Seller Financing 101 for home buyer, sellers and real estate investors

Seller financing can be highly advantageous to both buyers and sellers. If you want to get your house off the market, offering a seller-held mortgage can help you do so expeditiously. However, it’s essential to understand how seller financing works, its pros and cons, and how it will impact you before moving forward.

What Is Seller Financing?

Seller financing bypasses the traditional bank-owned mortgage, allowing the home seller to lend the buyer the money necessary to buy their property. The home seller takes on the bank’s role, deciding on the terms and conditions of the loan and using their discretion to approve potential buyers.

In a seller-held mortgage, the buyer makes monthly payments directly to the seller instead of a bank or credit union. The seller sets the home’s down payment amount and sales price, and they’ll decide whether a buyer is credit-worthy or not. Since the seller doesn’t need to answer to corporate executives or shareholders, as financial institutions do, buyers may find they can negotiate more favorable mortgage terms.

Seller financing is sometimes referred to as a purchase money mortgage or owner financing, and you’ll often find the terms used interchangeably.

Types of Seller Financing Agreements

There are several different forms of seller financing agreements. The agreement used varies depending on the type of property and the buyer and seller’s financing objectives. Here are a few of the most typical seller-financed arrangements.

Assumable Mortgage

In an assumable mortgage, the buyer takes over the seller’s current mortgage. The buyer makes payments according to the terms of the original mortgage. An assumable mortgage is advantageous when the seller’s mortgage has a more favorable interest rate than the buyer can obtain.

Seller Held Mortgage

A holding mortgage occurs when the seller acts as the lender to the buyer. No outside financial institution is a party to the agreement. The seller agrees to lend the buyer money to purchase the property, and the buyer makes monthly payments following the contract. Once the buyer fully repays the loan, the seller transfers the property title to the buyer.

Lease Purchase

A lease purchase is similar to a rent-to-own contract. The buyer is a renter who makes monthly payments to the homeowner. However, the rental agreement provides an exclusive option that allows them to purchase the property at a specific price in the future. If the renter exercises the option, they can buy the property at the agreed-upon amount.

Land Contract

In a land contract, the buyer borrows money from a landowner to purchase a plot. The seller acts as the lender rather than an outside financial institution. Most land contracts include a balloon payment at the end of the repayment period, which the buyer must pay or refinance to own the land.

How Seller Financing Works

If you’re considering offering an owner-finance contract to a potential homebuyer, it’s crucial to understand the process to avoid possible mistakes that could prove costly.

A seller-financed mortgage is between the owner and the buyer. Since no bank is involved, the seller assumes the risk of buyer default. Thus, the seller should ensure they are comfortable with the repercussions of default and can financially manage them should the worst happen.

Establishing a thorough contract that both the seller and buyer understand is critical. Ensure the contract includes the loan interest rate, a repayment schedule, property details, and specific consequences if the buyer stops making payments. The buyer should sign a promissory note and mortgage contract guaranteeing they’ll make timely payments. A promissory note and signed mortgage contract allow the seller to foreclose on the property if the buyer doesn’t abide by the agreement.

Sellers worried about the risks of overseeing a mortgage can consider selling the note to a buyer. If they plan to do so, they must include the option in the mortgage contract. Selling a mortgage contract allows the seller to receive a lump-sum payment for other purposes, like buying another piece of property. The mortgage note purchaser will assume total responsibility for the mortgage, and they’ll connect with the homebuyer to arrange payment collections.

It’s a good idea to have a qualified attorney review a seller-financed mortgage contract, both for sellers and buyers. An attorney can identify potential issues and suggest corrections to avoid future confusion.

Pros and Cons of Seller Financing

Seller financing has advantages and disadvantages to be aware of.

Advantages for Sellers

Homeowners seeking to quickly get their homes off the market may find seller financing beneficial. People unable to qualify for traditional mortgages, such as those with bad or no credit, will take an interest in your property. You may be able to sell the home as-is without making any repairs or improvements.

Since the seller sets the terms of the agreement, you can maximize your sales price and save on closing costs. For example, sellers can ask for a higher sales price in exchange for accepting a buyer with a less-than-stellar credit history. They can also ask buyers to assume some or all of the closing costs, so the seller doesn’t need to come up with money out of their pocket. Buyers with few other alternatives will be more likely to accept the terms you set, even if they’re unfavorable to them.

Finally, sellers don’t need to assume long-term risk from a seller held mortgage. Instead, they can sell the mortgage note to a company willing to purchase it. The loan buyer will reward them with a lump-sum payment they can use for a down payment on a new home or some other purpose. Plus, the loan buyer will assume the future risk of the mortgage and all further collection activity.

Advantages for Buyers

Buyers with poor credit may find seller-financed mortgages to be the only homeownership alternative available until they can improve their credit history. Since the seller sets the loan terms, they can set their qualification criteria, which may be less stringent than a bank’s.

Another advantage to buyers is flexibility. Buyers can ask the seller to exclude items that traditional mortgages usually require, such as private mortgage insurance (PMI) premiums. PMI costs are typical when the buyer doesn’t have enough money to make a 20% down payment on the home. They may significantly increase a buyer’s monthly mortgage payment.

Disadvantages of Seller Financing for Buyers and Sellers

Seller financing does have its drawbacks that both buyers and sellers should understand.

The primary drawback to sellers is the risk. The seller assumes all the risks and rewards of the mortgage note. If the buyer defaults on the loan, it can impact the seller’s financial circumstances.

Buyers also face potential disadvantages. If they’re looking for a seller-financed property because they can’t qualify for a traditional mortgage, the seller may charge a higher interest rate or sales price to cover the risk they’re assuming. Some sellers may require a more sizeable down payment, too.

Since seller-financed mortgages aren’t subject to as many regulations, buyers may lack some protections. Buyers should carefully evaluate a mortgage contract with their attorney before signing it to ensure they fully understand the terms.

What Buyers Should Know About Seller Financing

Seller financing, while an attractive option for many buyers, comes with nuances that are often overlooked. Here are five critical aspects that buyers might not know, coupled with precautions to take and strategies to maximize the benefits of a seller financing deal:

Flexibility in Terms Can Be a Double-Edged Sword

One of the most appealing aspects of seller financing is the potential for flexible terms, including down payment amounts, interest rates, and repayment schedules. However, this flexibility requires buyers to have a keen understanding of their financial limits and a clear long-term strategy.

Precaution: Buyers should approach negotiations with a well-researched plan, understanding market rates and how different terms will impact their future financial stability. It’s also beneficial to involve a financial advisor to help navigate these negotiations and ensure the terms are sustainable.

The Potential Need for Refinancing

Seller-financed agreements often include a balloon payment — a large, lump-sum payment due at the end of the loan term. This structure can catch buyers off guard if they’re not prepared to refinance or pay the remainder in full.

Precaution: From the outset, buyers should have a clear plan for handling the balloon payment, whether it’s through refinancing, selling the property, or other means. Establishing a savings plan or improving credit scores to qualify for traditional refinancing options are strategies to consider.

Seller’s Financial Situation

Rarely do buyers consider the seller’s financial stability in seller financing deals, yet it’s crucial. If the seller has debts or financial obligations secured against the property, the buyer’s rights could be compromised in the event of the seller’s bankruptcy or death.

Precaution: Buyers should request proof of the seller’s financial health and, where possible, structure the deal to include protective clauses in the event of the seller’s financial instability. Additionally, an escrow account can be established to manage payments directly, offering an extra layer of financial security.

How to Structure a Seller Financing Agreement (Free Template)

Structuring a seller financing agreement optimally requires a balanced approach, focusing on fairness, clarity, and protection for both the buyer and seller. Here’s how to best structure a financing deal:

Down Payment

Starting with a substantial down payment is beneficial for both parties. For the seller, it provides immediate liquidity and reduces the risk of default. For the buyer, it demonstrates commitment and can potentially lower the overall interest rate or monthly payment amounts. Aim for a down payment that is manageable for the buyer but also significant enough to secure the seller’s trust.

Interest Rate

The interest rate should be competitive yet fair, reflecting both current market rates and the additional risk the seller is taking by not going through a traditional lender. Use market rates as a baseline, but adjust according to the specifics of the deal and the credit risk presented by the buyer.

Repayment Schedule

Tailor the repayment schedule to suit the buyer’s financial situation, while ensuring the seller receives steady payments. Monthly payments are standard, but the length of the loan can vary. Shorter terms mean higher monthly payments but less interest over time, whereas longer terms reduce monthly payments but increase the total interest paid.

Balloon Payment

If including a balloon payment, ensure it’s realistically manageable for the buyer. This often means setting a balloon payment that aligns with the buyer’s projected financial growth or refinancing capabilities. Also, clearly outline the process and expectations for refinancing if the buyer cannot pay the balloon payment in full.

Default and Foreclosure Terms

Clearly define what constitutes a default and the steps that will be taken if it occurs. Include grace periods for late payments and the right to cure defaults to give the buyer a chance to rectify the situation. Foreclosure should be a last resort.

Documentation and Recording

The financing agreement, along with any deeds of trust or mortgages, should be formally documented and recorded with the appropriate local government office. This not only formalizes the deal but also protects both parties’ interests in the property.

Before structuring a deal following this free seller financing agreement template, both the buyer and seller should seek advice from real estate professionals, including attorneys and financial advisors. These experts can provide insights into the deal’s structure, suggest improvements, and ensure that all legal and financial bases are covered.

Seller Financing: An Alternative to Traditional Mortgages

While seller financing isn’t for everyone, it does have significant advantages for both sellers and buyers. Buyers who can’t qualify for a traditional mortgage will appreciate the opportunity for homeownership, even if they must pay a higher interest rate or purchase price. Sellers who want to get their home off the market quickly will find seller financing a good option.

Before finalizing a seller-financing agreement, make sure both buyers and sellers understand their responsibilities to one another. Both parties should seek help from an attorney to ensure they protect their interests in the contract.

What Sellers Who Agree to Carry Part of a Loan for a Buyer Need to Understand

If you’re thinking about helping a buyer by carrying part of the mortgage loan yourself, there are a few serious things you need to know first. Seller financing may be a smart move, but it’s not without real risks, and mistakes can get expensive fast.

First, make sure the interest rate you’re offering is fair. Using a fair interest rate formula, that is, one that reflects today’s market rates, your buyer’s credit strength, and the added risk you’re taking, can protect you from future regrets. Offering too low a rate just to close the deal could backfire later.

You’ll also need a tight real estate contract. A sloppy agreement can cost you a lot more than a few missed payments and may make you regret the home purchase. The mortgage agreement should cover the loan terms, payment schedule, down payment, balloon payment (if there is one), and what happens if the buyer defaults. You’ll need an experienced real estate attorney for seller financing transactions. Don’t skip this step just because the buyer seems trustworthy or is in a hurry to buy a house.

If you’re holding a junior mortgage (meaning there’s already a mortgage from a bank on the property) understand that you’re second in line if anything goes wrong. You could lose your claim entirely if the bank forecloses. Know where you stand legally before finalizing anything.

Getting an appraisal upfront is smart, even if you know the buyer. You need to know the real value before agreeing to the seller financing arrangement. It also helps if you later want to sell your mortgage note for a lump sum instead of waiting years for slow monthly payments.

Finally, be ready for the long haul. Until the mortgage is fully repaid, you or the mortgage loan originator managing the deal will need to collect payments, handle escrow (if any), and keep records tight. Make sure you’re set up for that or have a plan to sell the note later if it becomes too much work.

FAQs About Seller Financing

Can you do seller financing in the UK?

In the UK, seller financing is not as common or widely recognized as it is in countries like the United States, largely due to the differences in property laws and the prevalence of traditional mortgage financing options. However, it is possible to arrange seller financing, also known as owner financing, under specific circumstances, such as market downturns and short-term investment in real estate. Seller financing

Is there a seller financing calculator?

A seller financing calculator helps both buyers and sellers understand the financial implications of a seller-financed real estate transaction. It typically computes the monthly payment amount that the buyer needs to pay to the seller over the term of the loan, based on several inputs.

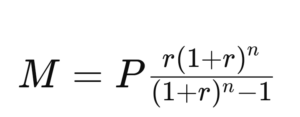

While specific calculators might include additional features, the core formula used in a basic seller financing calculator is derived from the standard formula for calculating the monthly payment of an amortizing loan, which is:

Where:

- M is the monthly payment.

- P is the principal amount (loan amount).

- r is the monthly interest rate (annual interest rate divided by 12 months).

- n is the total number of payments (loan term in years multiplied by 12 months/year).

Let’s break down the formula components:

- Principal (P): This is the amount of money that is being borrowed, which is typically the sale price of the property minus any down payment.

- Monthly Interest Rate (r): The annual interest rate agreed upon by the buyer and seller, divided by 12. This rate should reflect the time value of money and the risk the seller is taking by financing the purchase.

- Number of Payments (n): This is the duration of the loan in months. For example, a 15-year loan term would have n = 15 × 12 = 180 monthly payments.

This formula gives you the monthly payment amount that includes both principal and interest. Over the duration of the loan, the proportion of interest to principal in each payment changes, but the total monthly payment remains constant (in the case of a fixed-rate loan). Initially, payments consist of more interest than principal, but over time the principal portion increases with each payment, a process known as amortization.

Using a seller financing calculator with this formula helps you to quickly adjust the terms (like interest rate, loan amount, and term) to see how each variable affects the monthly payment.