Oregon Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

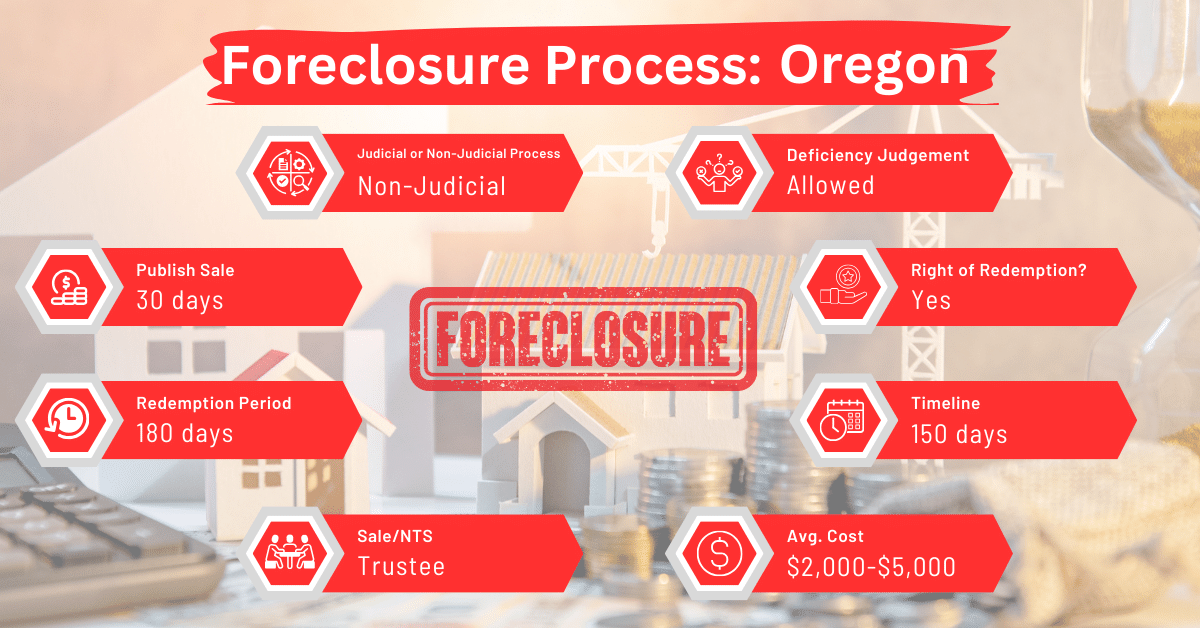

Specific foreclosure laws and steps govern foreclosure in Oregon. This article focuses on the most important parts of the foreclosure process in Oregon, especially the rights of homeowners and the timeline of events.

Foreclosure Process Overview

In Oregon, foreclosures can be conducted either through the court system (judicial) or outside of it (non-judicial), depending on the terms of the mortgage or deed of trust. The non-judicial process, known as a trustee sale, is predominantly used and takes approximately 150 days. This duration is relatively short compared to other states, where the process can be longer in judicial states or shorter in states with more streamlined non-judicial procedures.

Pre-foreclosure Period

The pre-foreclosure period in Oregon starts when the lender records a notice of default. If the mortgage includes a power-of-sale clause, the lender can proceed with a non-judicial foreclosure, which involves selling the property out of court. The lender must record a notice of default with the county recorder and deliver it to the borrower at least four months before the sale date.

If, before a judgment is issued, the owed amount along with the costs of the suit are paid to the court clerk, the suit will be dismissed. If this payment is made after the judgment but before the sale, the judgment concerning the paid amount will be terminated, and any execution that has been issued must be recalled by the clerk.

Types of Foreclosures

Oregon law allows both judicial and non-judicial foreclosures.

Judicial Foreclosure

When filing a lawsuit to foreclose a residential trust deed under this section, the complaint must include an attachment with a true copy of one of the following:

- A valid and unexpired certificate of compliance issued to a beneficiary by a service provider.

- An affidavit submitted by a person claiming an exemption, provided that the exemption is still valid;

- A notice received by the beneficiary.

A court can, on its own or in response to a motion from a borrower, dismiss the foreclosure suit without prejudice or stay the proceedings if the plaintiff fails to file the required certificate or the affidavits mentioned above.

The court can lift a stay it previously granted if the plaintiff later files the required certificate or affidavit. Furthermore, if a defendant successfully motions under this rule, the court may award them reasonable costs and attorney fees for the motion and any other relief the court considers appropriate.

When the court grants a judgment of foreclosure and sale, it can order that the property should be sold. If the judgment benefits only the plaintiff, the execution of the judgment can proceed as usual. However, if the judgment benefits multiple people who do not share a common interest, the execution must be issued either at their joint request or by a court or judge’s order upon one of their motions.

Non-judicial Foreclosure

Non-judicial foreclosures are more common in Oregon. They involve trustee sales, where lenders can sell the properties without court intervention.

Notice and Sale Process

The notice of sale must:

Provide the names of the grantor, trustee, and beneficiary listed in the trust deed, along with the trustee’s mailing address.

- Describe the property covered by the trust deed.

- Identify the book and page number where the trust deed is recorded in the mortgage records.

- Specify the default that has led to the foreclosure.

- State the total amount owed under the obligation secured by the trust deed.

- Indicate that the property will be sold to satisfy the obligation.

- Specify the date, time, and place where the sale will occur.

- Inform the borrower that they have a right to have the foreclosure proceedings dismissed and the trust deed reinstated.

When a trustee starts the foreclosure of a trust deed by advertising and planning a sale, the borrower has until five days before the scheduled sale date to fix the default.

If the default is due to a failure to pay sums secured by the trust deed when they are due, it can be resolved by paying the full amount that would be due at the time of correction, excluding any amounts that would not yet be due if there had been no default. Any other fixable default can be corrected by providing the performance specified in the obligation or trust deed.

In addition to paying the necessary sums or providing the required performance to correct the default, the person correcting the default must also cover all costs and expenses that the beneficiary actually incurred because of enforcing the obligation and trust deed, plus fees for the trustee and attorney. The fees are as follows:

- For a residential trust deed: A total of $1,000 for both trustee and attorney fees, or the actual amount charged by the trustee and attorney, whichever is less.

- For non-residential trust deeds: Reasonable attorney and trustee fees as actually charged by the trustee and attorney.

Anyone eligible to correct the default may ask a competent court to verify the reasonableness of the fees demanded or paid before or after reinstatement. The court can award attorney fees to the winning party. However, a lawsuit to determine these fees should not delay or invalidate any sale.

After the default is corrected as described, the trustee must dismiss all foreclosure proceedings, and the obligation and trust deed will be reinstated as if no acceleration had occurred.

Service and Advertisement of the Notice

For non-judicial foreclosures in Oregon, the notice of sale must be served on an occupant of the property described in the trust deed at least 120 days before the trustee conducts the sale.

If the person serving the notice cannot reach an occupant on the first try, they must post a copy of the notice in a visible spot on the property on the day of the first attempt. They must then try again to serve the notice at least two days after the first attempt.

If the second attempt also fails, the server must again post the notice in a conspicuous place on the property on the day of the second attempt. A third attempt to serve the notice must be made at least two days after the second attempt.

If the third attempt fails, the server should mail a copy of the notice addressed to “occupant” to the property address using first-class mail with prepaid postage.

Besides these, the notice of sale must be published in a newspaper of general circulation in each county where the property is located once a week for four consecutive weeks. The final publication must occur more than 20 days before the sale date.

Before the trustee conducts the sale, the following affidavits concerning the notice of sale must be filed for recording in the official records of the county or counties where the property is located:

- An affidavit of mailing, if applicable;

- An affidavit of service, if applicable;

- An affidavit of service attempts and posting, if applicable;

- An affidavit of publication.

Sale

The trustee’s sale must take place between 9 am and 4 pm, within the county or one of the counties where the property is located. Unless stated otherwise, the trustee may auction the property in one lot or in multiple parcels to the highest cash bidder.

Anyone, including the beneficiary of the trust deed but excluding the trustee, can bid at the sale. An attorney for the trustee or an agent designated by the trustee or the attorney may conduct the sale and act as the auctioneer for the trustee.

Avoiding Foreclosure by Selling Your Mortgage Note

Homeowners in Oregon at risk of foreclosure could sell their mortgage notes to a trusted buyer instead. This step can help them bypass the foreclosure process, thereby avoiding its detrimental effects on their credit score and the potential loss of their home.

Borrower Rights and Protections

In Oregon, borrowers are entitled to receive notification about impending foreclosure. These notices give them a chance to halt the process by settling overdue payments.

Redemption and Deficiency Judgments

After a non-judicial foreclosure sale in Oregon, the borrower cannot redeem the property. But the lender can seek a deficiency judgment, where the court orders the borrower to pay the difference between the sale price and the mortgage balance.

Special Protections and Programs

Oregon has some legal provisions ensuring that non-judicial foreclosures, such as those involving MERS (Mortgage Electronic Registration Systems), are documented correctly.

Comparative Insights

Comparing and contrasting Oregon’s foreclosure procedures with those of other states reveals some similarities and differences in certain areas. These include the duration of publication of the sale notice, foreclosure costs, and the impact of foreclosure on the borrower’s credit score.

Publish Sale Notice

Oregon requires that the sale notice should be advertised in a local newspaper for four weeks. In other states that permit non-judicial foreclosures, such as California, Colorado, Delaware, Georgia, Hawaii, Indiana, Iowa, Maine, Maryland, Nevada, and Washington, the timeline for advertisement is longer.

Costs in a Range and Comparison to Other States

Foreclosure costs in Oregon typically range from $2,000 to $5,000. These costs are high for a non-judicial foreclosure state. In Alabama, Alaska, Arizona, Georgia, Idaho, Michigan, Mississippi, Missouri, New Hampshire, North Carolina, Rhode Island, Texas, Utah, and Virginia, foreclosure costs start between $1,000 and $1,500.

Impact on Credit Score

Like in other states, foreclosure in Oregon can significantly affect a borrower’s credit score, often leading to a decrease of 100 points or more.

Conclusion

Navigating foreclosure in Oregon requires an understanding of the state’s judicial and non-judicial system. This knowledge will help you choose whether to go ahead with judicial foreclosure, non-judicial foreclosure, or avoid foreclosure altogether by selling your mortgage note.