Virginia Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

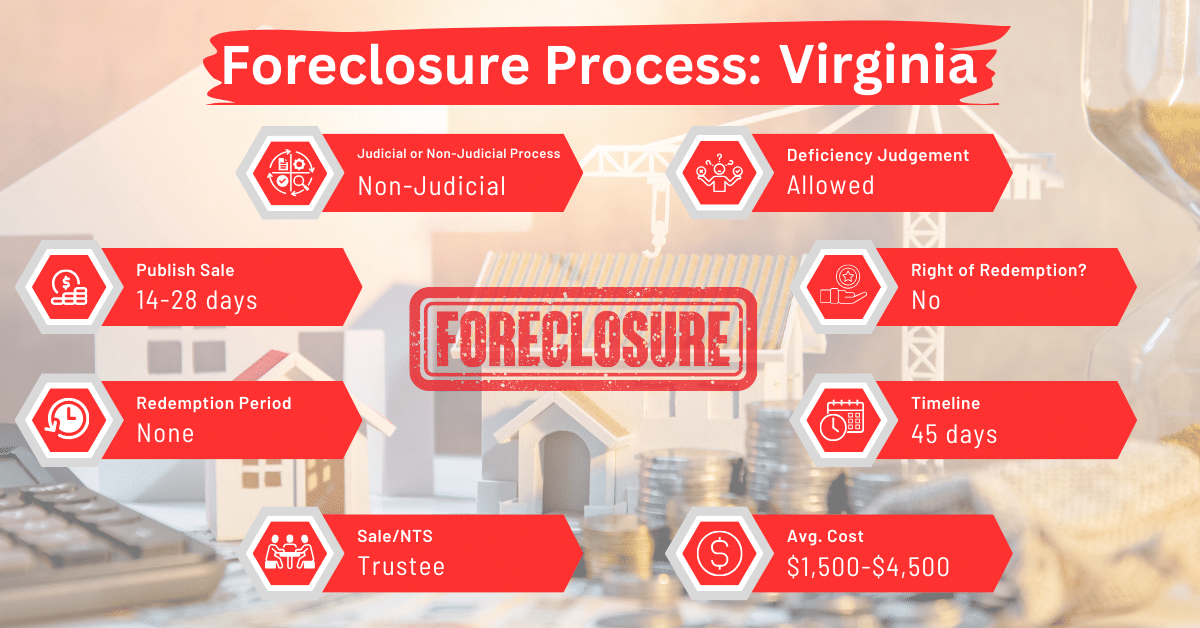

Virginia allows both judicial and non-judicial foreclosures, but non-judicial foreclosures are more common. The typical non-judicial foreclosure process in Virginia spans 45 days. This places Virginia among the states with the quickest foreclosure processes, similar to Texas, which takes about 27 days, Maryland at 46 days, and Georgia at 37 days.

Pre-Foreclosure Period in Virginia

The pre-foreclosure period in Virginia starts when the lender files a notice of default. After the lender files the notice, the borrower has 30 days to clear the default and prevent foreclosure. .

Types of Foreclosures in Virginia

In Virginia, most foreclosures happen without going to court, using a trustee sale. Court-involved foreclosures are also possible but less common. Whether a foreclosure is done in or out of court depends on the mortgage or deed of trust terms. This gives lenders the choice to pick a method that fits the loan agreement and the specific foreclosure situation, providing various ways to repossess a property.

Notice and Sale Process in Virginia

For a foreclosure sale in Virginia, the lender must advertise the sale and notify the involved parties. The notice must include details like the property description, sale terms, and the time and location of the sale. Borrowers must receive at least 60 days’ notice before the sale.

The trustee in charge of the sale must publish the notice in a local newspaper at least one per week for two weeks. Alternatively, he may publish the notice for three days in a row. Where the loan agreement doesn’t require the trustee to publish the notice of sale, then he must publish the notice one a week for four weeks or for five days in a row.

Within 30 days after the last time the notice is published, the sale must be conducted at the local courthouse. Usually, the property goes to the highest bidder.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Virginia can avoid foreclosure by selling their mortgage notes to a reliable buyer. This can quickly ease financial stress and skip the long foreclosure process. It’s a good way to avoid problems like credit damage and losing your home. This option helps homeowners pay off their mortgage and maintain financial stability without going through the difficulties of foreclosure.

Borrower Rights and Protections in Virginia

In Virginia, borrowers have certain rights and protections during the foreclosure process. For instance, they have the right to be notified of the foreclosure and have a set period to respond or rectify the default. They’re also entitled to file for bankruptcy or seek the modification of their loan.

Redemption and Deficiency Judgments in Virginia

Virginia does not offer a redemption period post-sale for non-judicial foreclosures. However, the lender may cancel the sale if the borrower manages to reinstate the loan before the sale. Regarding deficiency judgments, lenders can seek to recover the difference if the property’s sale price is less than the mortgage balance.

Special Protections and Programs in Virginia

In Virginia, there aren’t special state programs for those facing foreclosure, but standard legal rights and procedures exist. Homeowners have the right to be notified about foreclosure, can challenge it in court, and can pay off their debt to stop it. Virginia’s laws also ensure the foreclosure process is fair and clear, offering basic protection to homeowners at risk of losing their homes.

Comparative Insights

To better understand Virginia’s foreclosure rules, it’s helpful to look at how they differ from those in other states. This comparison gives us a clearer view of Virginia’s specific situation.

Publish Sale Notice

In Virginia, the law says that foreclosure sale notices must be published 14 to 28 days before the sale. This is a shorter period than in many other states, e.g. Nevada, Montana, Michigan, Maryland, Maine, Iowa, Indiana, Idaho, Hawaii, Delaware, Colorado, Alaska, and Arizona.

While this is good for lenders who want a fast resolution, it gives borrowers less time to react or stop the foreclosure. This shows how Virginia’s foreclosure laws try to balance the needs of both lenders and borrowers.

Costs

Foreclosure costs in Virginia, usually between $1,500 and $4,500, are average compared to other states. These costs include legal fees, publishing the foreclosure notices, and other administrative fees.

They cover all the legal and procedural steps needed for a foreclosure to follow state laws. This moderate cost shows Virginia’s fair approach to handling foreclosure expenses for both lenders and borrowers.

Impact on Credit Score

Like in other states, foreclosure in Virginia can significantly affect a borrower’s credit score, often leading to a decrease of around 100 points or more. This highlights the importance of exploring alternatives like selling a mortgage note to avoid foreclosure.

Conclusion

Understanding Virginia’s foreclosure laws and processes is necessary for homeowners and investors in the state. For those facing foreclosure, selling the mortgage note can help in avoiding the process and its impacts on credit and financial stability.