New Hampshire Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

In New Hampshire, as in other states, foreclosure laws and processes are specific and detailed, providing a framework for both lenders and borrowers. This article outlines the key aspects of New Hampshire’s foreclosure laws and process.

Foreclosure Process Overview

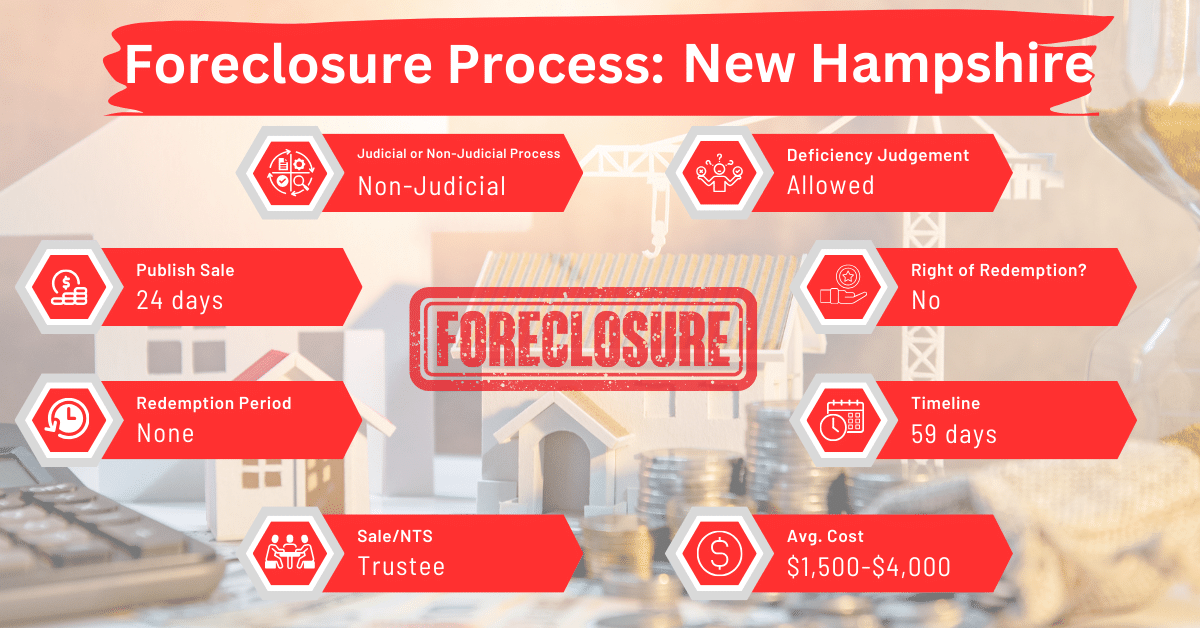

New Hampshire’s laws allow both judicial and non-judicial foreclosure. The process takes about 60 days. This swift timeline results from the state’s primary use of non-judicial procedures.

Non-judicial foreclosures are faster than judicial foreclosures, as they bypass the often lengthy and complex court proceedings. This approach also minimizes the period of uncertainty and financial strain for those involved.

Pre-foreclosure Period

In New Hampshire, the pre-foreclosure period begins when the lender records a notice of default with the county recorder and mails the notice to the borrower. Borrowers have 25 days from the notice of sale to address the default and stop the foreclosure. If the default is not resolved, the lender can proceed with scheduling the foreclosure sale.

Types of Foreclosures

New Hampshire’s foreclosure process is usually non-judicial, facilitated through a deed of trust that includes a power-of-sale clause. This clause enables the lender to sell the property without court intervention in the event of borrower default.

However, the lender may also foreclose on the property through judicial means. To do so, they must seek a conditional judgment in his favor. When a mortgage includes a power of sale and a conditional judgment is issued, the lender has the option to request a decree for the sale of the property under this power, instead of seeking a writ of possession.

Following the entry of such a decree, the lender is required to provide the necessary notices and perform all actions as directed by the terms of the power of sale or as ordered by the court in its decree.

The party responsible for conducting the sale must submit a detailed report of the sale and their actions to the court under oath within 10 days following the sale. This report must be filed in the office of the court clerk. The court will then review the report and either confirm and approve it or reject it and order a new sale if deemed necessary and just.

Notice and Sale Process

Notice

For non-judicial foreclosures, a notice of sale must be mailed to the borrower at least 25 days before the sale. It must be published once a week for three weeks, with the first publication appearing not less than 20 days before the sale.

A copy of the sale notice must be served on the mortgagor, or sent via registered or certified mail to the mortgagor’s last known address, or to a person designated in the mortgage. This must be done:

- At least 25 days before the sale, generally.

- At least 45 days before the sale for residential mortgages.

Before the sale date, notice of the sale must be properly recorded in the registry of deeds. The notice is considered sufficient if it includes the following details:

- The date, time, and place of the sale.

- The location of the mortgaged property, including town, county, street or highway, and street number (if applicable).

- The date of the mortgage.

- The book and page number where the mortgage is recorded.

- The terms of the sale.

If a mortgagor or a lienholder on record either refuses to accept, claims, or actively obstructs the delivery of the notice—such as by not providing a forwarding address or through other actions—they will still be considered as having been notified of the sale. This condition holds provided that the mortgagee has made a good faith effort to deliver such notice.

Sale

The foreclosure sale must be held on-site of the property unless the mortgage specifies a different location. If the mortgage includes more than one parcel of land, the sale can occur on any parcel designated in the notice of sale. During the sale, the property is sold to the highest bidder.

A foreclosure sale will not be considered invalid or ineffective if:

- Any party entitled to receive notice, who did not receive such notice, waives their right to have received notice before or after the foreclosure sale, or

- The lien or interest of such party in the mortgaged property is released or discharged at any time.

Any waiver of notice must be officially recorded in the registry of deeds for the county where the property is located.

Avoiding Foreclosure by Selling Your Mortgage Note

For homeowners in New Hampshire facing foreclosure, selling their mortgage notes to a reputable buyer can be an effective alternative. This option can circumvent the foreclosure process and mitigate its impacts, such as credit score damage and loss of property.

Borrower Rights and Protections

New Hampshire law ensures that borrowers are adequately informed about the foreclosure process through specific notices. Within a year and a day from the date the foreclosure deed is recorded, the borrower may file a claim disputing the format or delivery of the notice, or the process of the foreclosure sale.

Also, all properties mortgaged can be redeemed by the mortgagor after they have failed to meet the terms of the mortgage but before foreclosure. This redemption can occur through:

- Paying or tendering all amounts owed and fulfilling all obligations specified in the mortgage.

- Covering or tendering all damages and costs that arose due to the failure to meet the mortgage conditions.

Redemption and Deficiency Judgments

In New Hampshire, there is no redemption period after a non-judicial foreclosure sale. Deficiency judgments, where borrowers owe the remaining mortgage balance after the sale, are allowed in non-judicial foreclosures.

Special Protections and Programs

New Hampshire offers various programs and initiatives to assist homeowners facing foreclosure. These include loan modification options and government assistance programs, providing financial relief and alternative solutions.

Comparative Insights

This section looks at how New Hampshire’s foreclosure laws differ from other in timelines, financial implications, and effects on credit scores.

Publish Sale Notice

New Hampshire’s foreclosure process requires a 24-day notice period before the sale, which is shorter compared to many other states like Alaska, Arizona, California, Colorado, Delaware, Georgia, Hawaii, Idaho, Indiana, Iowa, Maine, Maryland, Nevada, North Carolina, and Washington.

This shorter notice period reflects New Hampshire’s efficient approach to foreclosure. However, it provides less time for homeowners to respond than in states with longer notice requirements.

Costs in a Range and Comparison to Other States

The costs of foreclosure in New Hampshire range from $1,500 to $4,000. Compared to other states like Louisiana, Kansas, Pennsylvania, South Dakota, Wisconsin, New Jersey, and New York, these costs are moderate.

Impact on Credit Score

Similar to other states, foreclosure in New Hampshire can significantly impact a homeowner’s credit score, usually leading to a decrease of 100 points or more.

Conclusion

In practice, New Hampshire’s foreclosure laws and processes offer a non-judicial approach, providing a quicker resolution to foreclosure cases. For homeowners facing foreclosure, selling the mortgage note can be a strategic alternative to avoid the process and its consequences.