the foreclosure sale, Arizona law allows borrowers the right to reinstate their loan. This involves paying all past due amounts plus any applicable fees and costs to bring the mortgage current, effectively stopping the foreclosure process.

Protections Under Federal and State Laws

State laws such as Title 33 of the Arizona Revised Statutes and federal laws including the Real Estate Settlement Procedures Act offer additional protections to borrowers facing foreclosure.

These include the right to receive counseling, apply for loan modification programs, and in some cases, the right to a mediation or settlement conference with the lender. These programs aim to provide alternatives to foreclosure and help borrowers maintain their homes.

Deficiency Judgments

Arizona’s approach to deficiency judgments depends on the type of foreclosure and the property involved. In non-judicial foreclosures, deficiency judgments are generally not pursued for residential properties of a certain size and use. However, in judicial foreclosures, lenders may seek a deficiency judgment, pursuing the borrower for the difference between the sale price of the property and the remaining loan balance under conditions described above.

Redemption Period

Arizona’s approach to redemption periods—where a borrower can reclaim their property after a foreclosure sale by paying the full sale price plus certain additional costs—varies based on the type of foreclosure process utilized. Typically, borrowers involved in non-judicial foreclosures in Arizona don’t enjoy redemption periods.

Conclusion

By favoring non-judicial foreclosures, Arizona’s foreclosure laws ensure quick resolution to property defaults. They also balance fast-tracked resolution with borrower protections like notification requirements and restrictions on deficiency judgment

Understanding these laws is crucial for homeowners and investors, as they outline opportunities to avoid foreclosure through means such as loan modifications and forbearance agreements. If facing foreclosure in Arizona, it’s important to act quickly, consult professionals, and explore all available resources to mitigate its impact.