Wyoming Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

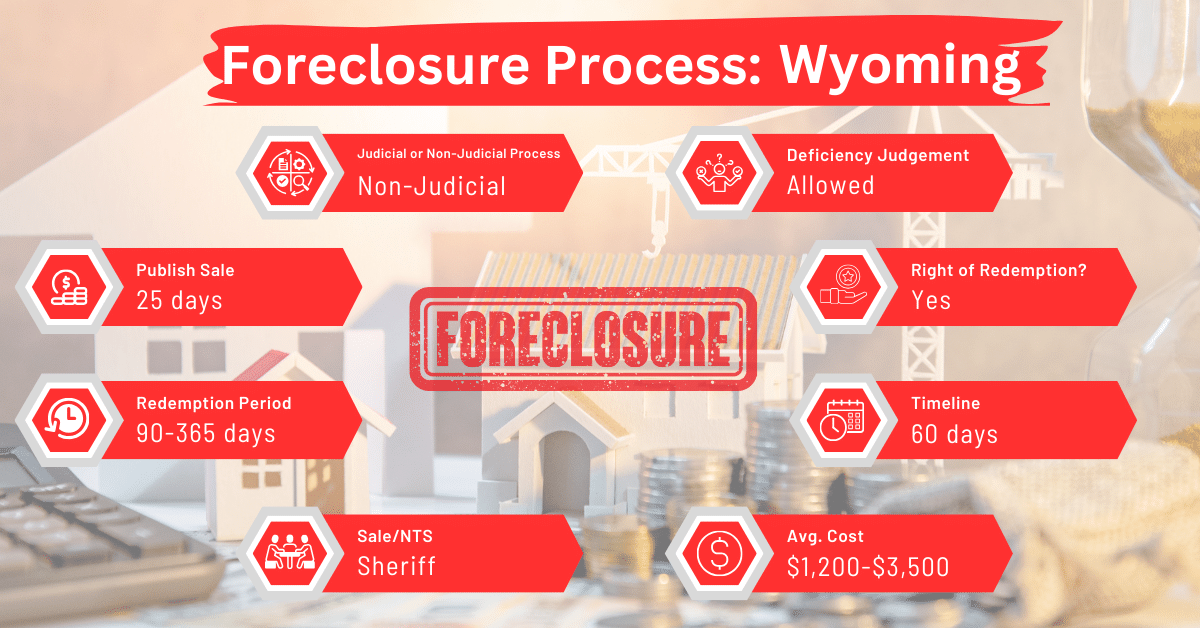

Although foreclosures can be judicial or non-judicial in Wyoming, most persons there prefer out-of-court foreclosures. The process typically takes about 60 days, excluding a redemption period of 90-365 days after the foreclosure sale. This timeline falls somewhere in the middle when you compare it to the timelines in other states like Georgia, Michigan, Mississippi, Missouri, and Tennessee, where non-judicial foreclosures are also more common.

Wyoming Pre-foreclosure Period

The pre-foreclosure period in Wyoming starts with the lender providing a notice of intent to foreclose at least 10 days prior to the first publication of the notice of sale. If the mortgage lacks a power-of-sale clause, the foreclosure must go through the court system. Otherwise, the lender can sell the property without court action in case of default.

Types of Foreclosures

Wyoming primarily uses non-judicial foreclosures, which are faster and less costly than judicial foreclosures. This method is preferred when a power-of-sale clause is included in the mortgage, allowing the lender to sell the property without court intervention.

Notice and Sale Process in Wyoming

The notice of sale must be published in a local newspaper at least once a week for four consecutive weeks. If there’s no local newspaper in the county where the property is located, then the notice must be printed in any publication that’s circulated in that county.

Before the notice is published for the first time, a certified copy of the notice must be served to the borrower or any person who’s legally allowed to receive such notice. This service must be done at least 25 days before the sale date.

The notice of sale must contain some information including: the amount due under the mortgage, the names of the parties to the mortgage, the place where the property will be auctioned and the time of auction. It must also include this statement: “The property being foreclosed upon may be subject to other liens and encumbrances that will not be extinguished at the sale and any prospective purchaser should research the status of title before submitting a bid.”

On the scheduled sale date, the sale must be conducted between 10 am and 5 pm by public auction at the county courthouse. The property must be sold to the highest bidder. After the sale, the borrower has a redemption period of 90 days to one year. During this period, he may reclaim the property by paying the purchase price plus interest and any taxes due.

Avoiding Foreclosure by Selling Your Mortgage Note

If you’re a homeowner in Wyoming and facing foreclosure, selling your mortgage note to a trusted buyer might be a smart move. This can help you avoid the negative impacts of foreclosure, like damaging your credit score and losing your home. Selling your mortgage note can also provide quick financial relief, safeguard your credit, and prevent you from losing your property.

Redemption and Deficiency Judgments

In Wyoming, after their property is sold in foreclosure, borrowers can get it back by paying a certain amount within 90 to 365 days. The length of time depends on things like the type of property and the specifics of the foreclosure.

But, if the property sells for less than what they owe on their mortgage, the lender can ask for a deficiency judgment. This means the lender can legally demand the borrower to pay the difference between the sale price and the mortgage debt.

Special Protections and Programs in Wyoming

In Wyoming, there aren’t any special state programs just for helping homeowners with foreclosure. People facing this situation have to rely on the usual legal rules and their rights as borrowers. This means they have to handle foreclosure using the existing laws, without extra help from the state.

Comparative Insights

This section provides a detailed comparison of Wyoming’s foreclosure processes with those in other states, focusing on the duration for publishing sale notices, associated costs, and the impact on credit scores.

Publish Sale Notice in Wyoming

Wyoming’s process for publishing a sale notice typically takes about 25 days, which is notably quicker than in other states that use non-judicial foreclosures. For example, Georgia’s laws spare the lender up to 32 days to publish the notice of sale. Meanwhile, under Michigan’s laws, the stipulated timeframe is 30 days.

Costs in a Range and Comparison to Other States

The costs associated with foreclosure in Wyoming generally range from $1,200 to $3,500. These costs are slightly lower compared to the costs in other states with non- judicial foreclosure processes. For instance, the average costs of foreclosure in Georgia, Michigan, and Tennessee range between $1500 and $4000.

Impact on Credit Score

The impact of foreclosure on credit scores in Wyoming is consistent with the national trend. Homeowners can expect a decrease of 100 points or more in their credit scores, similar to what is observed in other states.

Conclusion

When you’re up against the possibility of foreclosure in Wyoming, one option to consider is selling your mortgage note. This can help you dodge the negative effects of foreclosure. The key is to approach this situation well-informed and well-prepared.