Washington Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

Losing a home to foreclosure is very stressful. In Washington, where the housing market is different, it’s really important to know the foreclosure laws and steps. This article will explain the foreclosure process in Washington clearly and helpfully, especially for homeowners who are dealing with this tough issue.

Pre-Foreclosure Period in Washington

The Washington Revised Code provides that the lender must send a copy of the notice of sale to the borrower, grantor, or other classes of persons described in the Code. Such transmission of the notice must be done by first class and certified or registered mail.

In addition to the notice of sale, the lender must send a notice of foreclosure notifying the borrower or interested parties of his intention to sell the property at a particular time, date, and place, to the highest bidder. This foreclosure notice must inform the borrower of his right to reinstate the mortgage by curing the defaults owed under the mortgage, as well as other expenses that the lender may have incurred in starting the foreclosure process, like attorney’s fees.

Upon receipt of both notices, the borrower must cure the default within 30 days. If the borrower fails to address the default, the property can be scheduled for public sale. Borrowers can reinstate the mortgage within 11 days before the sale by paying the past-due amounts and applicable expenses.

Types of Foreclosures in Washington

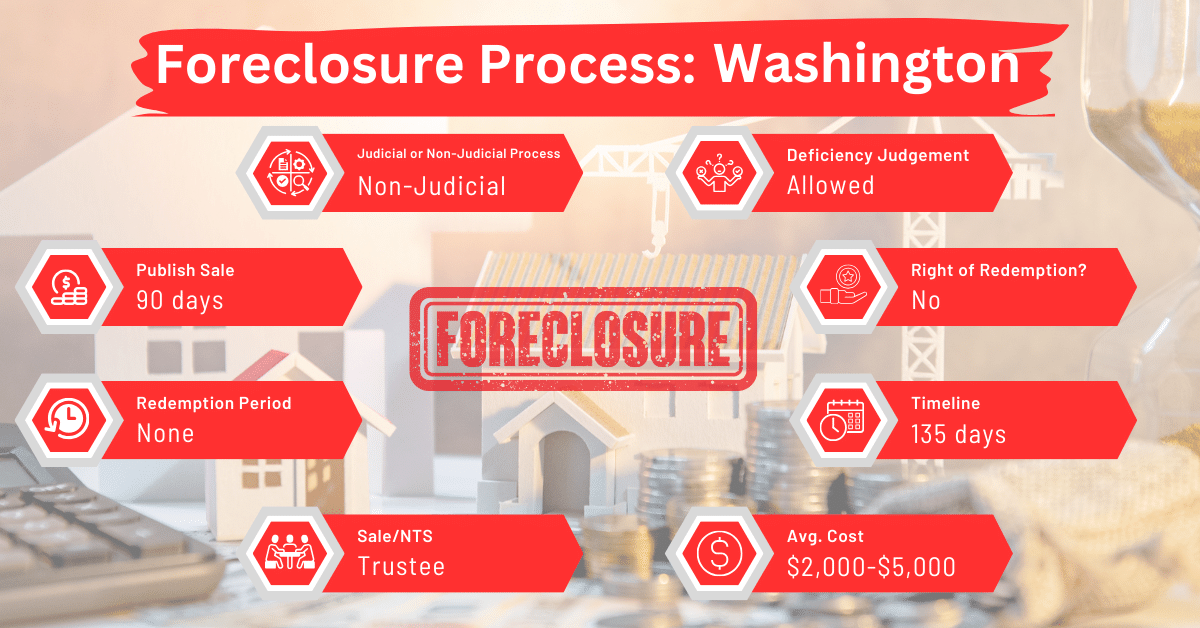

Washington State allows for both judicial and non-judicial foreclosures. The choice between these methods depends on the terms of the mortgage or deed of trust. Judicial foreclosures involve court proceedings and are generally used when a power of sale clause is absent in the loan agreement. Non-judicial foreclosures are quicker and involve a trustee who can sell the property without court intervention.

Notice and Sale Process in Washington

For a property to be foreclosed upon in Washington, the lender must record a notice of sale with the county recorder at least 90 days before the sale date. This notice is also published in a local newspaper twice, between 32 and 28 days prior to the sale, and again between 11 and 7 days before the sale.

Foreclosure sales are conducted by public auction at any selected public place in the county where the property is. The Washington Revised Code dictates that the sale must be on a Friday. If the chosen Friday is a public holiday, then the sale must be moved to the Monday that immediately follows that Friday.

The lender needs to sell the property to the highest bidder. If the lender thinks it would be more advantageous to sell the property in portions rather than as a whole, they can choose to do so. However, each portion must still be sold to the highest bidder for it.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Washington facing foreclosure can consider selling their mortgage note to a reliable buyer. This choice can help them avoid foreclosure and its downsides, such as a drop in credit score and losing their home. Selling the mortgage note offers quick financial help, allows them to pay off their mortgage, and keeps their financial situation stable without going through the tough foreclosure process.

Borrower Rights and Protections in Washington

Washington State offers several protections for borrowers in the foreclosure process. These include the right to receive notice of default and sale, the opportunity to stop the foreclosure by paying the overdue amounts. In a judicial foreclosure, the borrower has a redemption period where they can reclaim the property after the sale.

Redemption and Deficiency Judgments in Washington

In Washington, borrowers do not have a right to redeem the property after a non-judicial foreclosure sale. However, for judicial foreclosures, there is a one-year redemption period. Additionally, lenders may pursue deficiency judgments if the sale price does not cover the mortgage balance.

Special Protections and Programs in Washington

Washington State offers a mediation program under the Foreclosure Fairness Act, which helps homeowners and lenders talk about solutions to avoid foreclosure. With a neutral mediator’s help, they can discuss options like changing loan terms or setting up payment plans.

Comparative Insights

To understand Washington’s foreclosure rules, it helps to look at how they differ from other states. This comparison shows what makes Washington’s approach unique in the US.

Publish Sale Notice

Washington’s requirement for a 90-day notice period before the foreclosure sale is notably longer than many states. This extended timeframe offers borrowers additional time to prepare and respond. The longer timeline contrasts with states that have shorter notice periods, like Alabama, Alaska, Arizona, Arkansas, California, Colorado, Georgia, Florida, Hawaii, Iowa, New Jersey, Montana, North Carolina, Oklahoma, Oregon, Rhode Island, Tennessee, Virginia, West Virginia, and Wyoming.

Costs

The costs associated with foreclosure in Washington, typically ranging from $2,000 to $5,000, align with national averages. In comparison, some states, such as Pennsylvania and Vermont, have higher foreclosure costs due to more complex legal requirements or additional fees.

Impact on Credit Score

Similar to other states, foreclosure in Washington can lead to a significant decrease in credit scores, often dropping by 100 points or more. This impact is a common consequence across the United States, emphasizing the importance of considering alternatives like selling a mortgage note to mitigate the negative effects on credit.

Conclusion

It’s important to know Washington’s specific foreclosure rules if you’re facing this situation. A good option for homeowners is to sell their mortgage notes to a trusted buyer. This can help them avoid foreclosure and its negative effects, like harming their credit score and losing their home. Selling the mortgage note offers a simpler way to handle the issue and can lead to financial stability, avoiding the usual stress of foreclosure in Washington.