Connecticut Foreclosure Laws and Process

Disclaimer: This is for informational purposes only. This is not legal advice. Please, consult an attorney before taking any legal action on a foreclosure or eviction.

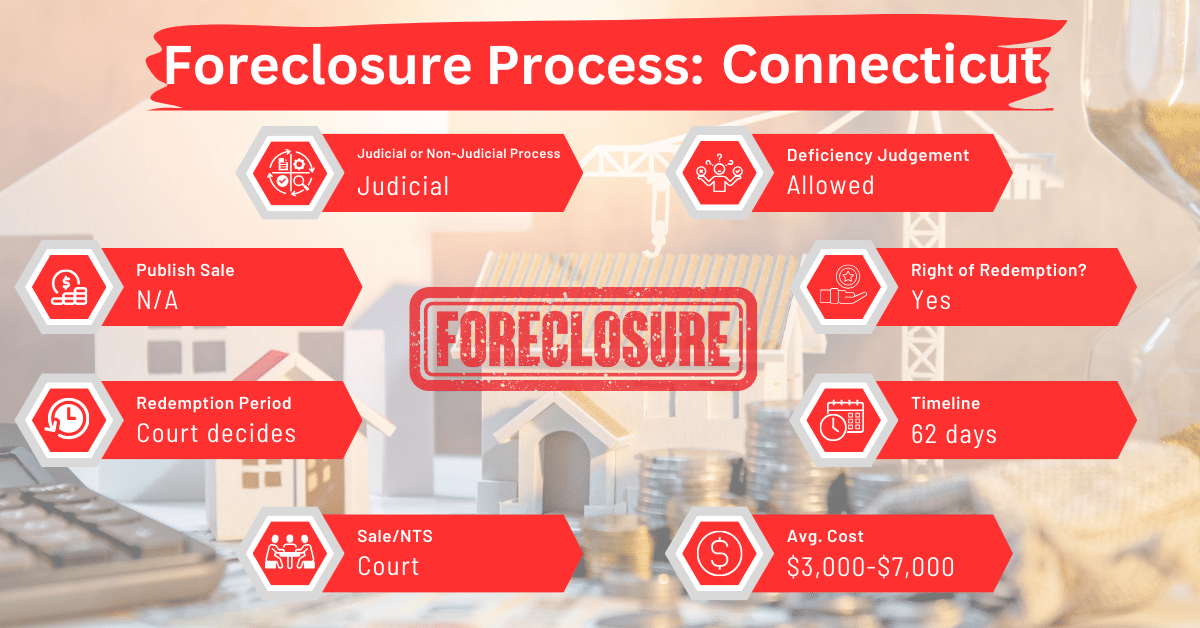

Connecticut exclusively employs judicial foreclosures, meaning the process must go through the court system. This approach ensures that a judge reviews each case, offering a level of oversight and protection for homeowners not available in non-judicial foreclosure states. The judicial process in Connecticut can grant either a “strict foreclosure” or a “foreclosure by sale,” depending on the property’s equity and the circumstances surrounding the foreclosure.

Connecticut Foreclosure Process Overview

In Connecticut, the foreclosure process begins with a civil suit filed in the Superior Court, leading to either a strict foreclosure or a foreclosure by sale. A strict foreclosure is granted when the court determines there is no equity in the property, allowing the lender to take ownership without a sale. Conversely, if there is sufficient equity, the court may order a foreclosure by sale, where the property is sold to the highest bidder under court supervision.

The process is initiated by a 60-day demand letter from the lender. After this period, the foreclosure action can commence. The entire proceeding typically spans 3-4 months. This timeline is relatively short compared to other states such as Florida, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Nebraska, New Jersey, New York, North Dakota, Ohio, Pennsylvania, South Carolina, and Vermont.

Pre-foreclosure Period and Notice Requirements

Connecticut’s foreclosure process is marked by a mandatory 60-day pre-foreclosure period, initiated by a demand letter from the lender. This period is designed to give homeowners a final opportunity to address the default before the foreclosure action is filed.

Borrower Rights and Protections in Connecticut

As you’re a homeowner in Connecticut, you have some solid rights and protections when it comes to foreclosure. For example, you can stop a foreclosure sale at any point right up until the sale itself by simply paying off what you owe on your mortgage. In addition, Connecticut gives you ways to challenge deficiency judgments.

Redemption and Deficiency Judgments

Connecticut’s approach to redemption and deficiency judgments is unique. In cases of strict foreclosure, the court assigns “law days” for parties with an interest in the property to redeem it. If no redemption occurs, the lender gains title free and clear. However, the state also permits lenders to pursue deficiency judgments, seeking to recover any remaining debt not covered by the foreclosure sale..

Special Protections and Programs

The state offers special protections and programs aimed at helping homeowners avoid foreclosure. One notable program is the mandatory mediation program, which encourages lenders and borrowers to find mutually agreeable solutions outside of the traditional foreclosure process.

Avoid Foreclosing by Selling Your Mortgage Note

Connecticut homeownsers facing foreclosure can consider selling their mortgage note to a reliable buyer. This choice can help them avoid foreclosure and its downsides, like harming their credit score and losing their home.

Comparative Insights

When compared to other states, Connecticut’s foreclosure process is relatively quick, largely due to its judicial nature and the pre-foreclosure requirements that expedite the timeline. The state’s median foreclosure costs range from $3,000 to $7,000, which is on the higher end nationally. This cost reflects the judicial process’s complexity and the involvement of court-appointed attorneys in foreclosure by sale cases.

Impact of Foreclosure on Credit Scores

The impact of foreclosure on credit scores is significant in Connecticut. A foreclosure can lead to a decrease of 100 points or more in an individual’s credit score, a negative mark that remains on the credit report for 7 years.

Conclusion

Connecticut’s foreclosure laws balance lenders’ rights with protections for homeowners. The judicial process, mandatory pre-foreclosure notices, and mediation programs help ensure fair treatment for homeowners and opportunities to avoid foreclosure.